As European markets face a pullback amid concerns about overvaluation in artificial intelligence-related stocks, investors are increasingly cautious, with major indexes such as Germany's DAX and France's CAC 40 experiencing notable declines. In this climate of uncertainty, companies with strong insider ownership often attract attention as they may indicate confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 12% | 44.9% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 96.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| Egetis Therapeutics (OM:EGTX) | 10.3% | 86.1% |

| DNO (OB:DNO) | 13.5% | 102.3% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 65.5% |

| CD Projekt (WSE:CDR) | 29.7% | 51% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.7% |

Let's review some notable picks from our screened stocks.

Ambu (CPSE:AMBU B)

Simply Wall St Growth Rating: ★★★★☆☆

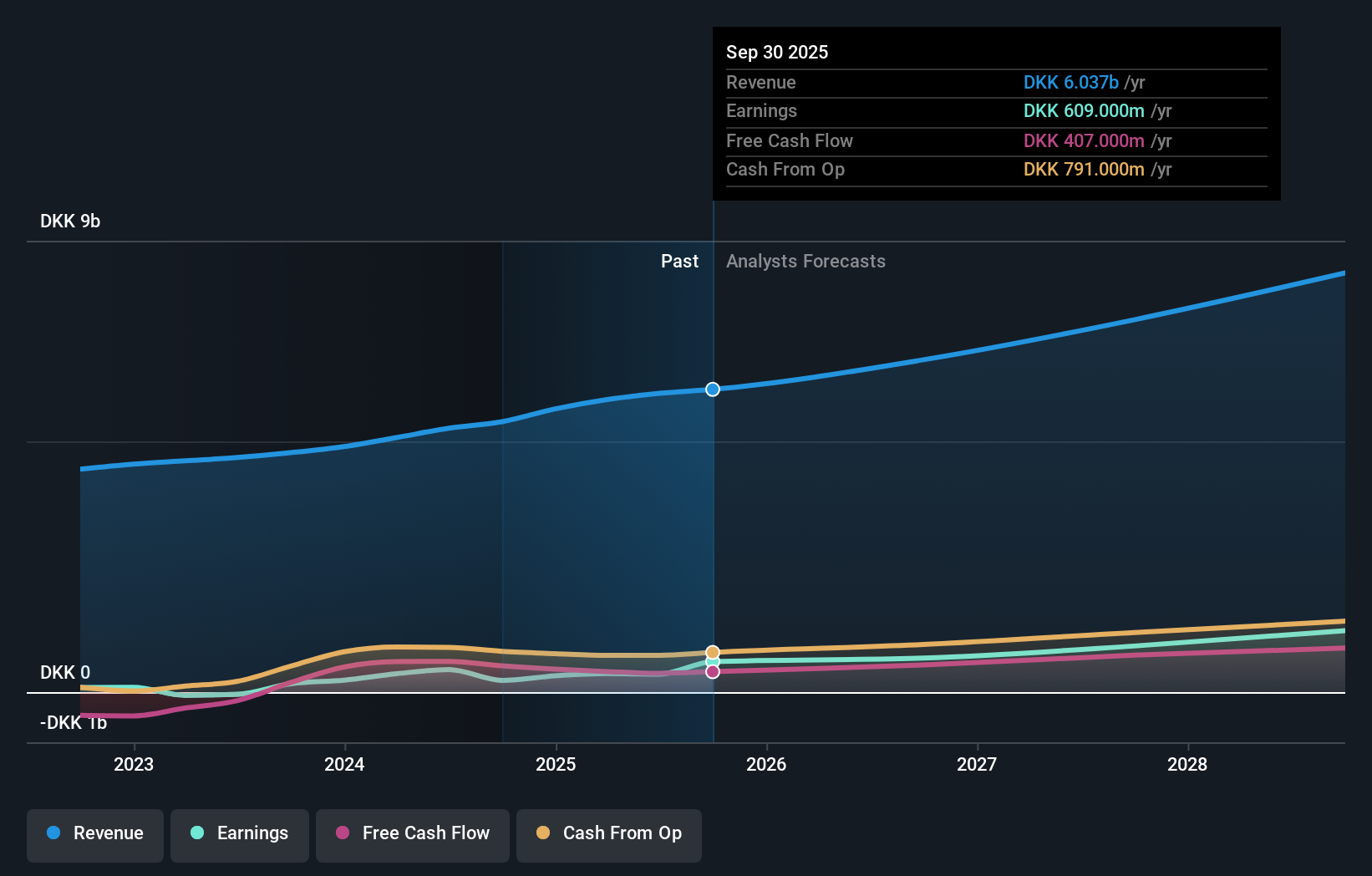

Overview: Ambu A/S, along with its subsidiaries, focuses on the research, development, manufacturing, marketing, and sale of medical technology solutions across North America, Europe, and other international markets; it has a market cap of approximately DKK22.88 billion.

Operations: Ambu's revenue is primarily derived from its Medical Technology Solutions segment, which generated DKK6.04 billion.

Insider Ownership: 20%

Ambu A/S demonstrates strong growth potential with earnings forecasted to grow significantly at 20.09% annually, surpassing the Danish market's average. Despite revenue growth projections of 10.6% per year being less than 20%, they exceed the local market rate. Recent results show a dramatic rise in net income to DKK 609 million from DKK 235 million year-on-year, reflecting robust operational performance. Insider activity indicates more buying than selling recently, aligning with its undervalued trading status.

- Click here and access our complete growth analysis report to understand the dynamics of Ambu.

- According our valuation report, there's an indication that Ambu's share price might be on the expensive side.

New Wave Group (OM:NEWA B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: New Wave Group AB (publ) designs, acquires, and develops brands and products across corporate, sports, gifts, and home furnishings sectors globally with a market cap of SEK15.11 billion.

Operations: The company's revenue is segmented into Corporate at SEK4.80 billion, Sports & Leisure at SEK4.05 billion, and Gifts & Home Furnishings at SEK855.50 million.

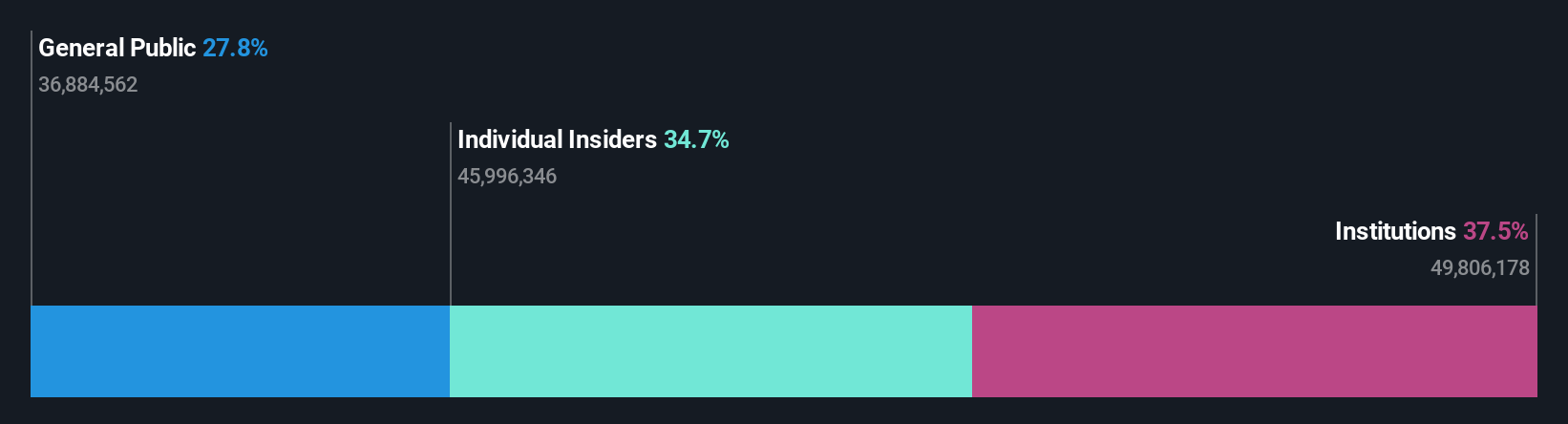

Insider Ownership: 34.7%

New Wave Group AB shows promising growth potential with earnings expected to grow significantly at 24.7% per year, outpacing the Swedish market's average. Revenue is forecasted to rise by 10.3% annually, exceeding local market rates but remaining below 20%. Recent earnings reports indicate a decline in net income compared to the previous year, yet insider activity reveals more buying than selling recently. The stock trades at a substantial discount relative to its estimated fair value and peers.

- Unlock comprehensive insights into our analysis of New Wave Group stock in this growth report.

- Our valuation report here indicates New Wave Group may be undervalued.

Straumann Holding (SWX:STMN)

Simply Wall St Growth Rating: ★★★★☆☆

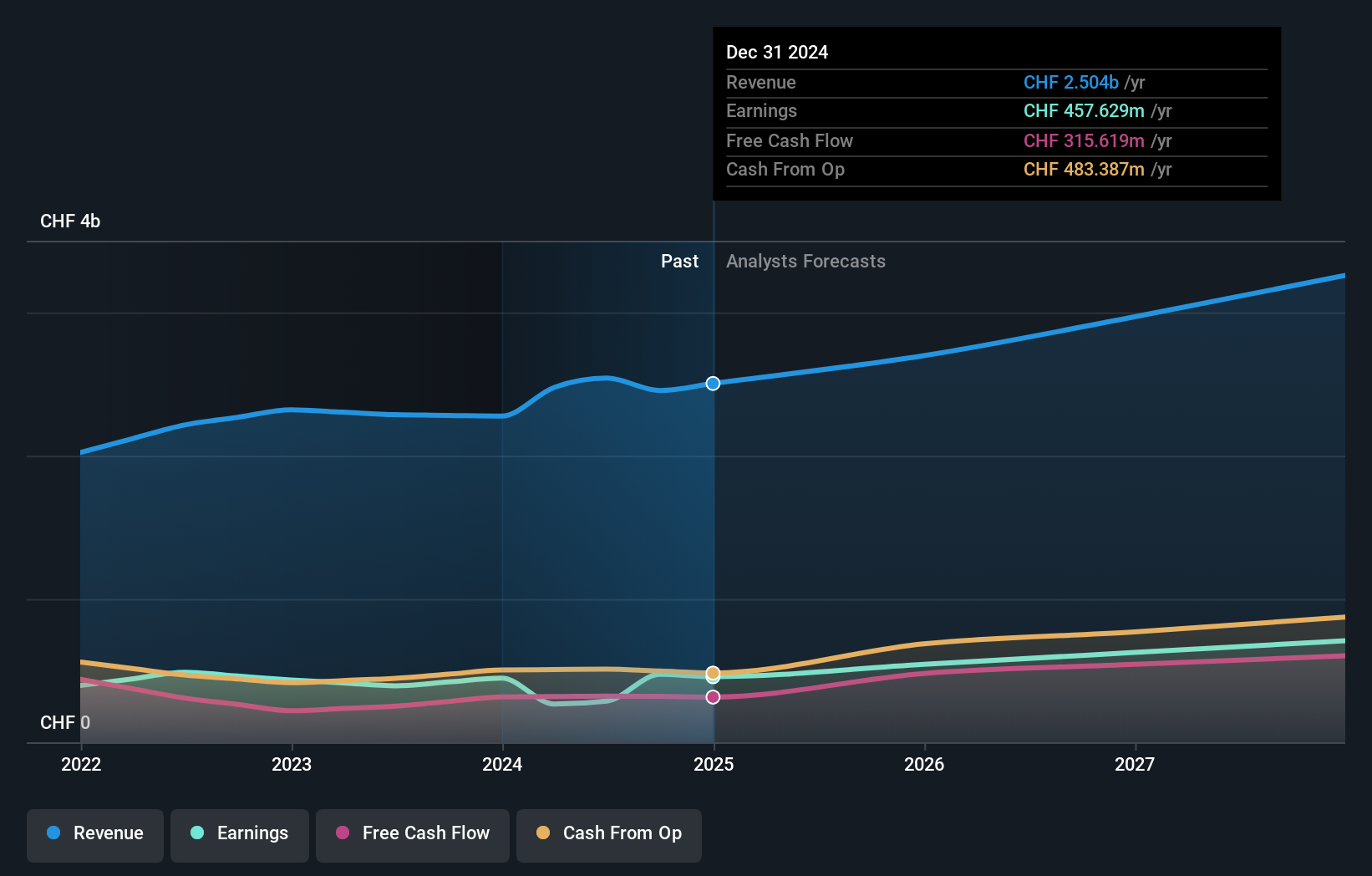

Overview: Straumann Holding AG is a global provider of tooth replacement and orthodontic solutions with a market cap of CHF16.25 billion.

Operations: Straumann Holding AG generates revenue primarily from its operations in Europe, the Middle East and Africa (CHF1.14 billion), North America (CHF783.18 million), Asia Pacific (CHF655.77 million), and Latin America (CHF292.92 million).

Insider Ownership: 32.3%

Straumann Holding's earnings are projected to grow at 15% annually, surpassing the Swiss market average. Revenue is expected to increase by 8.8% per year, driven by strategic partnerships like the one with Smartee Denti-Technology, enhancing its orthodontics business and profitability. The company's stock trades significantly below estimated fair value, indicating potential upside. Recent developments include a CHF 250 million bond issuance for refinancing and corporate purposes, reflecting sound financial management practices.

- Click here to discover the nuances of Straumann Holding with our detailed analytical future growth report.

- Our expertly prepared valuation report Straumann Holding implies its share price may be lower than expected.

Summing It All Up

- Navigate through the entire inventory of 191 Fast Growing European Companies With High Insider Ownership here.

- Searching for a Fresh Perspective? AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if New Wave Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NEWA B

New Wave Group

Designs, acquires, and develops brands and products in the corporate, sports, gifts, and home furnishings sectors in Sweden, the United States, Central Europe, rest of Nordiac countries, Southern Europe, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives