- Sweden

- /

- Hospitality

- /

- OM:EVO

Evolution (OM:EVO) Is Down 7.2% After Q3 Earnings Miss and Public Spat With Playtech

Reviewed by Sasha Jovanovic

- In the third quarter of 2025, Evolution AB reported revenue of €507.12 million and net income of €252.33 million, both lower than the same period last year. The company also publicly accused competitor Playtech of orchestrating a smear campaign, intensifying industry focus and market volatility.

- This rare public dispute between major live-casino providers highlights the competitive pressures and increasing scrutiny facing operators in the rapidly evolving online gaming industry.

- We'll examine how Evolution's earnings miss and heightened rivalry with Playtech may influence its medium-term growth outlook and risk profile.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Evolution Investment Narrative Recap

To be a shareholder in Evolution, you need to believe in its ability to maintain leadership in live casino, drive growth through expansion and innovation, and navigate an increasingly regulated and competitive online gaming sector. The Q3 2025 earnings miss and public dispute with Playtech have amplified scrutiny on short-term performance, but do not materially alter the core medium-term catalyst: capturing growth in newly regulating regions. The biggest risk remains increased regulatory pressure in Europe and its potential impact on profitability.

Among Evolution's recent announcements, its exclusive global licensing deal with Hasbro stands out. While the Q3 results were disappointing, this partnership could support revenue growth by launching new branded games and deepening product differentiation, directly reinforcing Evolution's efforts to unlock new regulated markets and expand its customer base.

In contrast, investors should be aware that even as Evolution pursues growth in new regions, rising regulatory costs and compliance demands may...

Read the full narrative on Evolution (it's free!)

Evolution's outlook projects €2.7 billion in revenue and €1.3 billion in earnings by 2028. This scenario assumes a 5.8% annual revenue growth rate and a €0.1 billion increase in earnings from €1.2 billion today.

Uncover how Evolution's forecasts yield a SEK817.27 fair value, a 21% upside to its current price.

Exploring Other Perspectives

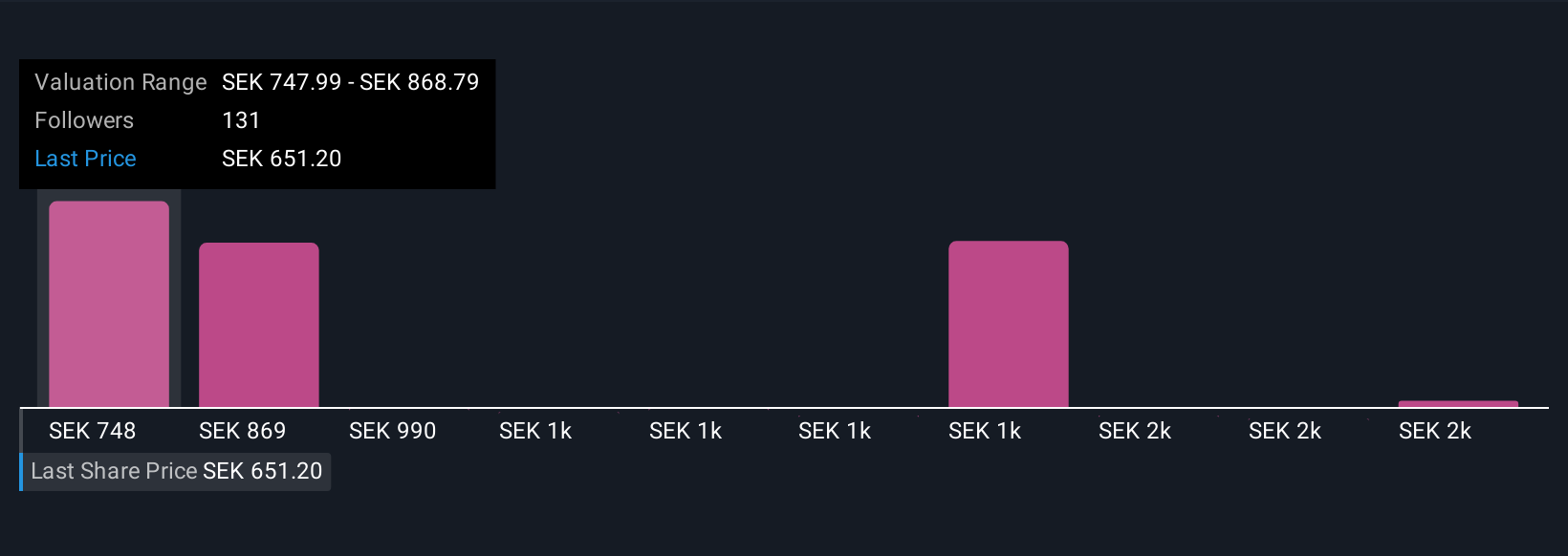

Thirty-four members of the Simply Wall St Community estimate Evolution's fair value between SEK748 and SEK1,956, showing a wide range of price targets. Persistent regulatory scrutiny across Europe continues to weigh on sentiment, making it important to consider multiple viewpoints when evaluating the stock’s potential.

Explore 34 other fair value estimates on Evolution - why the stock might be worth over 2x more than the current price!

Build Your Own Evolution Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Evolution research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Evolution research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Evolution's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evolution might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:EVO

Evolution

Develops, produces, markets, and licenses online casino systems to gaming operators in Europe, Asia, North America, Latin America, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives