- Sweden

- /

- Consumer Durables

- /

- OM:NBZ

Investors Still Aren't Entirely Convinced By Northbaze Group AB (publ)'s (STO:NBZ) Revenues Despite 42% Price Jump

Northbaze Group AB (publ) (STO:NBZ) shareholders are no doubt pleased to see that the share price has bounced 42% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 38% in the last twelve months.

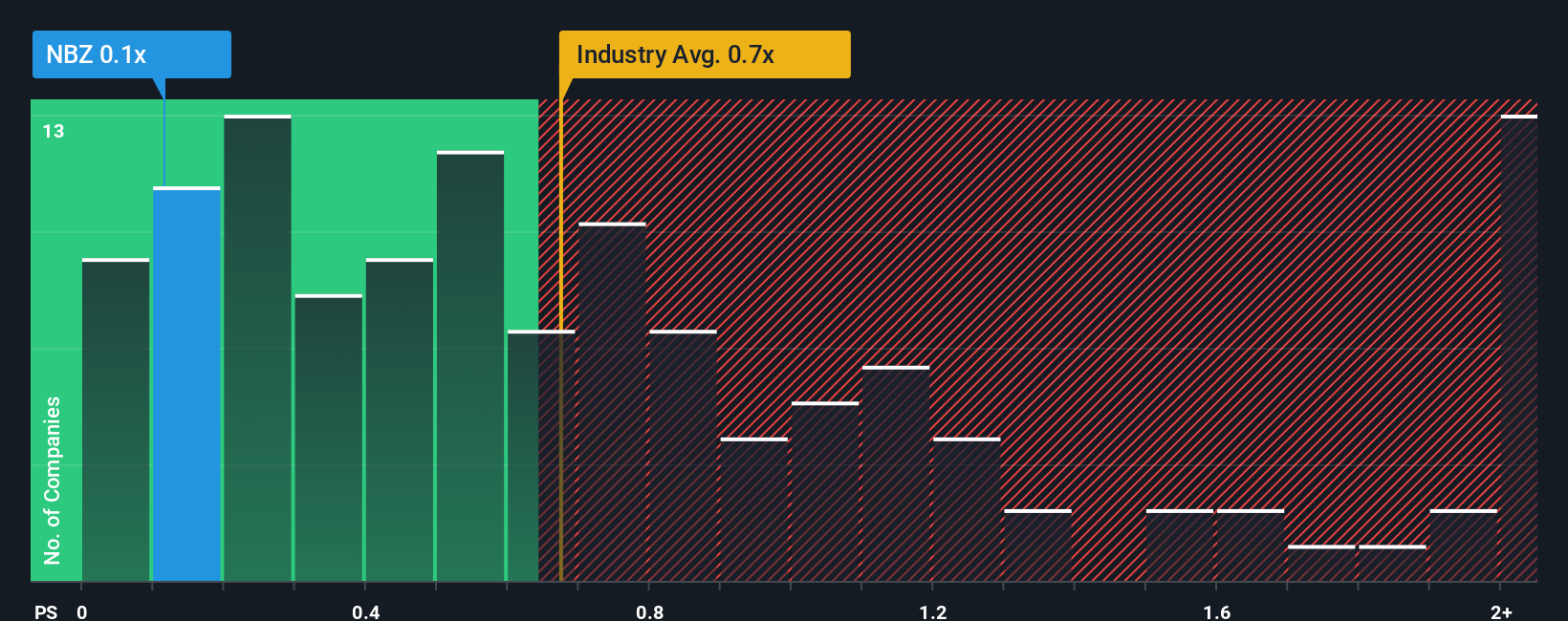

Although its price has surged higher, you could still be forgiven for feeling indifferent about Northbaze Group's P/S ratio of 0.1x, since the median price-to-sales (or "P/S") ratio for the Consumer Durables industry in Sweden is also close to 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Northbaze Group

What Does Northbaze Group's Recent Performance Look Like?

Northbaze Group certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. Those who are bullish on Northbaze Group will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Northbaze Group's earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Northbaze Group?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Northbaze Group's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 103% last year. The latest three year period has also seen an excellent 101% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 4.3% shows it's noticeably more attractive.

In light of this, it's curious that Northbaze Group's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Key Takeaway

Northbaze Group appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We didn't quite envision Northbaze Group's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Northbaze Group that you should be aware of.

If you're unsure about the strength of Northbaze Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Northbaze Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:NBZ

Northbaze Group

Designs, develops, produces, and markets audio and sound equipment in Nordic, Europe, Asia, the Middle East, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives