3 Global Stocks Estimated To Be Trading At Up To 48.5% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets grapple with ongoing trade uncertainties and recession fears, major indices like the S&P 500 and Dow Jones Industrial Average have seen consecutive weeks of negative returns. Amidst this volatility, identifying stocks that are trading below their intrinsic value can provide opportunities for investors seeking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| CS Wind (KOSE:A112610) | ₩37400.00 | ₩74797.66 | 50% |

| Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636) | CN¥15.30 | CN¥30.37 | 49.6% |

| Telefonaktiebolaget LM Ericsson (OM:ERIC B) | SEK83.36 | SEK164.66 | 49.4% |

| Takara Bio (TSE:4974) | ¥853.00 | ¥1693.16 | 49.6% |

| dormakaba Holding (SWX:DOKA) | CHF680.00 | CHF1358.27 | 49.9% |

| Star7 (BIT:STAR7) | €6.20 | €12.36 | 49.8% |

| Cint Group (OM:CINT) | SEK6.40 | SEK12.79 | 49.9% |

| Neosperience (BIT:NSP) | €0.53 | €1.06 | 49.9% |

| Nanofilm Technologies International (SGX:MZH) | SGD0.665 | SGD1.33 | 49.9% |

| Jiangsu Chuanzhiboke Education Technology (SZSE:003032) | CN¥8.55 | CN¥16.99 | 49.7% |

Here's a peek at a few of the choices from the screener.

RENK Group (DB:R3NK)

Overview: RENK Group AG specializes in the design, engineering, production, testing, and servicing of customized drive systems both in Germany and internationally, with a market cap of €4.05 billion.

Operations: The company's revenue segments are comprised of the VMS Segment at €631.93 million, the M&I Segment at €315.97 million, and the Slide Bearings Segment at €119.59 million.

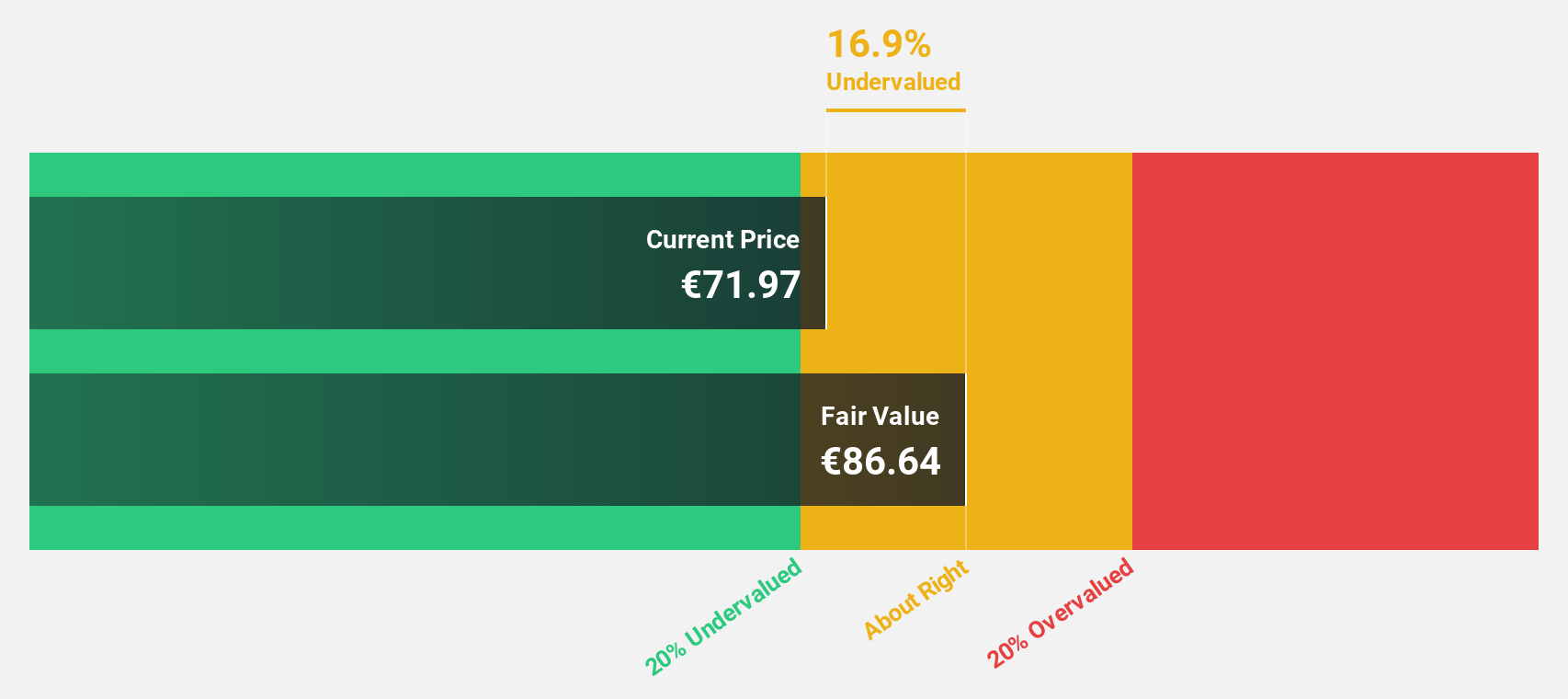

Estimated Discount To Fair Value: 24.6%

RENK Group is trading at €40.47, 24.6% below its estimated fair value of €53.66, indicating it may be undervalued based on cash flows. Despite a volatile share price recently, RENK's earnings are forecast to grow significantly at 39.3% annually over the next three years, outpacing the German market average of 16.5%. However, profit margins have decreased from last year and interest payments are not well covered by earnings, which could pose financial challenges moving forward.

- Our comprehensive growth report raises the possibility that RENK Group is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of RENK Group stock in this financial health report.

ALTEOGEN (KOSDAQ:A196170)

Overview: ALTEOGEN Inc., a biotechnology company, specializes in the development of long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars with a market cap of ₩20.89 trillion.

Operations: The company's revenue primarily comes from its biotechnology segment, amounting to ₩74.38 billion.

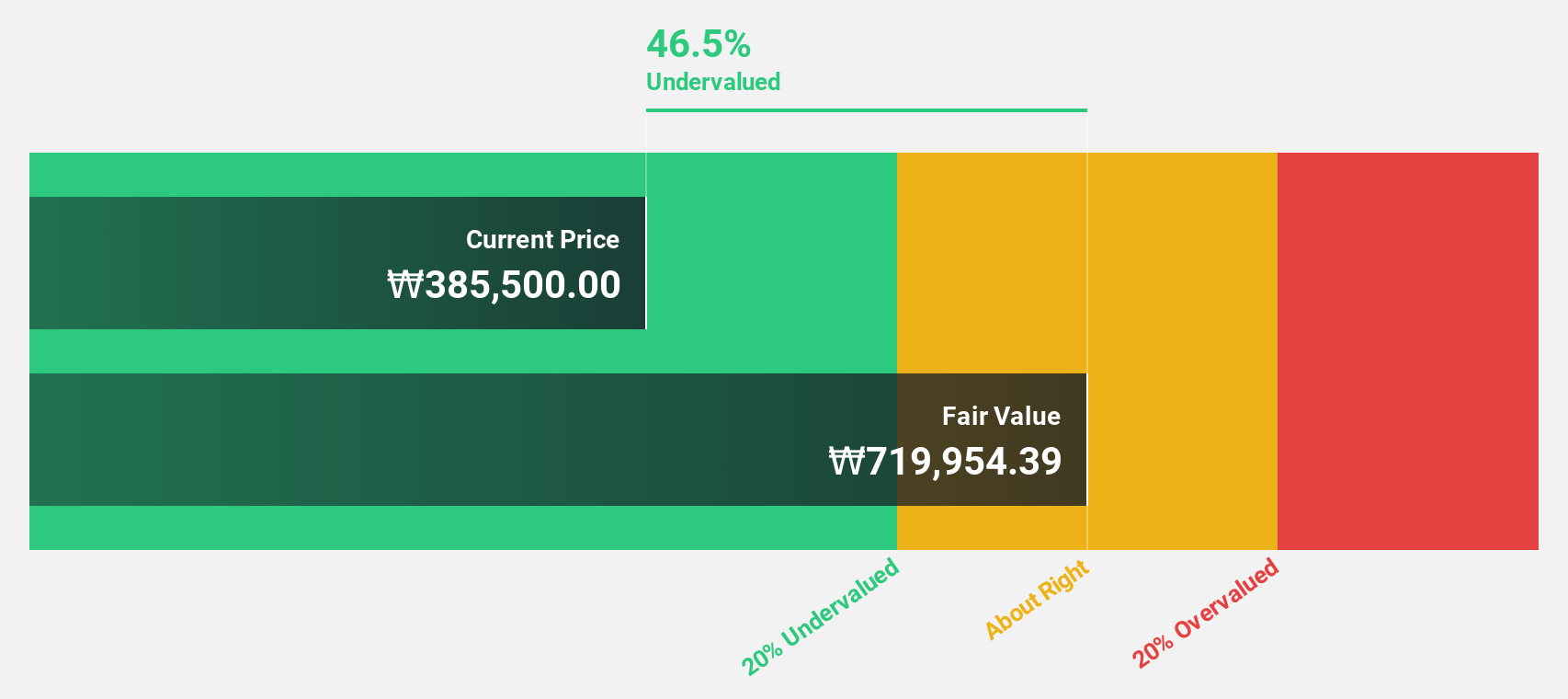

Estimated Discount To Fair Value: 48.5%

ALTEOGEN is currently trading at ₩439,500, significantly below its estimated fair value of ₩852,939.21. The company's revenue is expected to grow at an impressive 84.2% annually, surpassing the Korean market average of 8.7%. Additionally, ALTEOGEN's earnings are projected to increase by 140.63% per year and it is anticipated to become profitable within three years. Recent private placements may enhance financial flexibility but come with a mandatory one-year lockup period for investors.

- The growth report we've compiled suggests that ALTEOGEN's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of ALTEOGEN.

EQT (OM:EQT)

Overview: EQT AB (publ) is a global private equity and venture capital firm that specializes in private capital and real asset segments, with a market cap of approximately SEK368.69 billion.

Operations: The company's revenue is primarily derived from its Private Capital segment at €1.36 billion and Real Assets segment at €951.90 million, with an additional contribution of €41.50 million from the Central segment.

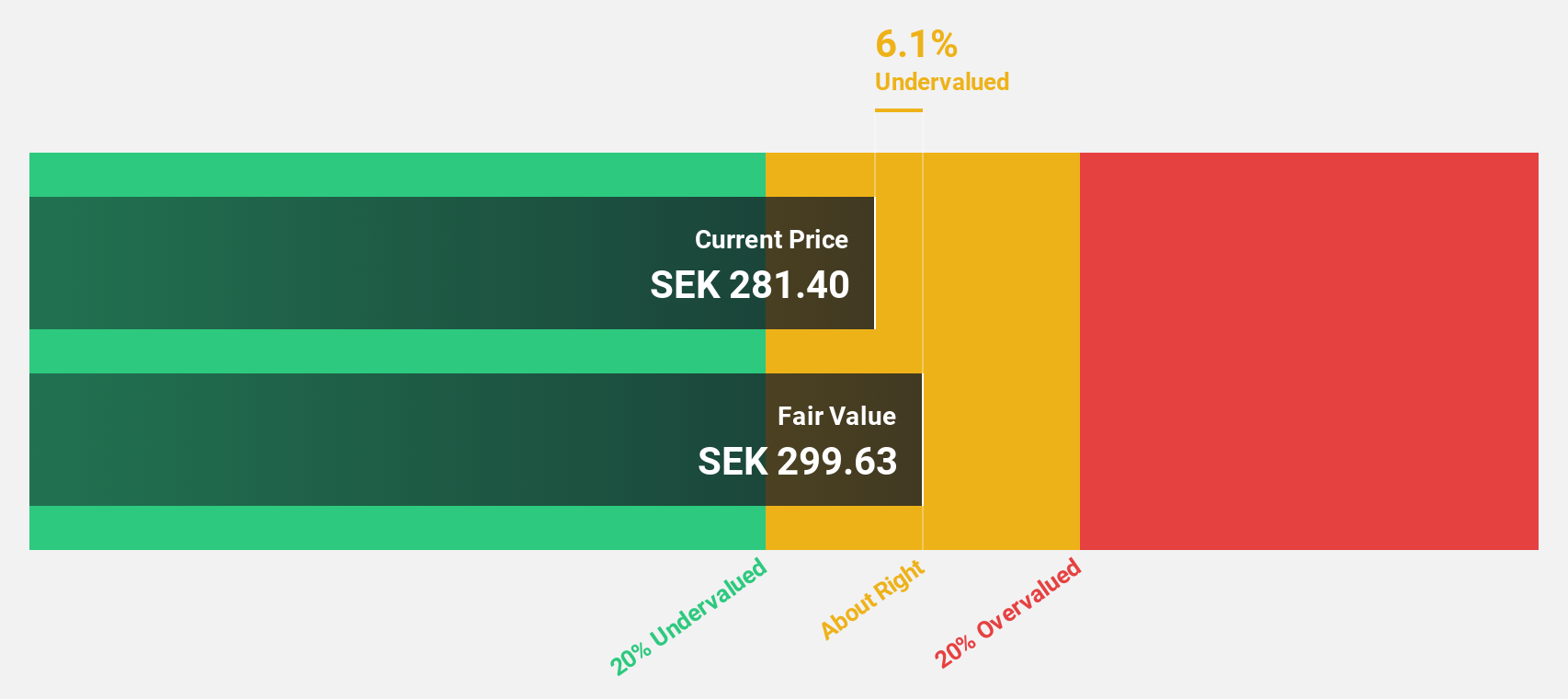

Estimated Discount To Fair Value: 21.1%

EQT's recent financials reveal a robust performance, with net income soaring to EUR 776 million from EUR 168 million. The stock is trading over 20% below its fair value estimate of SEK394.94, suggesting it may be undervalued based on cash flows. Despite insider selling and a dividend not well-covered by earnings, EQT's earnings are forecasted to grow significantly at 27.8% annually, outpacing the Swedish market average of 9.3%.

- According our earnings growth report, there's an indication that EQT might be ready to expand.

- Navigate through the intricacies of EQT with our comprehensive financial health report here.

Seize The Opportunity

- Click this link to deep-dive into the 496 companies within our Undervalued Global Stocks Based On Cash Flows screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DB:R3NK

RENK Group

Engages in the design, engineering, production, testing, and servicing of customized drive systems in Germany and internationally.

High growth potential with solid track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)