- Sweden

- /

- Capital Markets

- /

- NGM:SPGR

Improved Revenues Required Before Spotlight Group AB (publ) (NGM:SPGR) Shares Find Their Feet

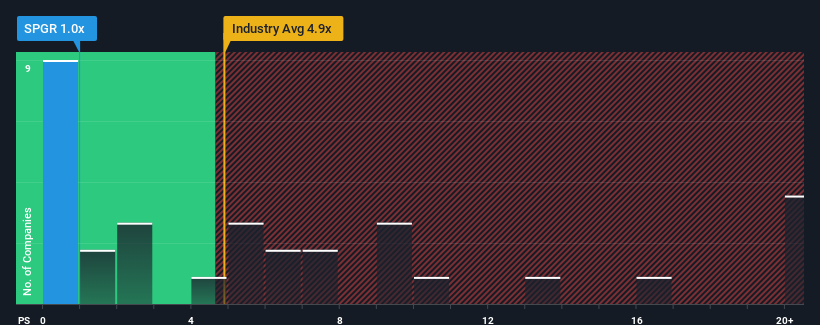

Spotlight Group AB (publ)'s (NGM:SPGR) price-to-sales (or "P/S") ratio of 1x might make it look like a strong buy right now compared to the Capital Markets industry in Sweden, where around half of the companies have P/S ratios above 4.9x and even P/S above 10x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Spotlight Group

How Has Spotlight Group Performed Recently?

While the industry has experienced revenue growth lately, Spotlight Group's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Spotlight Group will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Spotlight Group's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 4.3%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 14% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 10% each year during the coming three years according to the only analyst following the company. With the industry predicted to deliver 17% growth per annum, the company is positioned for a weaker revenue result.

With this information, we can see why Spotlight Group is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Spotlight Group's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Spotlight Group's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Spotlight Group (1 can't be ignored) you should be aware of.

If you're unsure about the strength of Spotlight Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NGM:SPGR

Spotlight Group

Through its subsidiaries, provides various financial services in Sweden.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives