Thule Group AB (publ) (STO:THULE) Shares May Have Slumped 31% But Getting In Cheap Is Still Unlikely

The Thule Group AB (publ) (STO:THULE) share price has fared very poorly over the last month, falling by a substantial 31%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 23% in that time.

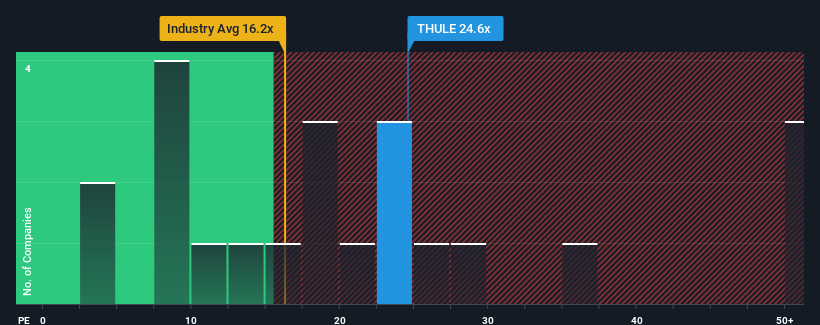

Even after such a large drop in price, given around half the companies in Sweden have price-to-earnings ratios (or "P/E's") below 19x, you may still consider Thule Group as a stock to potentially avoid with its 22.5x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's inferior to most other companies of late, Thule Group has been relatively sluggish. One possibility is that the P/E is high because investors think this lacklustre earnings performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

See our latest analysis for Thule Group

Is There Enough Growth For Thule Group?

In order to justify its P/E ratio, Thule Group would need to produce impressive growth in excess of the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. This isn't what shareholders were looking for as it means they've been left with a 39% decline in EPS over the last three years in total. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 19% per year as estimated by the six analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 20% each year, which is not materially different.

With this information, we find it interesting that Thule Group is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

There's still some solid strength behind Thule Group's P/E, if not its share price lately. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Thule Group's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware Thule Group is showing 2 warning signs in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Thule Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Thule Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:THULE

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives