- Sweden

- /

- Capital Markets

- /

- OM:AZA

Strong Q3 Earnings Growth Could Be a Game Changer for Avanza Bank Holding (OM:AZA)

Reviewed by Sasha Jovanovic

- Avanza Bank Holding reported third-quarter earnings for the period ended September 30, 2025, highlighting net income of SEK699 million and basic earnings per share of SEK4.37, both increasing significantly from the previous year.

- This growth in profit and earnings per share over both the quarter and nine months signals stronger core business performance and resilience through recent market conditions.

- We'll explore how this stronger quarterly net income may highlight momentum in Avanza Bank Holding's operational efficiency and customer engagement strategies.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Avanza Bank Holding Investment Narrative Recap

Owning shares in Avanza Bank Holding AB means believing in the platform’s ability to deliver strong profit growth through customer engagement and capital inflow, even as market conditions shift. While the company’s robust Q3 results add evidence of operational momentum, the main short-term catalyst remains sustained high customer activity, with the key risk being any drop-off in trading volumes, a factor unchanged by the recent news event, but always present for a brokerage-driven business.

Among recent announcements, the decision to discontinue external savings accounts stands out for its relevance here. As Avanza brings more customer deposits in-house, this move has the potential to enhance net interest income, supporting profitability if inflows remain strong, a financial lever that aligns with the ongoing improvement in quarterly earnings. However, it also introduces execution risk, particularly if customers react by moving assets elsewhere and reducing overall deposit growth.

In contrast, periods of lower trading activity can quickly test the sustainability of recent positive results, a consideration investors should be aware of…

Read the full narrative on Avanza Bank Holding (it's free!)

Avanza Bank Holding's narrative projects SEK 5.4 billion revenue and SEK 3.1 billion earnings by 2028. This requires 4.8% yearly revenue growth and a SEK 0.6 billion increase in earnings from SEK 2.5 billion.

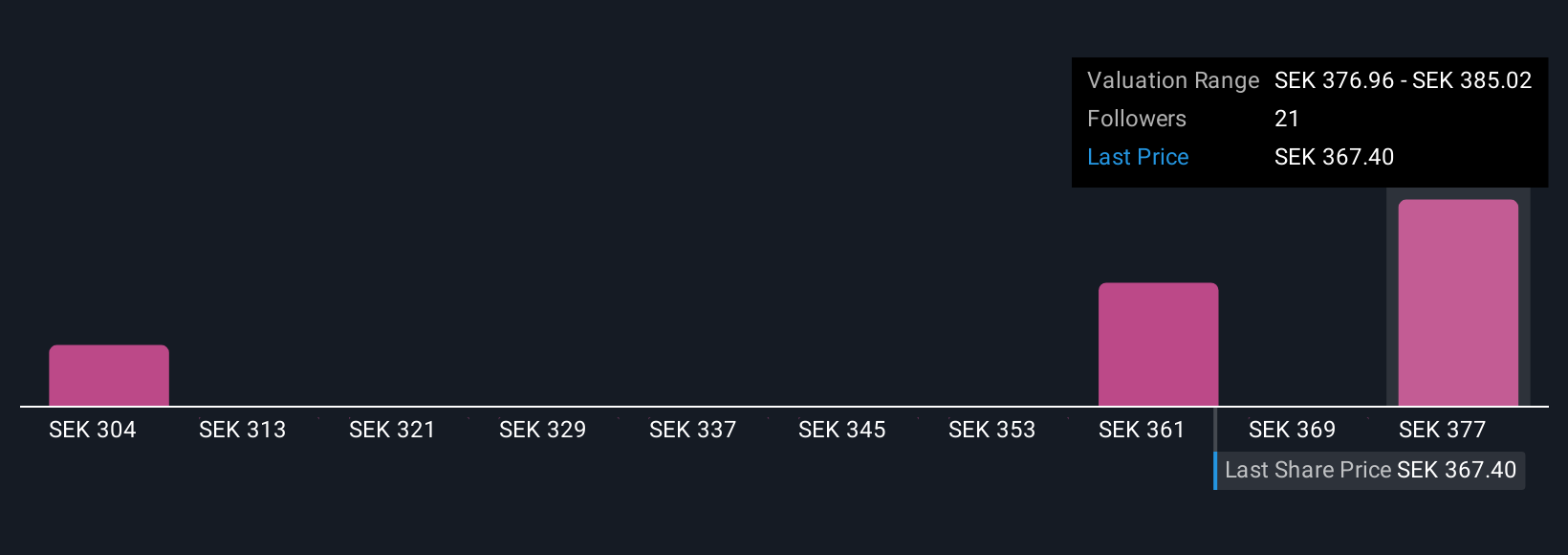

Uncover how Avanza Bank Holding's forecasts yield a SEK361.33 fair value, a 3% downside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community range widely, from SEK304.47 to SEK378.05 per share. While many focus on operational efficiency improvements, sustained customer activity remains pivotal for future performance, so reviewing multiple viewpoints can help balance this core risk.

Explore 3 other fair value estimates on Avanza Bank Holding - why the stock might be worth as much as SEK378.05!

Build Your Own Avanza Bank Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Avanza Bank Holding research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Avanza Bank Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Avanza Bank Holding's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:AZA

Avanza Bank Holding

Offers a range of savings, pension, and mortgages products in Sweden.

Outstanding track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives