- Sweden

- /

- Hospitality

- /

- OM:RAKE

Did You Manage To Avoid Raketech Group Holding's (STO:RAKE) 35% Share Price Drop?

Investors can approximate the average market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Investors in Raketech Group Holding PLC (STO:RAKE) have tasted that bitter downside in the last year, as the share price dropped 35%. That's well bellow the market return of 21%. Raketech Group Holding may have better days ahead, of course; we've only looked at a one year period. Furthermore, it's down 12% in about a quarter. That's not much fun for holders.

Check out our latest analysis for Raketech Group Holding

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the unfortunate twelve months during which the Raketech Group Holding share price fell, it actually saw its earnings per share (EPS) improve by 113%. It could be that the share price was previously over-hyped.

It's surprising to see the share price fall so much, despite the improved EPS. But we might find some different metrics explain the share price movements better.

Raketech Group Holding managed to grow revenue over the last year, which is usually a real positive. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

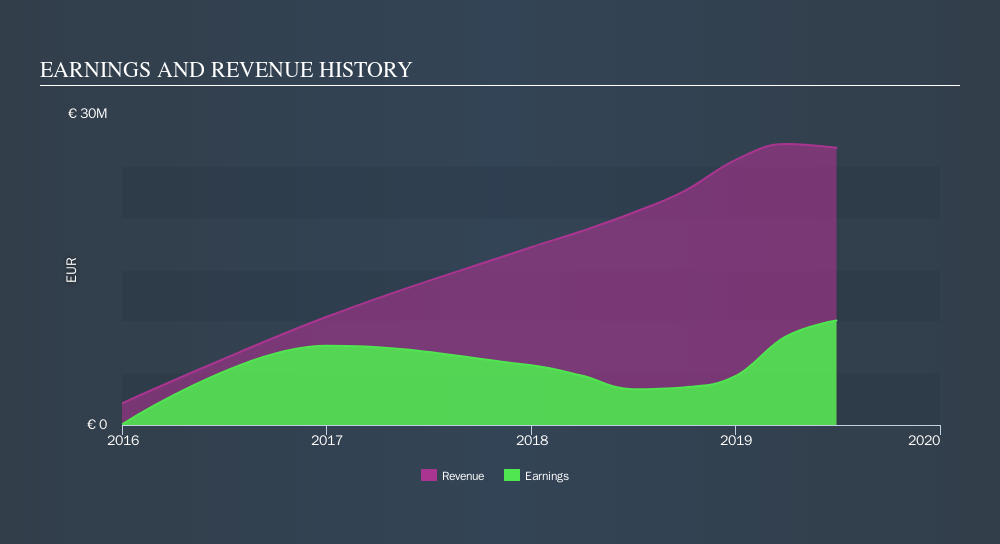

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. If you are thinking of buying or selling Raketech Group Holding stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

While Raketech Group Holding shareholders are down 35% for the year, the market itself is up 21%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. The share price decline has continued throughout the most recent three months, down 12%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Raketech Group Holding by clicking this link.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OM:RAKE

Raketech Group Holding

Operates as an affiliate and performance marketing company worldwide.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives