It Looks Like Nimbus Group AB (Publ)'s (STO:BOAT) CEO May Expect Their Salary To Be Put Under The Microscope

Key Insights

- Nimbus Group to hold its Annual General Meeting on 16th of May

- CEO Jan-Erik Lindström's total compensation includes salary of kr2.24m

- The total compensation is similar to the average for the industry

- Nimbus Group's EPS declined by 40% over the past three years while total shareholder loss over the past three years was 63%

Nimbus Group AB (Publ) (STO:BOAT) has not performed well recently and CEO Jan-Erik Lindström will probably need to up their game. At the upcoming AGM on 16th of May, shareholders can hear from the board including their plans for turning around performance. They will also get a chance to influence managerial decision-making through voting on resolutions such as executive remuneration, which may impact firm value in the future. From our analysis, we think CEO compensation may need a review in light of the recent performance.

Check out our latest analysis for Nimbus Group

Comparing Nimbus Group AB (Publ)'s CEO Compensation With The Industry

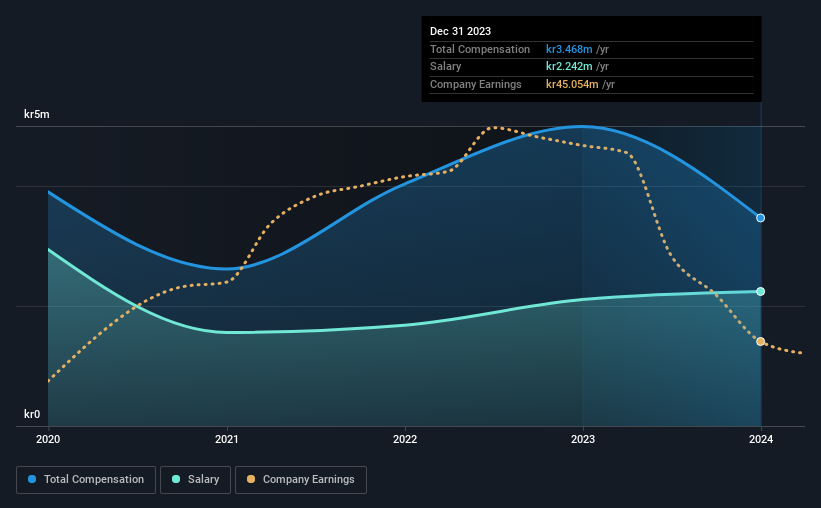

Our data indicates that Nimbus Group AB (Publ) has a market capitalization of kr531m, and total annual CEO compensation was reported as kr3.5m for the year to December 2023. Notably, that's a decrease of 31% over the year before. We note that the salary portion, which stands at kr2.24m constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the Sweden Leisure industry with market capitalizations under kr2.2b, the reported median total CEO compensation was kr3.5m. From this we gather that Jan-Erik Lindström is paid around the median for CEOs in the industry. What's more, Jan-Erik Lindström holds kr7.9m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | kr2.2m | kr2.1m | 65% |

| Other | kr1.2m | kr2.9m | 35% |

| Total Compensation | kr3.5m | kr5.0m | 100% |

On an industry level, roughly 68% of total compensation represents salary and 32% is other remuneration. Nimbus Group is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Nimbus Group AB (Publ)'s Growth

Over the last three years, Nimbus Group AB (Publ) has shrunk its earnings per share by 40% per year. It achieved revenue growth of 9.6% over the last year.

The decline in EPS is a bit concerning. And the modest revenue growth over 12 months isn't much comfort against the reduced EPS. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Nimbus Group AB (Publ) Been A Good Investment?

Few Nimbus Group AB (Publ) shareholders would feel satisfied with the return of -63% over three years. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 2 warning signs for Nimbus Group that investors should think about before committing capital to this stock.

Important note: Nimbus Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Nimbus Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BOAT

Nimbus Group

Designs, manufactures, and markets leisure motorboats in the Nordics, Europe, and the United States.

Reasonable growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026