- Sweden

- /

- Hospitality

- /

- OM:EVO

Evolution (OM:EVO) Margin Miss Undercuts Bullish Growth Narrative Despite High Profitability

Reviewed by Simply Wall St

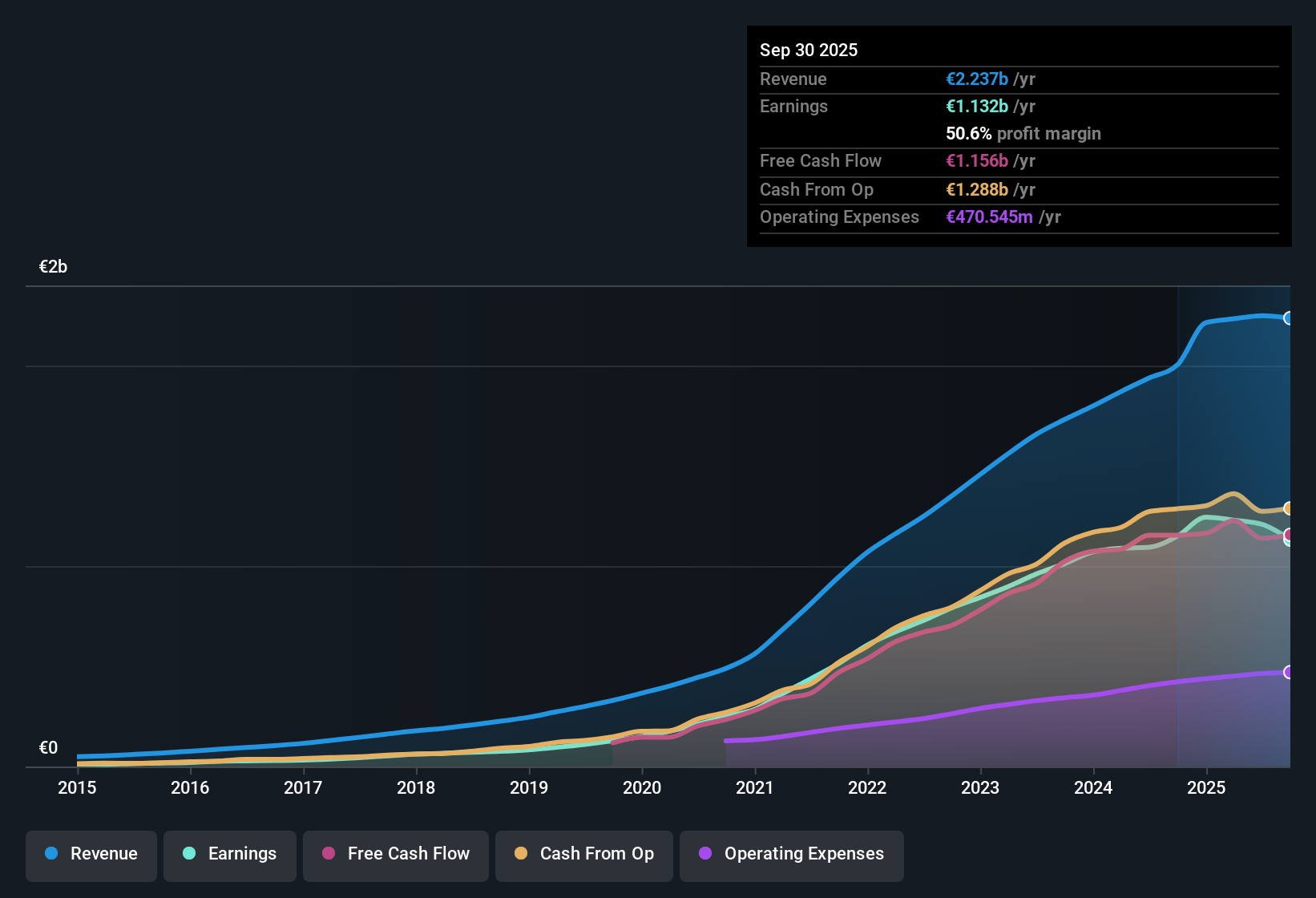

Evolution (OM:EVO) posted net profit margins of 53.7%, down from last year’s 56.5%, even as earnings grew 10.5% over the past year. Looking ahead, the company’s earnings are forecast to rise 10.8% annually and revenue by 9.4% per year. This continues a standout five-year average earnings growth rate of 26.4%. Investors are likely weighing the mix of strong historic growth and consistently high margins against a modest year-on-year decline in profitability.

See our full analysis for Evolution.Now let’s see how these results hold up when set against the core narratives circulating in the market. Some storylines will match the data, but others might get a reality check.

See what the community is saying about Evolution

DCF Fair Value Nearly Doubles Share Price

- Evolution's current share price stands at SEK673.80, which is less than half of its DCF fair value of SEK1,660.63.

- The analysts' consensus view highlights that this wide valuation gap is unusual for a company that has averaged 26.4% annual earnings growth over the past five years.

- Consensus narrative draws attention to the fact that Evolution now trades at a relatively low 10.3x price-to-earnings ratio compared to 17.5x for the European Hospitality industry, which could signal undervaluation if the company sustains its profit margins.

- However, the consensus also cautions that with earnings forecast to rise at just 10.8% per year and margins expected to shrink to 49.3% over three years, some of this discount reflects investor worries around regulatory and operational risks.

- Look deeper into whether Evolution's steep discount is really an opportunity as analysts debate its risk-reward balance. 📊 Read the full Evolution Consensus Narrative.

Analysts See Margin Pressure Mounting

- Analysts project profit margins will contract from 53.7% today to 49.3% by year three, even as the number of shares outstanding is expected to shrink roughly 2.37% per year.

- The consensus narrative points out that while expansion into new markets and major branded game partnerships support the bull case for stable margins, Bears are quick to highlight that European regulatory pressures and rising compliance costs accounted for a 5% sequential revenue decline in Europe, raising the risk that margin compression may accelerate if costs continue outpacing top-line growth.

- Bears also argue that growth in Evolution's RNG segment has nearly stalled at 0.3% annual growth, weighing on future diversification and margin upside.

- Consensus ultimately suggests that margin trends over the next few years will play a pivotal role in validating or refuting both sides of the investment debate.

Profit Growth Slowing From Historic Highs

- Evolution delivered earnings growth of 10.5% in the latest year, a marked slowdown from its 5-year average growth rate of 26.4% annually, and consensus now forecasts annual earnings growth of 10.8% ahead.

- According to the consensus narrative, this deceleration means Evolution’s future investment case leans more on capture of new regulated markets, strong branded content, and cost discipline rather than the turbocharged organic growth of the past.

- The consensus emphasizes that as topline growth cools, shareholder returns will depend increasingly on the success of new studio launches in places like Brazil and the Philippines, as well as whether continued buybacks and operational efficiencies can offset profit margin headwinds.

- Analysts are watching for signs that Evolution can return to high-teens growth, but projected rates imply steadier, lower-volatility gains for now.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Evolution on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got your own take on these figures? Bring your fresh perspective to life and shape your own narrative in under three minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Evolution.

See What Else Is Out There

Despite Evolution’s historic outperformance, its growth is now slowing and margins are facing increasing pressure from regulatory and operational headwinds.

If you’d prefer steadier performers with reliable earnings momentum, use our stable growth stocks screener (2090 results) to focus on companies that consistently deliver results through changing market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evolution might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:EVO

Evolution

Develops, produces, markets, and licenses online casino systems to gaming operators in Europe, Asia, North America, Latin America, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives