- China

- /

- Hospitality

- /

- SZSE:000007

Exploring 3 Undiscovered Gems With Promising Potential

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating consumer confidence and mixed economic indicators, the small-cap segment continues to offer intriguing opportunities for investors. In this environment, identifying stocks with strong fundamentals, innovative business models, and resilience in the face of economic shifts can be key to uncovering undiscovered gems with promising potential.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Lithium Chile | NA | nan | 42.01% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Creades (OM:CRED A)

Simply Wall St Value Rating: ★★★★★★

Overview: Creades AB is a private equity and venture capital investment firm that focuses on early to late-stage venture, emerging growth, middle market, growth capital, and buyout investments with a market cap of approximately SEK9.80 billion.

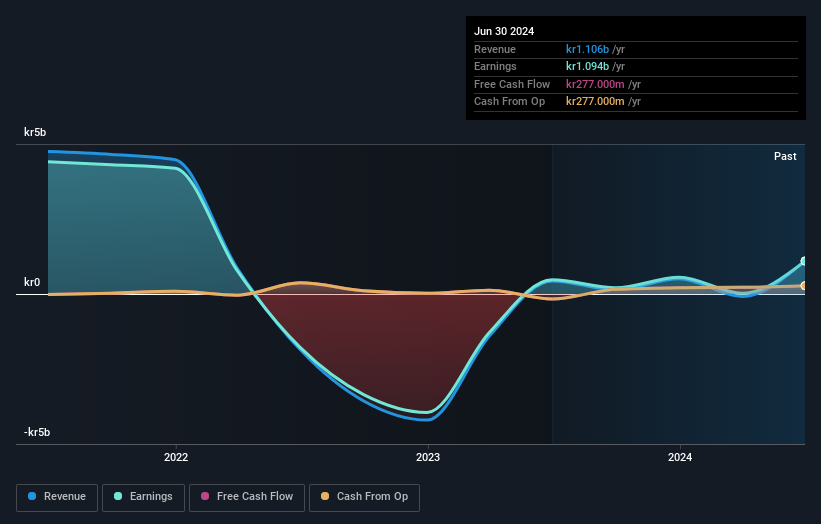

Operations: Creades generates revenue primarily from its investments in online retailers, amounting to SEK2.17 billion.

Creades, a nimble player in the investment landscape, has showcased remarkable resilience with earnings growth of 921% over the past year, outpacing its industry peers. This debt-free entity reported a dramatic turnaround in Q3 2024, swinging from a SEK 827 million net loss to SEK 182 million net income. Despite this impressive growth spurt, its profit margins at 97% have dipped compared to previous years. The company's price-to-earnings ratio of 4.7x suggests it may be undervalued relative to the broader Swedish market average of 23.2x, hinting at potential value for discerning investors seeking opportunities in under-the-radar stocks.

- Click to explore a detailed breakdown of our findings in Creades' health report.

Explore historical data to track Creades' performance over time in our Past section.

Shenzhen Quanxinhao (SZSE:000007)

Simply Wall St Value Rating: ★★★★★☆

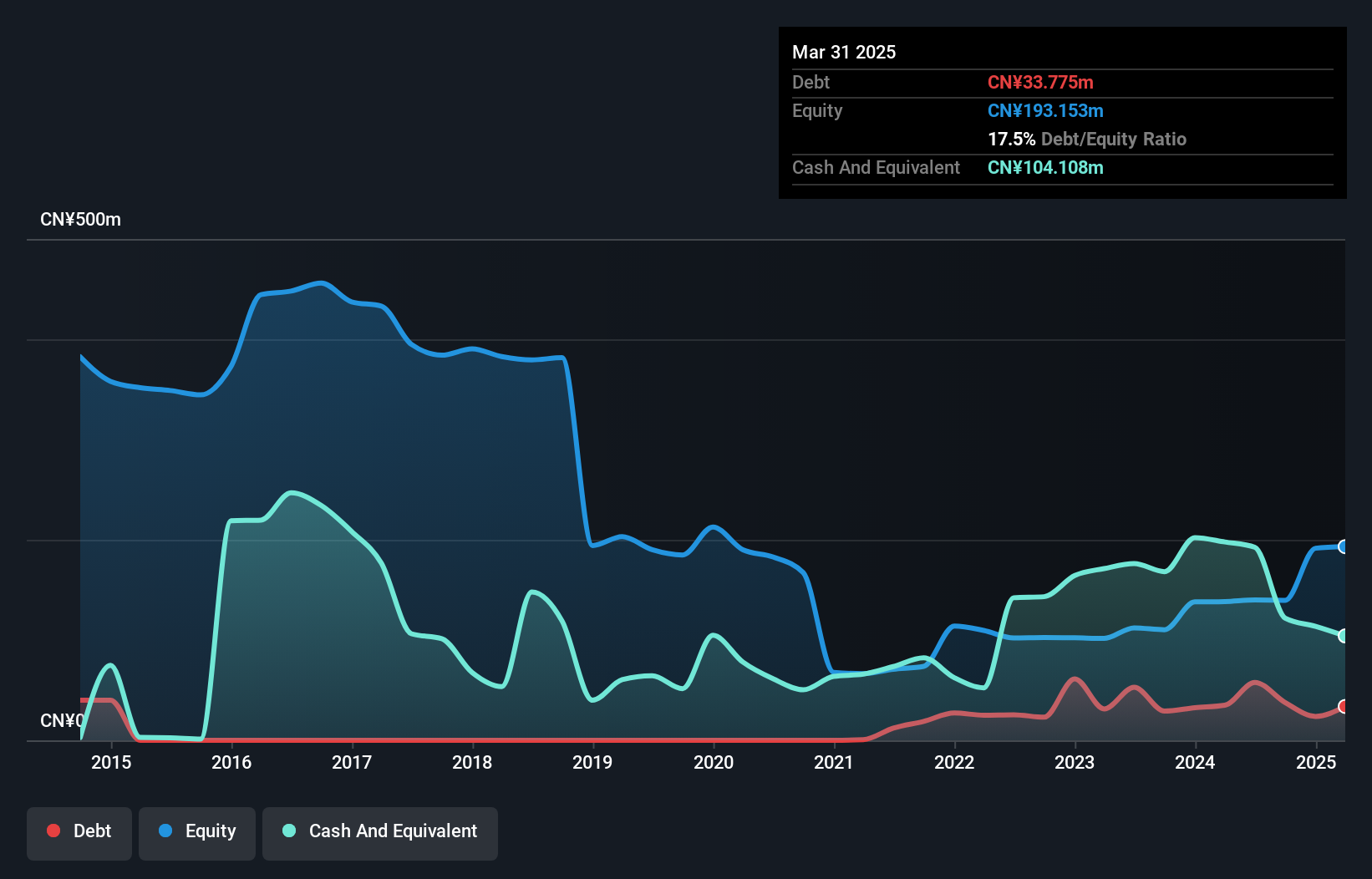

Overview: Shenzhen Quanxinhao Co., Ltd. operates in property leasing and management both in China and internationally, with a market cap of CN¥2.44 billion.

Operations: Shenzhen Quanxinhao generates revenue primarily through its property leasing and management business. The company's cost structure includes expenses related to the maintenance and operation of leased properties. Its net profit margin exhibits variability, reflecting changes in operational efficiency and market conditions.

Shenzhen Quanxinhao, a smaller player in its field, has seen its earnings grow by 96% over the past year, outpacing the hospitality industry's -6.9%. Despite this impressive growth, net income for the nine months ending September 2024 was CNY 3.18 million, down from CNY 10.85 million in the previous year. The company's debt to equity ratio increased to 26.9% over five years but remains manageable with more cash than total debt on hand. Recent board changes and shareholder meetings suggest active governance and strategic reevaluations are underway to bolster future performance prospects further.

- Delve into the full analysis health report here for a deeper understanding of Shenzhen Quanxinhao.

Assess Shenzhen Quanxinhao's past performance with our detailed historical performance reports.

Ship Healthcare Holdings (TSE:3360)

Simply Wall St Value Rating: ★★★★★★

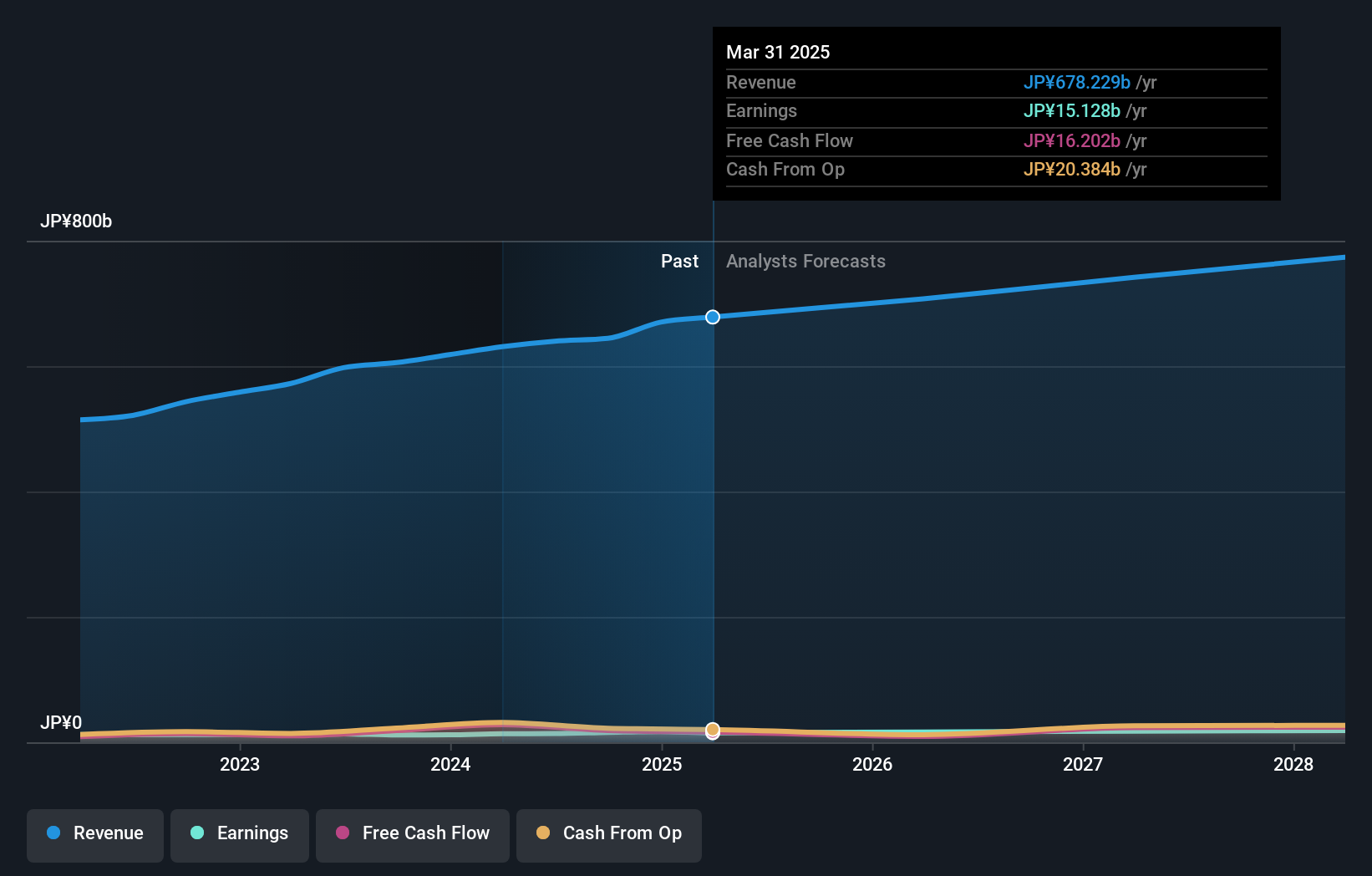

Overview: Ship Healthcare Holdings, Inc. operates globally in the medical, healthcare, welfare, and nursing care sectors with a market cap of ¥208.04 billion.

Operations: Ship Healthcare Holdings generates revenue primarily from its operations in the medical, healthcare, welfare, and nursing care sectors. The company focuses on providing comprehensive solutions across these areas, contributing to its financial performance.

Ship Healthcare Holdings, a nimble player in the healthcare sector, has shown robust financial health with its debt to equity ratio improving from 62.8% to 32.6% over five years. The company is trading at a significant discount of 63.9% below its estimated fair value, suggesting potential upside for investors seeking value opportunities. With earnings growth of 34.8% last year outpacing the industry average of 8.3%, it seems Ship Healthcare is on a solid trajectory for continued profitability, supported by positive free cash flow and high-quality past earnings that bolster investor confidence in its future prospects.

- Take a closer look at Ship Healthcare Holdings' potential here in our health report.

Evaluate Ship Healthcare Holdings' historical performance by accessing our past performance report.

Key Takeaways

- Get an in-depth perspective on all 4638 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000007

Shenzhen Quanxinhao

Engages in property leasing and management business in China and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives