- Sweden

- /

- Commercial Services

- /

- OM:SVIK

Pulling back 10% this week, Studsvik's STO:SVIK) five-year decline in earnings may be coming into investors focus

The Studsvik AB (publ) (STO:SVIK) share price has had a bad week, falling 10%. But that doesn't undermine the fantastic longer term performance (measured over five years). To be precise, the stock price is 301% higher than it was five years ago, a wonderful performance by any measure. Arguably, the recent fall is to be expected after such a strong rise. Only time will tell if there is still too much optimism currently reflected in the share price.

In light of the stock dropping 10% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive five-year return.

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Studsvik actually saw its EPS drop 5.5% per year.

This means it's unlikely the market is judging the company based on earnings growth. Because earnings per share don't seem to match up with the share price, we'll take a look at other metrics instead.

The modest 0.8% dividend yield is unlikely to be propping up the share price. In contrast revenue growth of 4.9% per year is probably viewed as evidence that Studsvik is growing, a real positive. It's quite possible that management are prioritizing revenue growth over EPS growth at the moment.

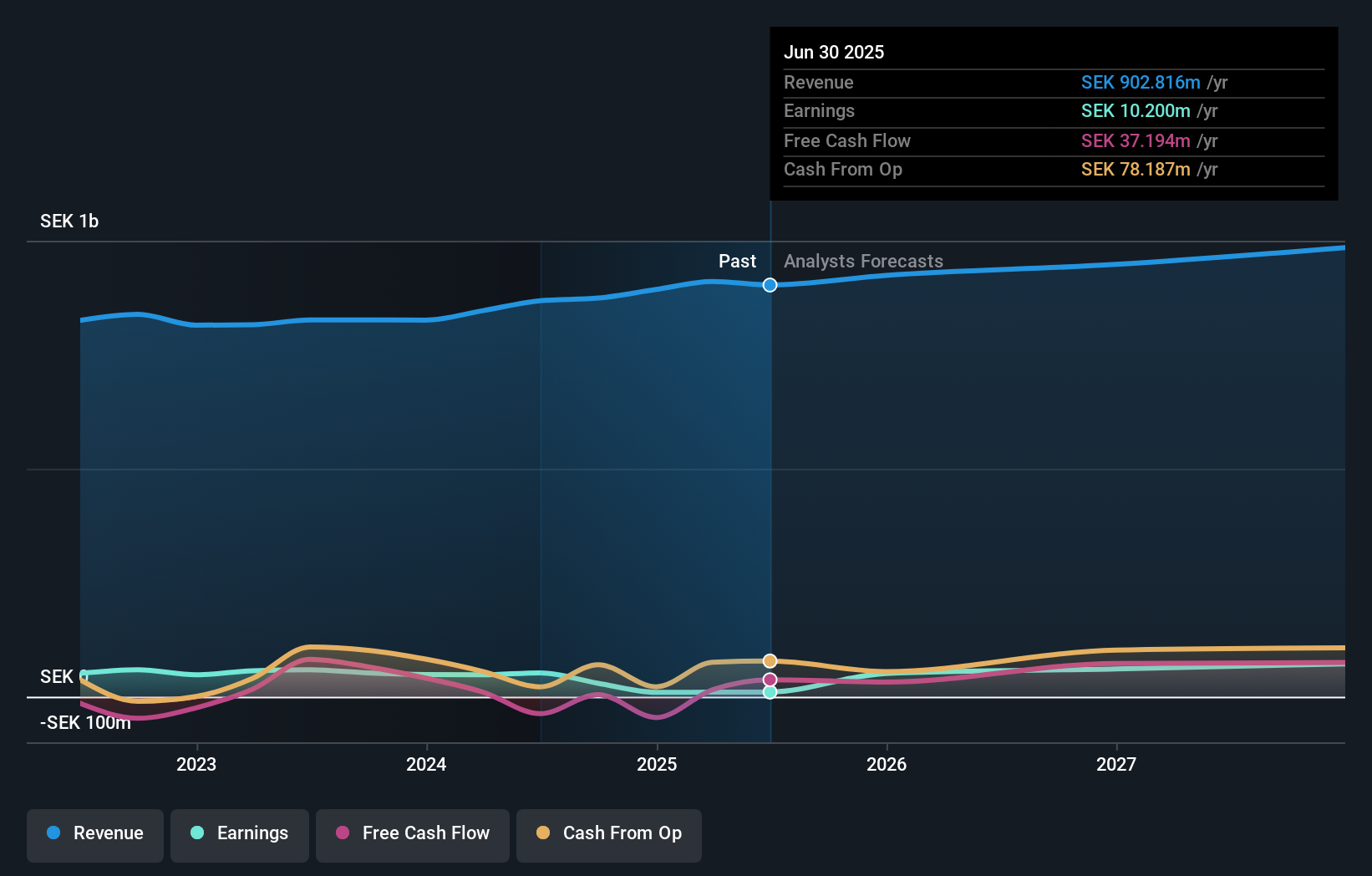

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Studsvik, it has a TSR of 335% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

It's good to see that Studsvik has rewarded shareholders with a total shareholder return of 74% in the last twelve months. Of course, that includes the dividend. That's better than the annualised return of 34% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Studsvik better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Studsvik you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:SVIK

Studsvik

Provides technical solutions across the nuclear and radioactive material lifecycle in Sweden, Germany, rest of Europe, Asia, North America, and internationally.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives