- Sweden

- /

- Hospitality

- /

- OM:SCOUT

If You Had Bought Scout Gaming Group (STO:SCOUT) Stock A Year Ago, You'd Be Sitting On A 32% Loss, Today

It is a pleasure to report that the Scout Gaming Group AB (publ) (STO:SCOUT) is up 67% in the last quarter. But that doesn't change the fact that the returns over the last year have been less than pleasing. The cold reality is that the stock has dropped 32% in one year, under-performing the market.

View our latest analysis for Scout Gaming Group

Because Scout Gaming Group made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year Scout Gaming Group saw its revenue grow by 51%. That's well above most other pre-profit companies. Given the revenue growth, the share price drop of 32% seems quite harsh. Our sympathies to shareholders who are now underwater. On the bright side, if this company is moving profits in the right direction, top-line growth like that could be an opportunity. Our brains have evolved to think in linear fashion, so there's value in learning to recognize exponential growth. We are, in some ways, simply the wisest of the monkeys.

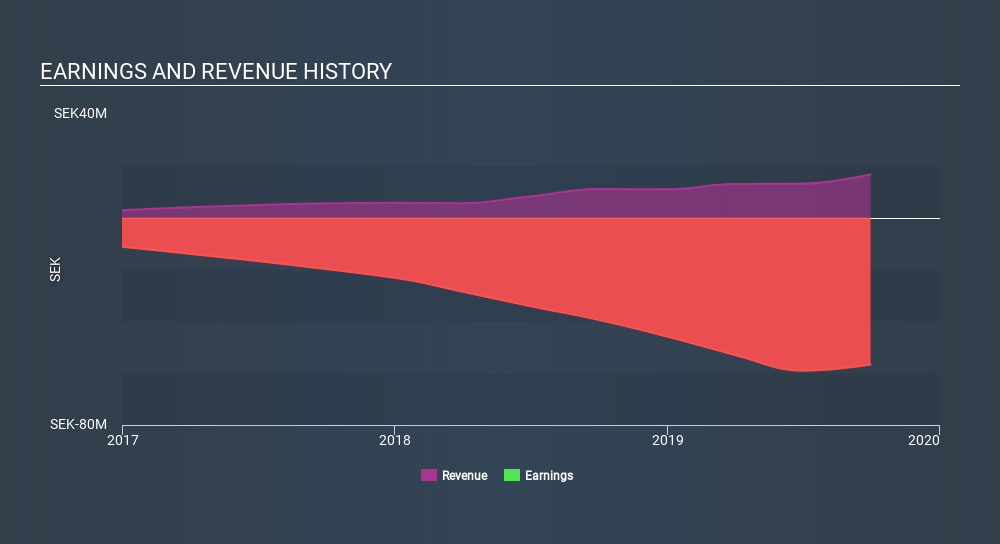

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Scout Gaming Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Given that the market gained 27% in the last year, Scout Gaming Group shareholders might be miffed that they lost 32%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. It's great to see a nice little 67% rebound in the last three months. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). It's always interesting to track share price performance over the longer term. But to understand Scout Gaming Group better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 6 warning signs for Scout Gaming Group (of which 1 is significant!) you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About OM:SCOUT

Scout Gaming Group

Provides B2B daily fantasy sports, sportsbook, fantasy betting, and other sports betting products in Europe.

Flawless balance sheet low.

Market Insights

Community Narratives