- Sweden

- /

- Capital Markets

- /

- OM:CS

CoinShares (OM:CS) Valuation in Focus After Altcoins ETF Launch and Crypto Market Shake-Up

Reviewed by Kshitija Bhandaru

CoinShares International (OM:CS) is drawing attention after launching its Altcoins ETF, just as crypto markets react to the U.S. government’s sweeping tariffs on Chinese goods. These tariffs have triggered unprecedented fund outflows and liquidations.

See our latest analysis for CoinShares International.

After unveiling its Altcoins ETF, CoinShares International has grabbed attention as crypto markets have been jolted by U.S. tariff moves and historic volatility. While these events triggered short-term turbulence, the company’s share price return over the past year remains staggering, with a 1-year share price gain of 71.89% and a 1-year total shareholder return of 187.66%. This momentum has left most of its sector in the dust. The rally this year hints at growing optimism about CoinShares’ role in providing access to next-wave digital assets, even as changing macro risks keep the ride bumpy.

If big swings in digital assets have you wondering what’s out there, now’s an ideal time to broaden your search and discover fast growing stocks with high insider ownership.

The question now, with CoinShares’ powerful rally and new altcoin product launch, is whether the stock remains undervalued based on future growth prospects or if recent gains mean everything is already priced in by the market.

Price-to-Earnings of 8.2x: Is it justified?

At a last close price of SEK148 and a price-to-earnings (P/E) ratio of just 8.2x, CoinShares International trades at a striking discount compared to both peers and the broader market.

The price-to-earnings ratio, or P/E, compares the company's current share price to its per-share earnings, offering a quick sense of how the market values expected profit. A low P/E can indicate the market is underpricing growth potential, especially for a firm expanding into sectors like digital assets.

With CoinShares' P/E at nearly one-third of the peer average of 26.4x and half the European sector average, it suggests investors are cautious or skeptical about its durability. Notably, the P/E also stands well below the estimated fair ratio of 19.6x, implying significant upside if market sentiment improves or forecasted growth materializes.

Explore the SWS fair ratio for CoinShares International

Result: Price-to-Earnings of 8.2x (UNDERVALUED)

However, CoinShares faces risks from sudden market sentiment shifts and analyst price targets that are below current levels. These factors could limit further upside in the near term.

Find out about the key risks to this CoinShares International narrative.

Another View: Discounted Cash Flow Model Sends a Strong Signal

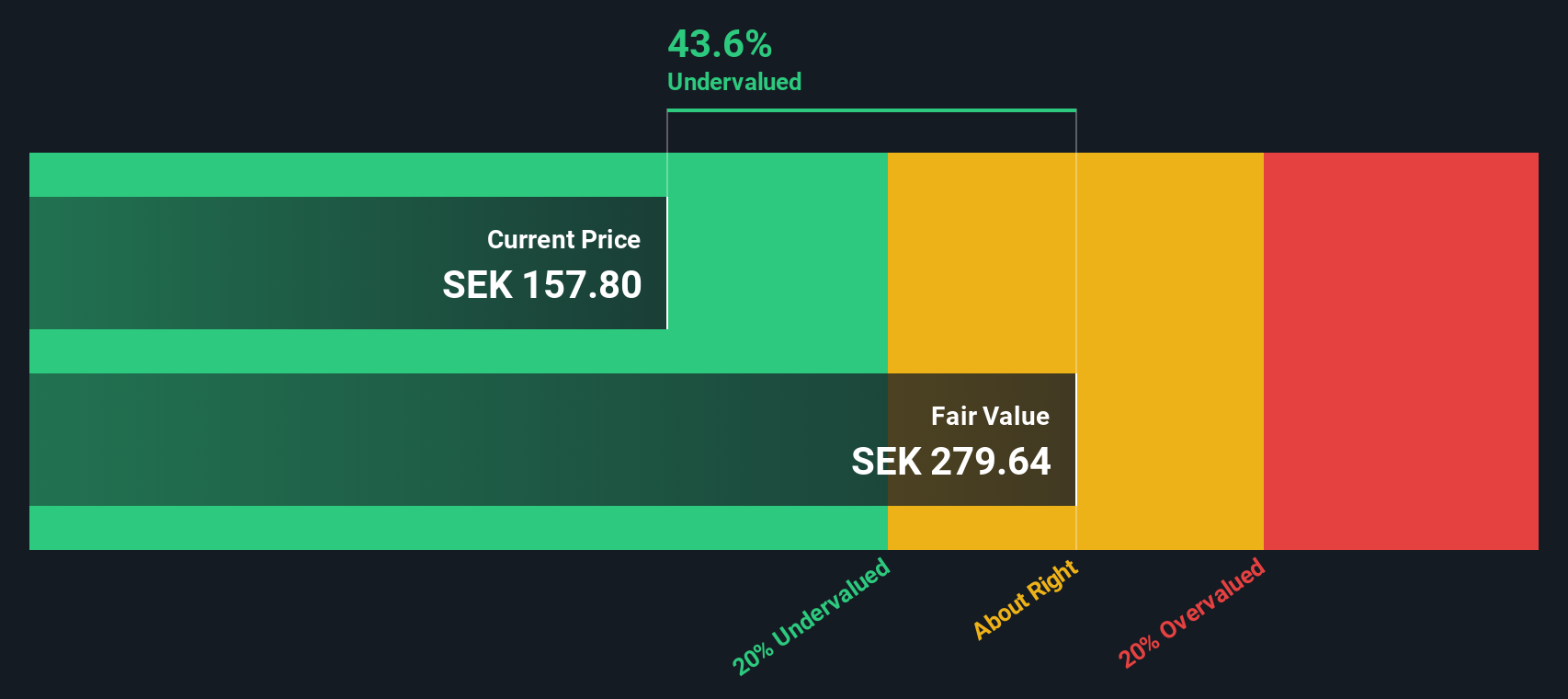

While the price-to-earnings approach points to undervaluation, our DCF model supports this assessment in a dramatic way. It estimates CoinShares' fair value at SEK280.06. This means the current price trades at a 47.2% discount. Such a large gap could represent an opportunity or reflect market skepticism.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CoinShares International for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CoinShares International Narrative

If you want a fresh perspective or prefer digging into the numbers yourself, it’s simple to build your own view of CoinShares’ story in just a few minutes. Do it your way.

A great starting point for your CoinShares International research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Set yourself apart from the crowd by tapping into unique opportunities beyond CoinShares. Simply Wall Street’s powerful screener uncovers stocks that many investors overlook. Don’t let the next big winner slip through your fingers.

- Spot potential market-shaking upstarts with strong financials by checking out these 3579 penny stocks with strong financials.

- Capture the momentum of tomorrow’s healthcare breakthroughs when you use these 33 healthcare AI stocks to track companies transforming medicine with artificial intelligence.

- Boost your income stream and stability by exploring these 20 dividend stocks with yields > 3% known for reliable yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CS

CoinShares International

Engages in the creating financial products with digital assets and blockchain technology business in Jersey.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives