Thule Group (OM:THULE) Eyes Growth with AI Investments Despite Dividend Constraints and Market Volatility

Reviewed by Simply Wall St

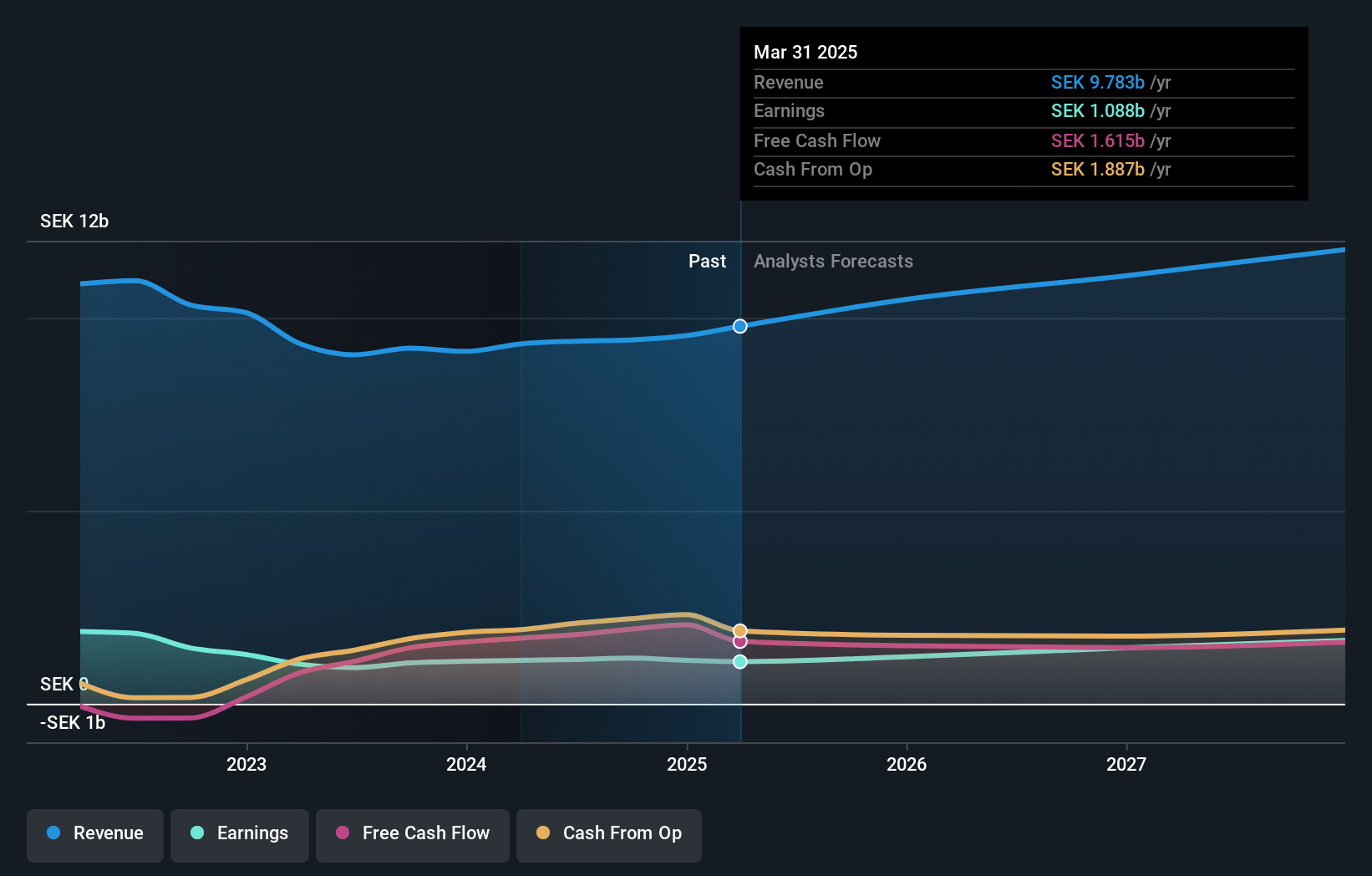

Thule Group (OM:THULE) continues to demonstrate strong financial health with a forecasted return on equity of 21.5% and an annual revenue growth of 13.2%, surpassing the Swedish market averages. Recent developments include strategic investments in AI and automation, aiming to expand product lines and enhance customer engagement, aligning with industry trends in sustainability and digital transformation. This report will explore Thule's core advantages, challenges, growth avenues, and the impact of market volatility on its operations.

Click here to discover the nuances of Thule Group with our detailed analytical report.

Core Advantages Driving Sustained Success for Thule Group

Thule Group's financial health is underscored by a high forecasted return on equity of 21.5% over the next three years, significantly outpacing the Swedish market. This is complemented by an expected revenue growth of 13.2% annually, which is notably faster than the market average. The company's strategic focus on product innovation has been a key driver, as highlighted by Toby Lawton's remarks on the success of recent launches. Additionally, Thule's improved net profit margin of 12.5% and well-covered interest payments demonstrate financial stability. Trading below its estimated fair value at SEK346.4, the company shows strong market positioning compared to peers.

Challenges Constraining Thule Group's Potential

Operational inefficiencies remain a concern, as acknowledged by Lawton, indicating areas for improvement despite the growth. The company's earnings growth over the past five years has been modest at 2.1% annually, trailing the leisure industry average. Furthermore, Thule's return on equity is considered low at 16.6%, and its dividend yield of 2.74% falls short of top-tier payers. The high dividend payout ratio of 84.9% suggests potential constraints on reinvestment capabilities.

Growth Avenues Awaiting Thule Group

Thule is poised to capitalize on significant earnings growth opportunities over the next three years. The company is actively expanding its product lines, aiming to capture new customer segments, as noted by Mattias Ankarberg. Investments in AI and automation are set to enhance operational capabilities and customer engagement, aligning with favorable industry trends in sustainability and digital transformation. These initiatives could fortify Thule's market position and drive long-term growth.

Market Volatility Affecting Thule Group's Position

Economic headwinds pose a threat to Thule's revenue, with potential downturns impacting consumer spending. The company's high Price-To-Earnings Ratio of 31x, compared to the global leisure industry average, raises concerns about overvaluation. Regulatory challenges and supply chain disruptions further complicate the situation, necessitating strategic responses to maintain operational stability. Ankarberg's proactive monitoring of regulatory developments reflects an awareness of these external pressures.

Conclusion

Thule Group's financial outlook is promising, with a projected return on equity of 21.5% over the next three years and anticipated revenue growth of 13.2% annually, positioning it ahead of the Swedish market. This strong performance is driven by strategic product innovation and a solid net profit margin of 12.5%, reinforcing its market position. However, operational inefficiencies and a high dividend payout ratio could limit reinvestment and growth potential. Thule's investment in AI and automation, along with its expansion into new customer segments, offers significant growth opportunities. Currently trading below its estimated fair value of SEK392.73 at SEK346.4, Thule presents a compelling investment opportunity compared to peers, though it remains relatively high-priced against the global leisure industry average. This pricing suggests that while Thule is a strong contender in its market, investors should weigh the potential for future growth against current economic uncertainties and industry pressures.

Where To Now?

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Thule Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About OM:THULE

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives