- Sweden

- /

- Capital Markets

- /

- OM:CS

CoinShares (OM:CS): Assessing Valuation Following a 230% 12-Month Share Price Surge

Reviewed by Simply Wall St

See our latest analysis for CoinShares International.

Momentum for CoinShares is clearly building. The stock’s share price return has accelerated in recent weeks, and the 12-month total shareholder return has reached over 230 percent. Investors seem increasingly optimistic about the company’s growth prospects, especially following its strong performance so far this year.

If CoinShares’ dramatic gains have you thinking bigger, this could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

But after such a remarkable run, investors are left wondering, is CoinShares still trading at an attractive valuation or is all the excitement about its future already reflected in the price? Could there still be a real buying opportunity here?

Price-to-Earnings of 8.8x: Is it justified?

CoinShares International’s stock is being valued at just 8.8 times its earnings, which is well below both industry and peer averages. This raises the prospect that it is undervalued relative to the broader market.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay today for each unit of current earnings. For companies in the capital markets sector, this multiple is an essential benchmark because it reflects expectations of future profitability and growth.

Such a low multiple could mean that the market is not fully pricing in CoinShares’ earnings power, or it may be overlooking its future prospects. Compared to the European Capital Markets industry average of 16.2x and the peer average of 20.3x, CoinShares’ P/E appears especially compelling. Regression analysis suggests a fair P/E ratio could be as high as 19.8x, which is more than double its current level. This indicates there is significant potential for the market to re-rate the stock upward if sentiment or fundamentals improve.

Explore the SWS fair ratio for CoinShares International

Result: Price-to-Earnings of 8.8x (UNDERVALUED)

However, slower net income growth and the current share price, which is trading above analyst targets, could limit further upside and temper investor expectations.

Find out about the key risks to this CoinShares International narrative.

Another View: Discounted Cash Flow Perspective

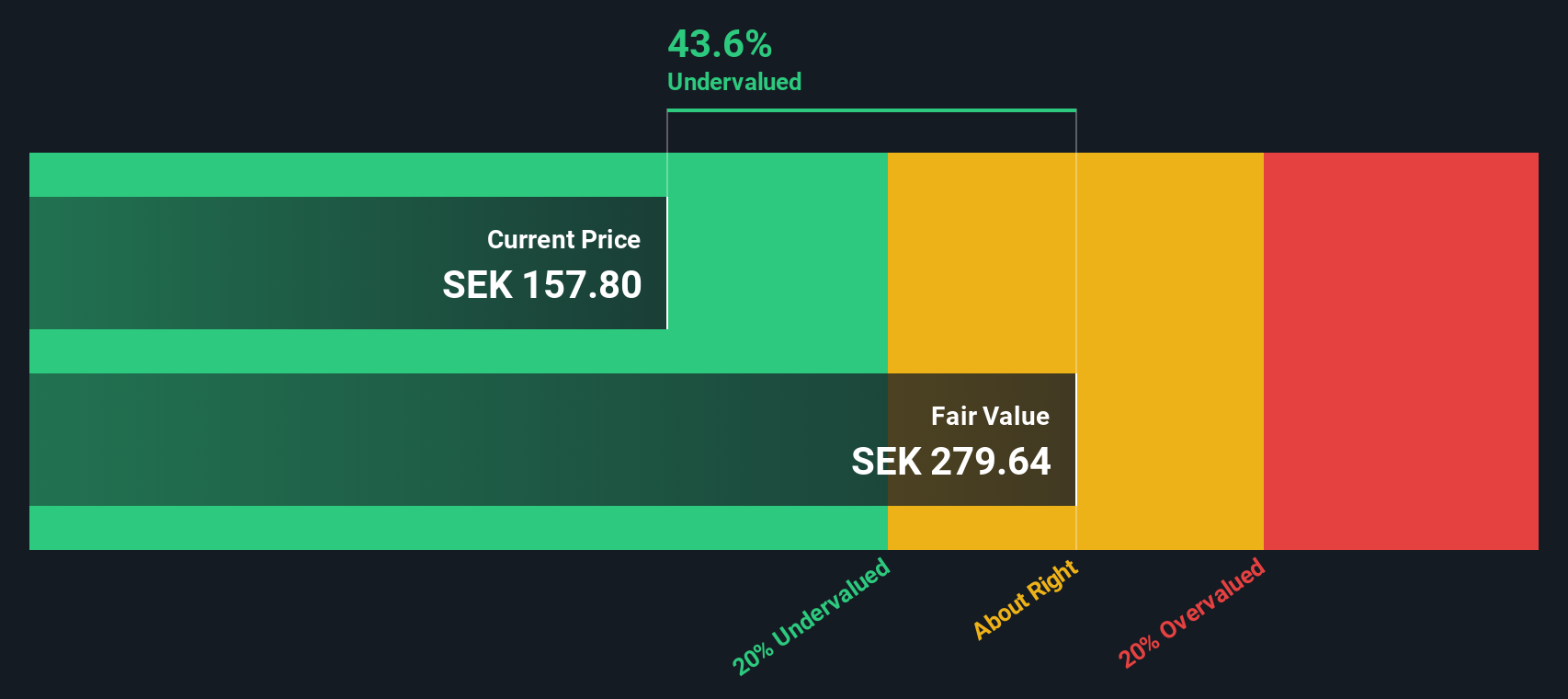

While the price-to-earnings approach points to undervaluation, the SWS DCF model offers a more forward-looking valuation tool. According to this method, CoinShares trades at around 44% below our estimate of fair value, signaling an even greater potential upside. However, can this model’s projections hold up as market conditions change?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CoinShares International for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CoinShares International Narrative

If you prefer a hands-on approach or would like to see the story from your own perspective, you can dive in and craft your personal CoinShares narrative in just a few minutes, Do it your way

A great starting point for your CoinShares International research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Want an edge in the market? You could be missing out if you ignore these high-potential investment themes. Put yourself ahead of the crowd now.

- Target steady growth and income by tapping into these 17 dividend stocks with yields > 3% with attractive yields above 3 percent for your portfolio.

- Boost your investing toolkit with these 880 undervalued stocks based on cash flows that present compelling value based on robust cash flow fundamentals.

- Ride the innovation wave and capitalize on these 27 AI penny stocks as they transform industries through artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CS

CoinShares International

Engages in the creating financial products with digital assets and blockchain technology business in Jersey.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives