- Sweden

- /

- Capital Markets

- /

- OM:BURE

I Ran A Stock Scan For Earnings Growth And Bure Equity (STO:BURE) Passed With Ease

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Bure Equity (STO:BURE). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Bure Equity

How Fast Is Bure Equity Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. I, for one, am blown away by the fact that Bure Equity has grown EPS by 48% per year, over the last three years. That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

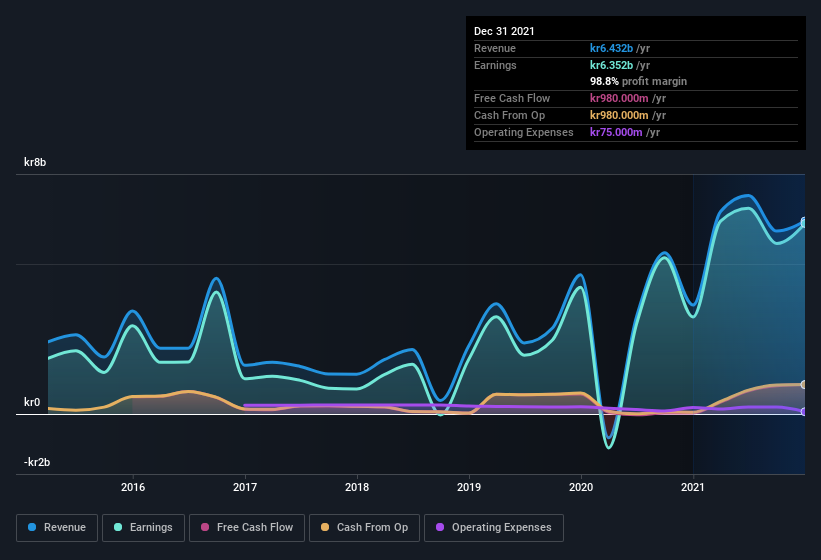

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. I note that Bure Equity's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. The good news is that Bure Equity is growing revenues, and EBIT margins improved by 9.0 percentage points to 99%, over the last year. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Bure Equity's balance sheet strength, before getting too excited.

Are Bure Equity Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Over the last 12 months Bure Equity insiders spent kr596k more buying shares than they received from selling them. On balance, that's a good sign. Zooming in, we can see that the biggest insider purchase was by CEO & President Henrik Blomquist for kr1.2m worth of shares, at about kr358 per share.

Along with the insider buying, another encouraging sign for Bure Equity is that insiders, as a group, have a considerable shareholding. Indeed, they have a glittering mountain of wealth invested in it, currently valued at kr5.3b. That equates to 25% of the company, making insiders powerful and aligned with other shareholders. Very encouraging.

Should You Add Bure Equity To Your Watchlist?

Bure Equity's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. Just as heartening; insiders both own and are buying more stock. Because of the potential that it has reached an inflection point, I'd suggest Bure Equity belongs on the top of your watchlist. It is worth noting though that we have found 2 warning signs for Bure Equity (1 makes us a bit uncomfortable!) that you need to take into consideration.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Bure Equity, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Bure Equity, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bure Equity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BURE

Bure Equity

A private equity and venture capital firm specializing in secondary direct, later stage, middle market, mature, buyouts, emerging growth, expansion capital, mid venture, late venture, PIPES, bridge, industry consolidation, recapitalizations, growth capital, special situation and turnarounds.

Flawless balance sheet and good value.

Market Insights

Community Narratives