- Sweden

- /

- Hospitality

- /

- OM:SHOT

Scandic Hotels Group (OM:SHOT): Assessing Valuation After Recent Share Price Momentum

Reviewed by Kshitija Bhandaru

Scandic Hotels Group (OM:SHOT) shares have caught investors’ attention recently, with the stock gaining 3% over the past month and up 28% year to date. Many are evaluating what could be next for the hospitality company as summer travel picks up.

See our latest analysis for Scandic Hotels Group.

Momentum has been picking up for Scandic Hotels Group, with its share price climbing by 28% so far this year as optimism around travel demand grows and the company continues to benefit from broader sector tailwinds. While the 1-year total shareholder return stands at 34%, recent action suggests renewed investor confidence as the summer travel season begins.

If you're drawing inspiration from Scandic's momentum, it's a great opportunity to broaden your search and discover fast growing stocks with high insider ownership

The question now is whether Scandic Hotels Group’s rapid gains reflect true value for investors, or if the market has already factored in the company’s expected growth, leaving little room for new buyers to benefit.

Most Popular Narrative: 6.6% Overvalued

Scandic Hotels Group is currently trading just above the fair value estimated by the most widely followed narrative, with the last close price sitting slightly higher than the consensus target. The tension between market optimism and modest analyst expectations is especially clear as investors debate if current levels reflect justified confidence or overly optimistic projections.

Strategic initiatives such as launching a new website and app to enhance customer experience, and a partnership with SAS enabling loyalty program status matching, are expected to improve customer retention and potentially boost revenue. The implementation of the workforce management platform, Quinyx, is anticipated to enhance scheduling efficiency, likely improving operational efficiency and margins.

The secret sauce behind this fair value comes down to the bold moves in digital, loyalty, and tech efficiency. These efforts focus on operational upgrades that could transform revenue and profitability. Curious which future forecasts analysts have staked on this scenario? Peek at the full narrative for the detailed numbers and debate fueling the share price story.

Result: Fair Value of $83.26 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent geopolitical tensions and declining room rates in Finland could challenge Scandic Hotels Group’s outlook, which may potentially undermine the current growth narrative.

Find out about the key risks to this Scandic Hotels Group narrative.

Another View: Discounted Cash Flow Paints a Different Picture

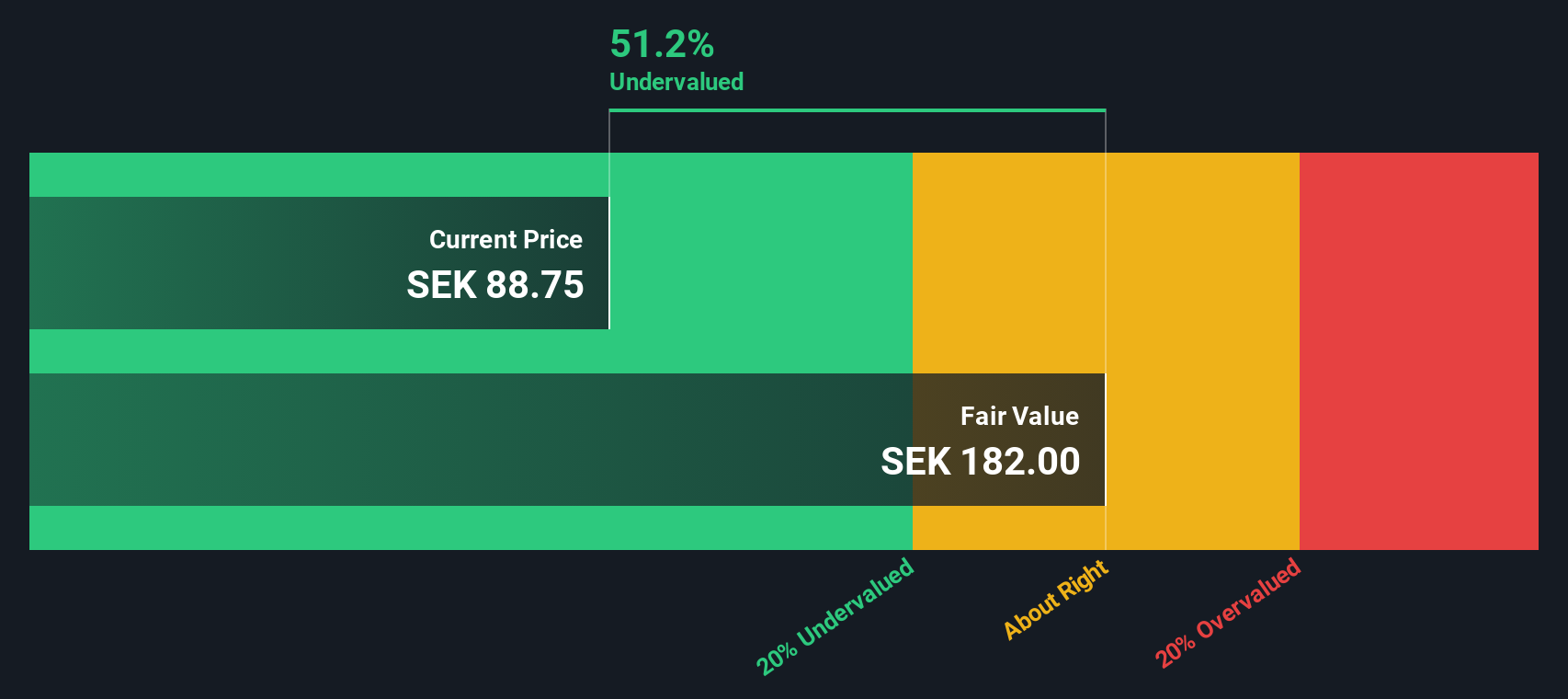

Looking through the lens of our SWS DCF model, Scandic Hotels Group appears undervalued, with its current share price trading more than 50% below the estimate of fair value (SEK182). This sharp difference raises the question of whether the market is missing potential long-term value, or if the assumptions behind the DCF are overly optimistic. Which perspective aligns closer to reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Scandic Hotels Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Scandic Hotels Group Narrative

If you want to dig deeper or approach the data with your own perspective, it only takes a few minutes to craft your personal view. Do it your way

A great starting point for your Scandic Hotels Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Sharpen your investing strategy by checking out other dynamic opportunities that could reshape your portfolio, so you never miss the next big mover.

- Tap into future-defining innovation by checking out these 24 AI penny stocks, which are poised to disrupt industries and accelerate growth with artificial intelligence.

- Unlock potential bargains by targeting these 904 undervalued stocks based on cash flows that deliver strong fundamentals and attractive valuations.

- Secure consistent cash flow by browsing these 19 dividend stocks with yields > 3%, which features attractive yields above 3% from established market performers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SHOT

Scandic Hotels Group

Engages in the operation and franchising of hotels in Sweden, Norway, Finland, Denmark, Germany, and Poland.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives