- Sweden

- /

- Consumer Durables

- /

- OM:CANDLE B

Take Care Before Jumping Onto Candles Scandinavia AB (publ) (STO:CANDLE B) Even Though It's 26% Cheaper

To the annoyance of some shareholders, Candles Scandinavia AB (publ) (STO:CANDLE B) shares are down a considerable 26% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 51% share price decline.

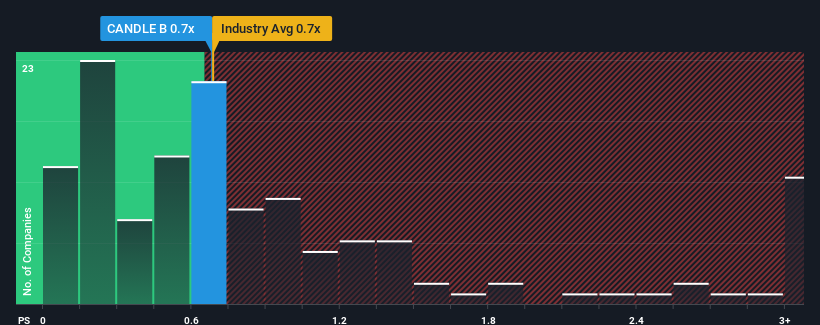

In spite of the heavy fall in price, it's still not a stretch to say that Candles Scandinavia's price-to-sales (or "P/S") ratio of 0.7x right now seems quite "middle-of-the-road" compared to the Consumer Durables industry in Sweden, seeing as it matches the P/S ratio of the wider industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Candles Scandinavia

How Has Candles Scandinavia Performed Recently?

Recent times have been advantageous for Candles Scandinavia as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think Candles Scandinavia's future stacks up against the industry? In that case, our free report is a great place to start.How Is Candles Scandinavia's Revenue Growth Trending?

In order to justify its P/S ratio, Candles Scandinavia would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 5.7%. The solid recent performance means it was also able to grow revenue by 24% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 26% during the coming year according to the lone analyst following the company. With the rest of the industry predicted to shrink by 3.1%, that would be a fantastic result.

In light of this, it's peculiar that Candles Scandinavia's P/S sits in-line with the majority of other companies. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

What Does Candles Scandinavia's P/S Mean For Investors?

Following Candles Scandinavia's share price tumble, its P/S is just clinging on to the industry median P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Candles Scandinavia currently trades on a lower than expected P/S since its growth forecasts are potentially beating a struggling industry. We assume that investors are attributing some risk to the company's future revenues, keeping it from trading at a higher P/S. The market could be pricing in the event that tough industry conditions will impact future revenues. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Candles Scandinavia (1 shouldn't be ignored!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:CANDLE B

Candles Scandinavia

Manufactures and sells scented candles based on plant-based wax made of rapeseed oil.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives