- Sweden

- /

- Electrical

- /

- OM:AQ

Discovering Three Hidden Gems With Strong Potential

Reviewed by Simply Wall St

In a week marked by record highs in major indices, including the Russell 2000 for small-cap stocks, global markets have shown resilience despite geopolitical tensions and tariff concerns. As investors navigate these dynamic conditions, identifying stocks with robust fundamentals and growth potential becomes crucial for those looking to capitalize on emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| National Investments Company K.S.C.P | 26.01% | 3.66% | 4.99% | ★★★★☆☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

AQ Group (OM:AQ)

Simply Wall St Value Rating: ★★★★★★

Overview: AQ Group AB (publ) is a company that manufactures and sells components and systems for industrial customers across Sweden, other European countries, and internationally, with a market cap of approximately SEK12.48 billion.

Operations: AQ Group generates revenue primarily from its Component segment, contributing SEK7.81 billion, and the System segment, adding SEK1.59 billion.

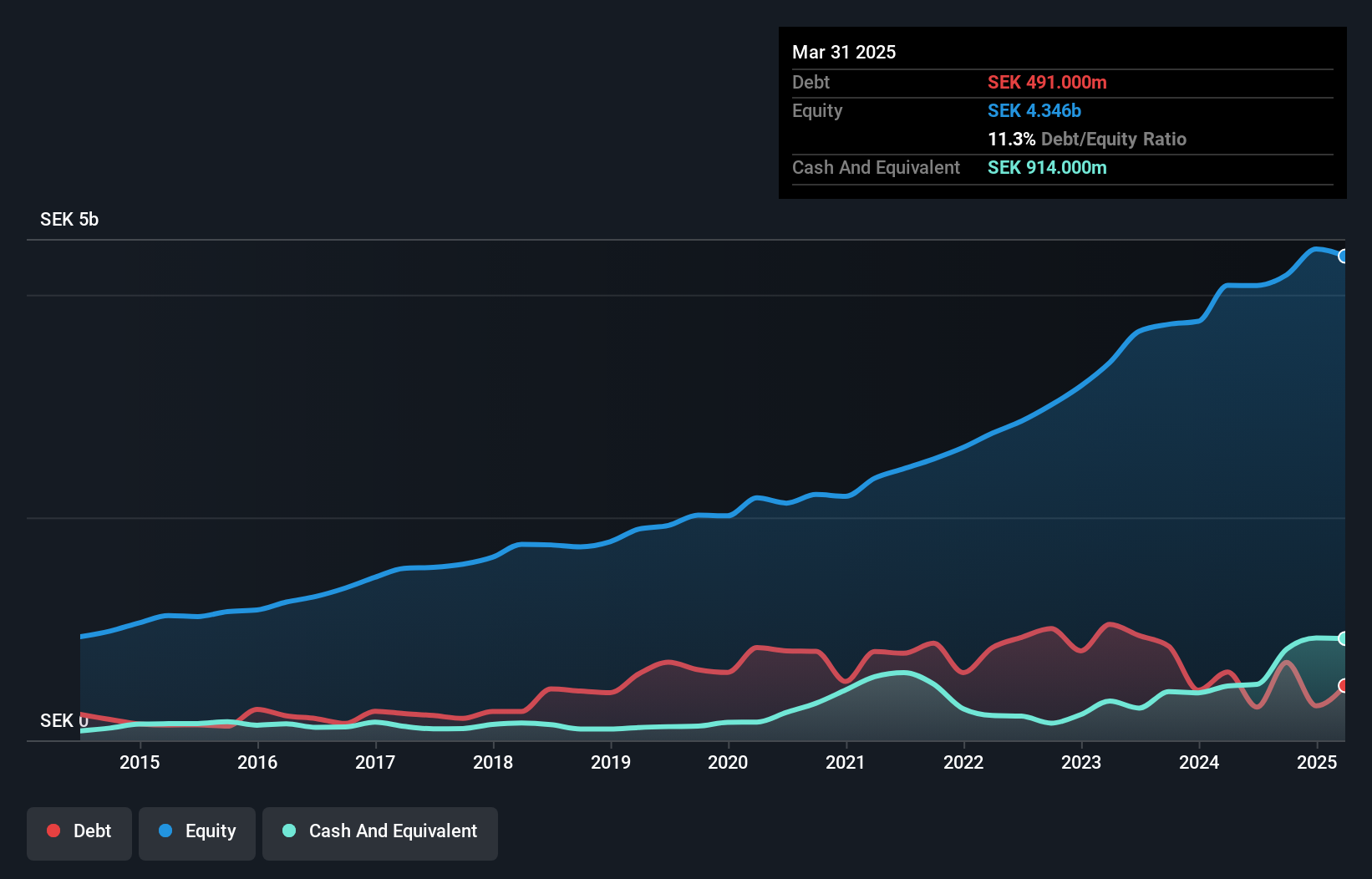

AQ Group, a notable player in the electrical industry, has shown resilience with its earnings growth of 1.7% over the past year, outpacing the industry's -20.2%. The company is trading at 4.1% below its estimated fair value, suggesting potential undervaluation. Over five years, AQ's debt-to-equity ratio improved from 31.4% to 16.8%, indicating better financial health and reduced leverage risks. Despite a slight dip in recent quarterly sales and net income compared to last year (SEK 1,949 million vs SEK 2,149 million; SEK 146 million vs SEK 171 million), AQ remains profitable with high-quality earnings and robust interest coverage of EBIT at 26.7x interest payments.

- Take a closer look at AQ Group's potential here in our health report.

Gain insights into AQ Group's historical performance by reviewing our past performance report.

Creades (OM:CRED A)

Simply Wall St Value Rating: ★★★★★★

Overview: Creades AB is a private equity and venture capital investment firm focusing on early to late-stage ventures, emerging growth, middle market, growth capital, and buyout investments with a market cap of SEK9.67 billion.

Operations: Creades generates revenue primarily from its investments in online retailers, totaling SEK2.17 billion.

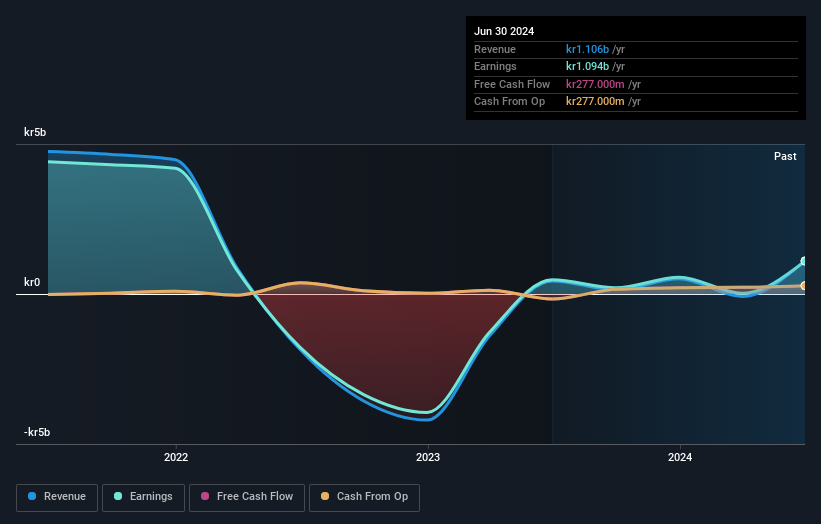

Creades, a financial entity with no debt, showcases a robust profile with its earnings growing by 920.9% over the past year, outpacing the industry growth of 137%. Despite this impressive growth, its net profit margin is at 96.7%, lower than last year's figures. The company appears to be undervalued with a price-to-earnings ratio of 4.7x compared to the Swedish market's average of 22.8x. Recent reports highlight significant improvement; for Q3, Creades reported SEK 173 million in revenue and SEK 182 million in net income against negative figures from the previous year, reflecting strong recovery and potential for future performance improvements.

- Click to explore a detailed breakdown of our findings in Creades' health report.

Assess Creades' past performance with our detailed historical performance reports.

Jinzi HamLtd (SZSE:002515)

Simply Wall St Value Rating: ★★★★★★

Overview: Jinzi Ham Co., Ltd. is involved in the research, development, production, and sale of fermented meat products both in China and internationally, with a market cap of CN¥6.16 billion.

Operations: Jinzi Ham Co., Ltd. generates revenue primarily from the sale of fermented meat products in domestic and international markets. The company's financial performance is influenced by its cost structure, which impacts its net profit margin.

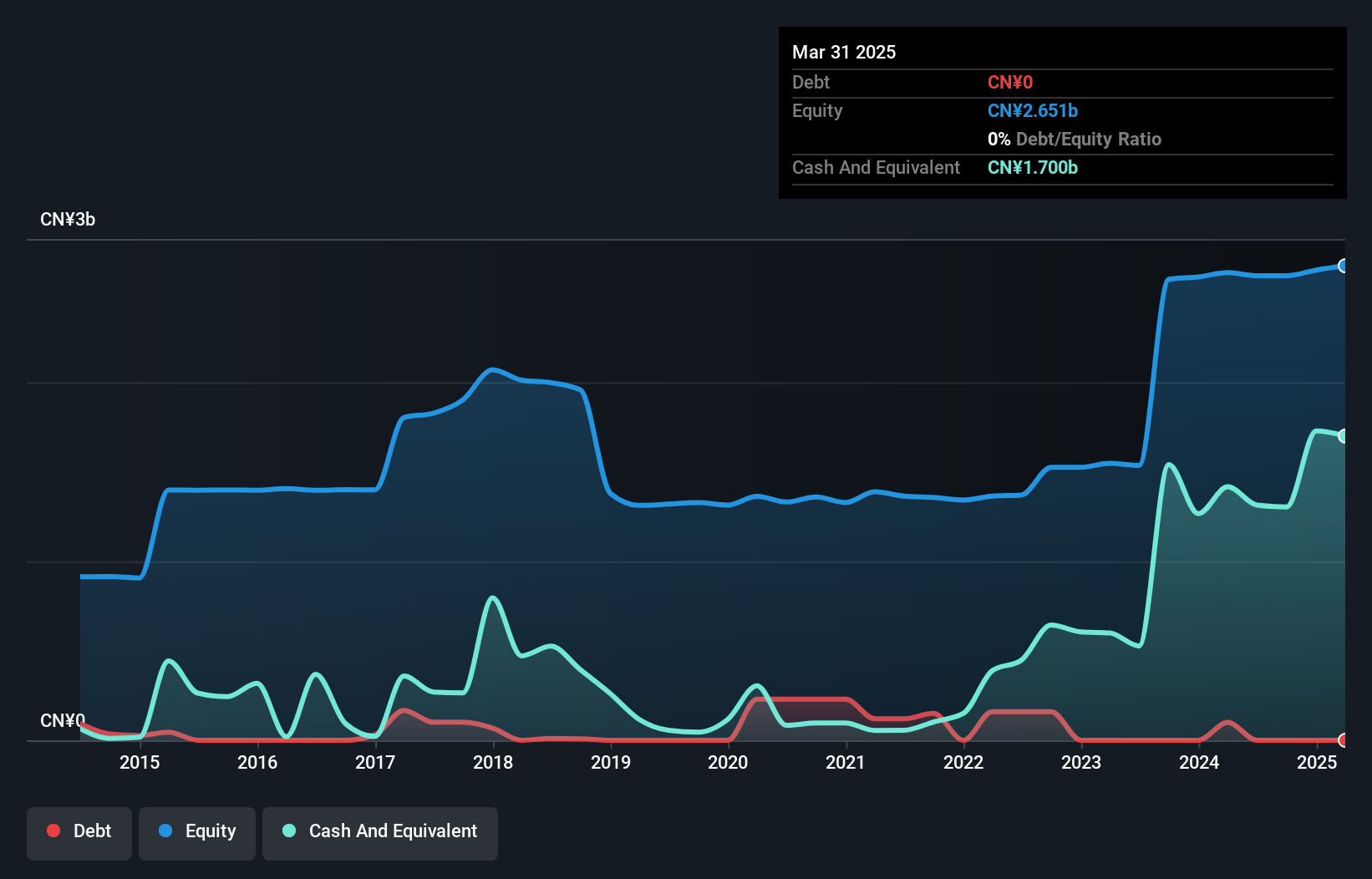

Jinzi Ham Ltd. has been making waves with a notable earnings growth of 79.8% over the past year, outpacing the food industry's -5.8%. The company reported revenue of CNY 258.41 million for the first nine months of 2024, an increase from CNY 233.7 million in the previous year, while net income rose to CNY 29.85 million from CNY 27.3 million. Despite a slight dip in basic and diluted earnings per share to CNY 0.025 from CNY 0.027, Jinzi Ham remains debt-free with high-quality past earnings and positive free cash flow, reflecting robust financial health and potential for future growth amidst industry challenges.

- Unlock comprehensive insights into our analysis of Jinzi HamLtd stock in this health report.

Examine Jinzi HamLtd's past performance report to understand how it has performed in the past.

Seize The Opportunity

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4640 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:AQ

AQ Group

Develops, manufactures, and assembles components and systems for industrial customers in Sweden, Finland, Germany, the United States of America, China, France, Poland, Italy, the Netherlands, India, Canada, and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives