European Undervalued Small Caps With Insider Action In June 2025

Reviewed by Simply Wall St

In recent weeks, European markets have experienced a modest upswing, with the pan-European STOXX Europe 600 Index rising by 0.65%, buoyed by easing trade tensions and expectations of potential interest rate cuts from the European Central Bank. Amidst this backdrop, investors are increasingly focusing on small-cap stocks, which can offer unique opportunities for growth due to their agility and potential for innovation in a dynamic economic environment.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 12.0x | 0.5x | 34.01% | ★★★★★☆ |

| Tristel | 26.8x | 3.8x | 14.45% | ★★★★☆☆ |

| AKVA group | 15.8x | 0.7x | 45.82% | ★★★★☆☆ |

| Close Brothers Group | NA | 0.5x | 45.84% | ★★★★☆☆ |

| Eastnine | 18.2x | 8.8x | 40.64% | ★★★★☆☆ |

| Savills | 24.7x | 0.6x | 41.68% | ★★★☆☆☆ |

| Absolent Air Care Group | 22.3x | 1.8x | 49.40% | ★★★☆☆☆ |

| Italmobiliare | 11.9x | 1.6x | -219.73% | ★★★☆☆☆ |

| SmartCraft | 42.3x | 7.6x | 32.44% | ★★★☆☆☆ |

| Seeing Machines | NA | 2.3x | 45.51% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

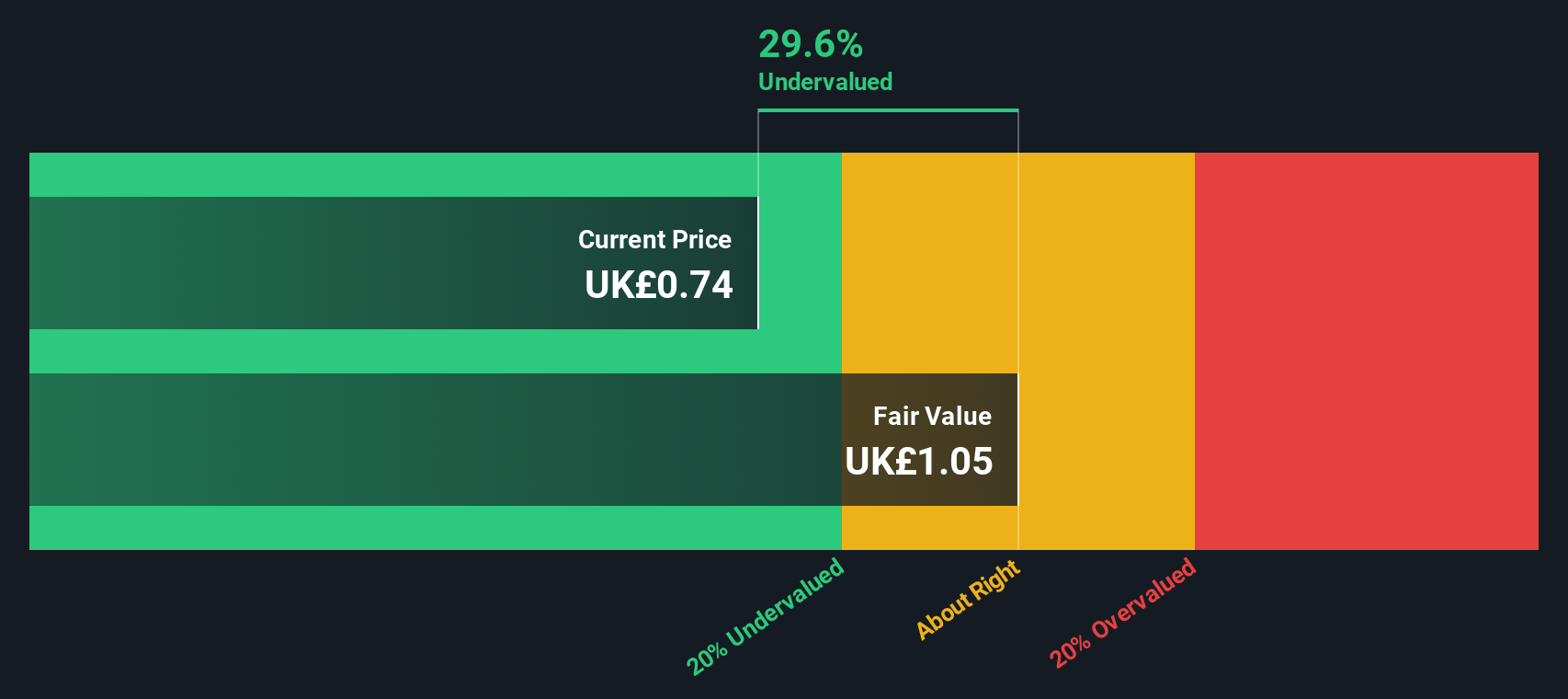

Dr. Martens (LSE:DOCS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Dr. Martens is a renowned British footwear brand known for its iconic boots and shoes, with a market capitalization of approximately £2.5 billion.

Operations: The company's revenue primarily comes from footwear sales, with a recent reported revenue of £805.9 million. The gross profit margin has shown an upward trend, reaching 65.52% in the latest period. Operating expenses are significant, including general and administrative costs and non-operating expenses contributing to the overall financial performance.

PE: 19.7x

Dr. Martens, a known footwear brand in Europe, is experiencing insider confidence with recent share purchases in May 2025. Despite a dip in profit margins to 3.6% from last year's 10.6%, the company forecasts earnings growth of 24% annually, suggesting potential for future expansion. However, reliance on external borrowing poses financial risks as interest payments aren't fully covered by earnings. A strategy update presentation on May 15, 2025, highlighted efforts to address these challenges and leverage growth opportunities within their niche market segment.

- Delve into the full analysis valuation report here for a deeper understanding of Dr. Martens.

Review our historical performance report to gain insights into Dr. Martens''s past performance.

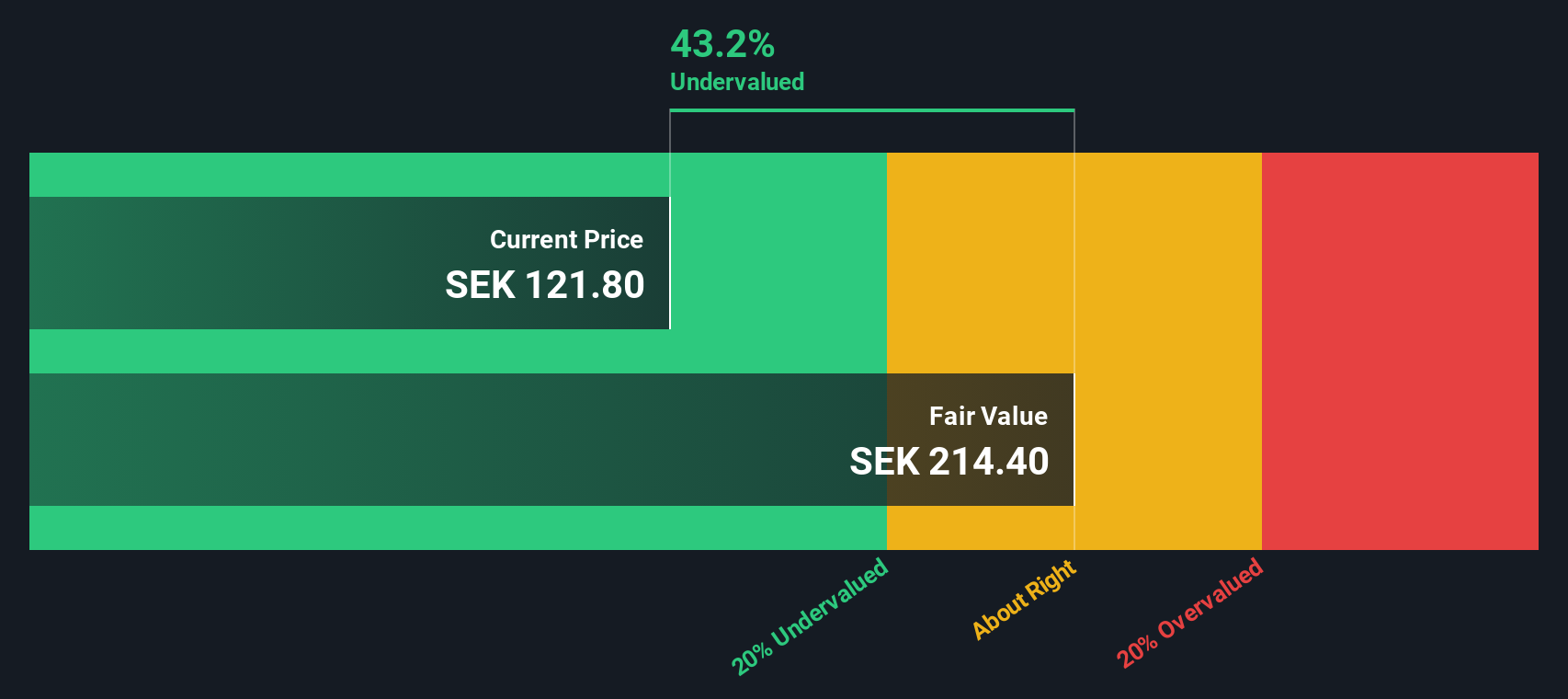

New Wave Group (OM:NEWA B)

Simply Wall St Value Rating: ★★★★☆☆

Overview: New Wave Group operates in the corporate, sports and leisure, and gifts and home furnishings sectors, with a market capitalization of SEK 8.52 billion.

Operations: The company generates revenue primarily from three segments: Corporate, Sports & Leisure, and Gifts & Home Furnishings. Over recent periods, the gross profit margin has shown a trend of fluctuating around 50%, reflecting its ability to manage costs relative to sales. Operating expenses have been significant but stable in relation to its gross profit, indicating effective cost management.

PE: 17.8x

New Wave Group exhibits insider confidence with Jens Petersson acquiring 248,250 shares, reflecting a 54% increase in their holdings. Despite relying on external borrowing as its sole funding source, the company shows potential with forecasted earnings growth of 18% annually. Recent financials reveal a rise in Q1 sales to SEK 2.2 billion and net income to SEK 144 million. A dividend of SEK 3.50 per share is set for distribution across two installments in May and December 2025.

- Click here and access our complete valuation analysis report to understand the dynamics of New Wave Group.

Evaluate New Wave Group's historical performance by accessing our past performance report.

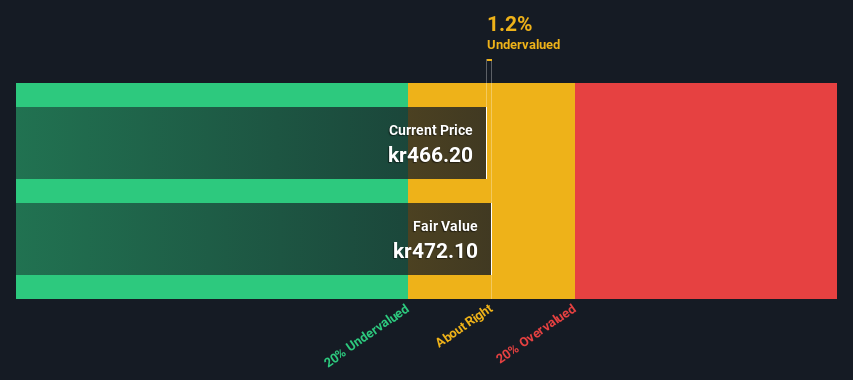

Vitec Software Group (OM:VIT B)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Vitec Software Group is a Swedish company specializing in the development and provision of industry-specific software solutions, with a market capitalization of approximately SEK 12.34 billion.

Operations: Vitec Software Group's primary revenue stream is from software and programming, generating SEK 3.50 billion. The company's gross profit margin has shown fluctuations, peaking at 54.13% in Q3 2022 before adjusting to 47.21% by Q1 2025. Operating expenses are a significant component of their cost structure, with general and administrative expenses being the largest category within operating costs.

PE: 44.3x

Vitec Software Group, a European software company, demonstrates potential as an undervalued small-cap stock. Despite high debt levels and reliance on external borrowing, its revenue for Q1 2025 rose to SEK 902.4 million from SEK 716.05 million the previous year, indicating strong growth momentum. Insider confidence is reflected in recent share purchases by key figures within the company. The approved quarterly dividend of SEK 3.60 per share underscores financial stability and shareholder commitment amidst projected earnings growth of 17.9% annually.

- Get an in-depth perspective on Vitec Software Group's performance by reading our valuation report here.

Assess Vitec Software Group's past performance with our detailed historical performance reports.

Seize The Opportunity

- Get an in-depth perspective on all 79 Undervalued European Small Caps With Insider Buying by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VIT B

Vitec Software Group

Develops and delivers vertical market software solutions in Sweden, Denmark, Finland, Norway, the Netherlands, the United States, and internationally.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives