- Sweden

- /

- Hospitality

- /

- OM:SKIS B

SkiStar (OM:SKIS B) Valuation in Focus as Dividend Raised and Profit Margins Improve

Reviewed by Kshitija Bhandaru

SkiStar (OM:SKIS B) has proposed raising its annual dividend to SEK 3.00 per share as part of its full-year 2025 update. The company cites strong operating margins and a surge in international guest numbers as reasons for the proposal. The Board’s decision highlights growing investor confidence, even as management points to heavier investment needs ahead and a more cautious earnings outlook for coming years.

See our latest analysis for SkiStar.

After a year of solid earnings growth and higher profit margins, SkiStar’s share price has shown little momentum, with total shareholder return remaining essentially flat over the past year. However, fresh optimism from the company’s upbeat winter booking trends and a larger international customer base suggests that sentiment could be shifting. Investors may now be considering the potential for a longer-term recovery in contrast to near-term spending challenges.

If you’re curious what other companies are showing positive shifts, this is the perfect time to discover fast growing stocks with high insider ownership

With the stock trading at a substantial discount to analyst targets despite rising profits and international growth, the key question now is whether SkiStar is undervalued or if the market is already factoring in tougher times ahead.

Most Popular Narrative: 17.6% Undervalued

SkiStar’s last close price sits well below the fair value set by the most widely followed narrative, which signals a substantial upside based on fundamental drivers. Investors are watching to see whether revenue and margin expansion can fuel a re-rating from here.

*The continued growth and focus on the retail segment, particularly through acquisitions and strengthening operations, indicate an effort to diversify income streams and capture higher margins through branded products, improving earnings.*

Want to know the blueprint for that bullish price target? This narrative expects Snowbelt-style growth driven by upgrades, growing customer volumes, and ambitious margin targets. The model hinges on several aggressive assumptions about future financial momentum. Do you know which bets matter most?

Result: Fair Value of $191.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, SkiStar’s outlook relies heavily on stable weather and ongoing demand. Poor snow or slowing digital sales could quickly undercut these optimistic projections.

Find out about the key risks to this SkiStar narrative.

Another View: Valuation Looks Rich on Market Ratios

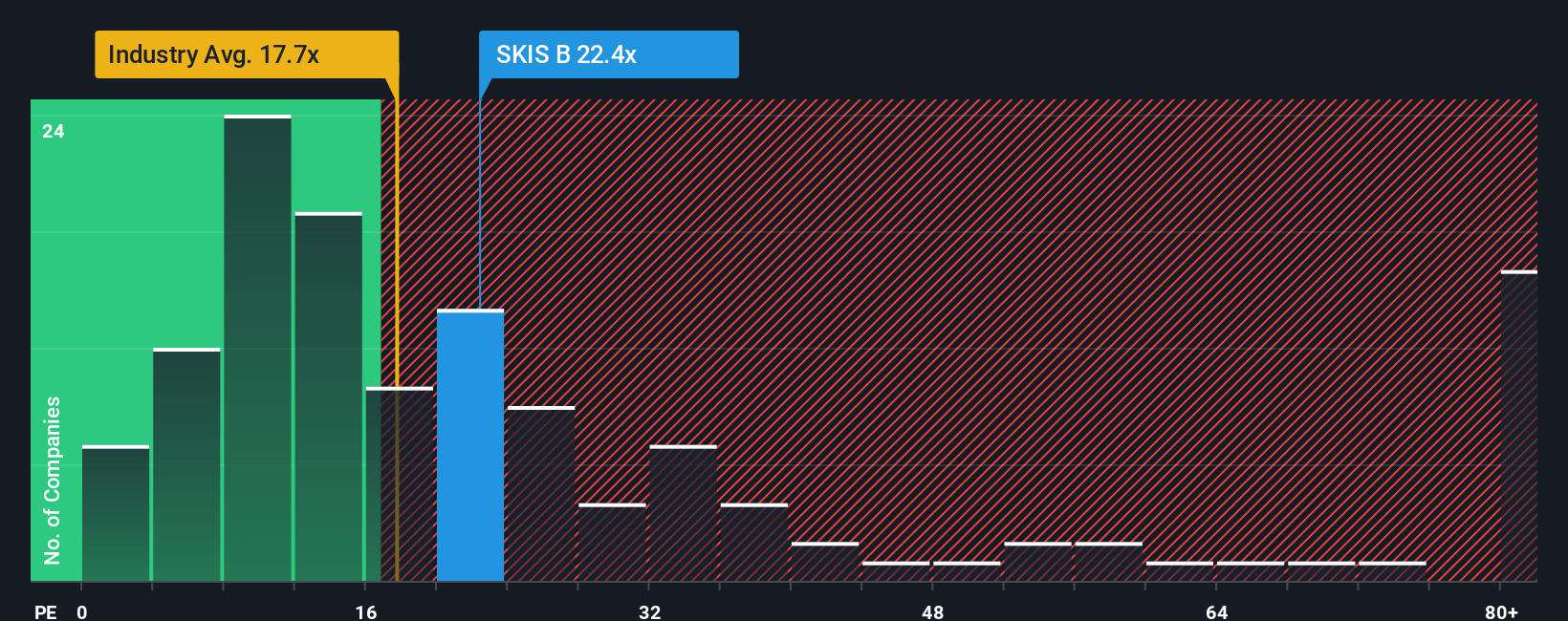

While fundamental models see upside, the market’s own pricing tells a less optimistic story. SkiStar trades at a price-to-earnings ratio of 22.4x, which is well above both its peer average of 14.9x and the industry’s 17.6x. This is also higher than its fair ratio of 13.8x. This sizable gap means investors are paying a premium that could limit future gains if growth fails to accelerate. Is the market already factoring in all the good news?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SkiStar Narrative

If the story here doesn’t match your view or you’d rather analyze SkiStar’s trends personally, you can put together your own narrative in just a few minutes: Do it your way

A great starting point for your SkiStar research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Great opportunities rarely wait around, so don’t let the next winning stock pass you by. Find hidden gems and fresh investment angles with these targeted ideas:

- Boost your income potential by scanning for steady yields using these 19 dividend stocks with yields > 3%, which spotlights companies offering attractive and reliable dividends above 3%.

- Catch the wave of innovation by targeting these 24 AI penny stocks, companies poised to lead in artificial intelligence and breakthrough automation.

- Take advantage of value opportunities by identifying these 900 undervalued stocks based on cash flows, which may be trading below their intrinsic worth based on real cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SKIS B

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives