- Sweden

- /

- Consumer Durables

- /

- OM:NBZ

Positive Sentiment Still Eludes Northbaze Group AB (publ) (STO:NBZ) Following 32% Share Price Slump

Northbaze Group AB (publ) (STO:NBZ) shareholders won't be pleased to see that the share price has had a very rough month, dropping 32% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 40% share price drop.

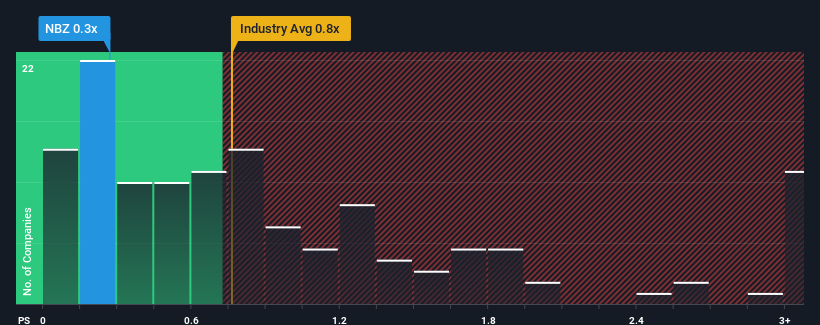

Following the heavy fall in price, it would be understandable if you think Northbaze Group is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.3x, considering almost half the companies in Sweden's Consumer Durables industry have P/S ratios above 0.9x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Northbaze Group

What Does Northbaze Group's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Northbaze Group has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Northbaze Group will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Northbaze Group?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Northbaze Group's to be considered reasonable.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. That's essentially a continuation of what we've seen over the last three years, as its revenue growth has been virtually non-existent for that entire period. Therefore, it's fair to say that revenue growth has definitely eluded the company recently.

Turning to the outlook, the next year should demonstrate the company's robustness, generating growth of 166% as estimated by the only analyst watching the company. That would be an excellent outcome when the industry is expected to decline by 5.1%.

With this information, we find it very odd that Northbaze Group is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the contrarian forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Northbaze Group's recently weak share price has pulled its P/S back below other Consumer Durables companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Northbaze Group's analyst forecasts revealed that its superior revenue outlook against a shaky industry isn't contributing to its P/S anywhere near as much as we would have predicted. When we see a superior revenue outlook with some actual growth, we can only assume investor uncertainty is what's been suppressing the P/S figures. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. It appears many are indeed anticipating revenue instability, because the company's current prospects should normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 3 warning signs for Northbaze Group you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Northbaze Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:NBZ

Northbaze Group

Develops, produces, and markets audio and sound equipment in Sweden, Germany, China, and Thailand.

Undervalued with high growth potential.