For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Betsson (STO:BETS B). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Betsson

How Quickly Is Betsson Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. It certainly is nice to see that Betsson has managed to grow EPS by 25% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

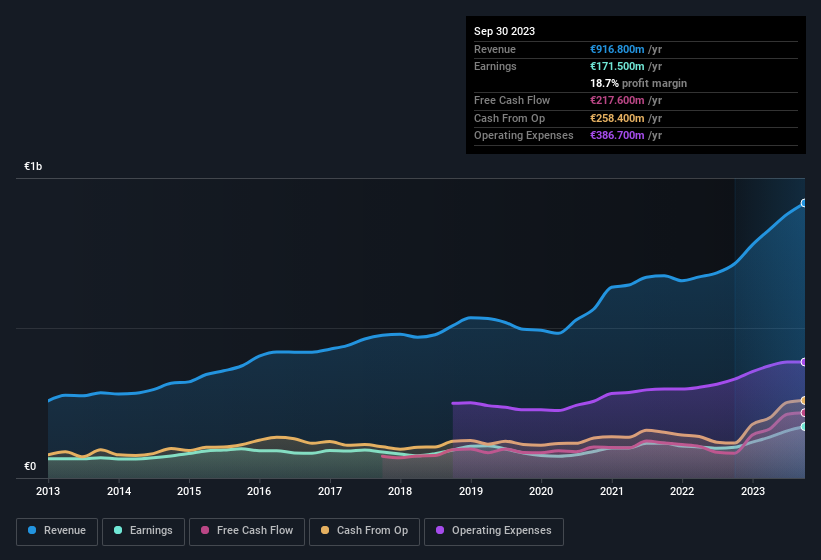

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Betsson shareholders can take confidence from the fact that EBIT margins are up from 16% to 21%, and revenue is growing. Both of which are great metrics to check off for potential growth.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Betsson?

Are Betsson Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Any way you look at it Betsson shareholders can gain quiet confidence from the fact that insiders shelled out €4.6m to buy stock, over the last year. And when you consider that there was no insider selling, you can understand why shareholders might believe that there are brighter days ahead. Zooming in, we can see that the biggest insider purchase was by Director Peter Hamberg for kr4.0m worth of shares, at about kr106 per share.

Along with the insider buying, another encouraging sign for Betsson is that insiders, as a group, have a considerable shareholding. To be specific, they have €393m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 2.7% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. The cherry on top is that the CEO, Pontus Lindwall is paid comparatively modestly to CEOs at similar sized companies. The median total compensation for CEOs of companies similar in size to Betsson, with market caps between €934m and €3.0b, is around €794k.

Betsson's CEO only received compensation totalling €1.7k in the year to December 2022. This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Betsson Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Betsson's strong EPS growth. On top of that, insiders own a significant stake in the company and have been buying more shares. So it's fair to say that this stock may well deserve a spot on your watchlist. You should always think about risks though. Case in point, we've spotted 1 warning sign for Betsson you should be aware of.

The good news is that Betsson is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Betsson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BETS B

Betsson

Through its subsidiaries, invests in and manages online gaming business primarily in the Nordic countries, Latin America, Western Europe, Central and Eastern Europe, Central Asia, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives