- Sweden

- /

- Professional Services

- /

- OM:REJL B

Rejlers (OM:REJL B) Net Profit Margins Hold Steady, Reinforcing Quality Narrative

Reviewed by Simply Wall St

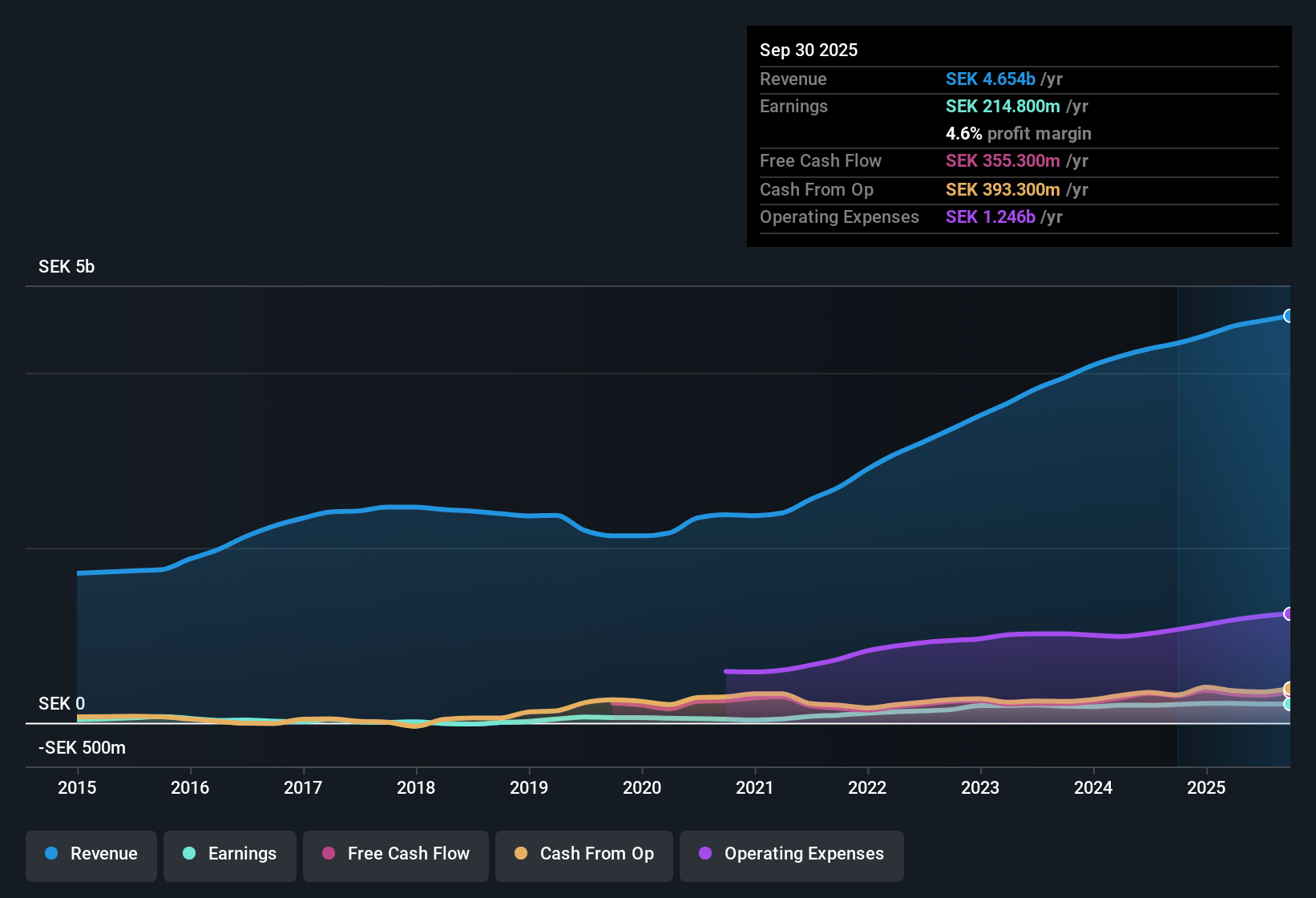

Rejlers (OM:REJL B) posted steady net profit margins of 4.7% in line with last year, while earnings grew 7.1% over the period, trailing behind the company’s five-year average of 27.5% annual growth. Consensus expectations call for revenue to rise 4.8% per year and earnings to advance 14.2% per year, both outpacing the broader Swedish market. With margins holding up and future growth forecasts running above market norms, the latest results present a mixed picture for investors weighing momentum and valuation.

See our full analysis for Rejlers.Next, we'll see how the latest earnings measure up against the widely followed narratives, highlighting where the numbers support the story and where they might bring surprises.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Consistency Defies Typical Slowdowns

- Net profit margin held steady at 4.7%, matching last year’s level even as annual earnings growth slowed to 7.1% from the five-year average of 27.5% per year.

- What stands out is how the margin stability directly supports the view that Rejlers' revenue stability and ongoing profit growth are not just a short-term blip. This is underpinned by solid core operations, especially when compared with other engineering consultancies that typically see margins fluctuate more dramatically year to year.

- The latest 7.1% earnings growth, below the historical trend, could make some investors cautious, but margin resilience signals underlying business quality.

- Steady margins, despite decelerating growth, reinforce that Rejlers remains well-positioned within its sector to capture above-market expansion, aided by its recurring project base.

Valuation Gap Signals Upside Against DCF Fair Value

- Rejlers is trading at SEK 196.40 per share, well below the DCF fair value of SEK 492.19 and also lower than the broader European Professional Services industry average price-to-earnings (P/E) ratio of 21.2x. Its own P/E of 20.6x sits above the Swedish peer average of 15.7x.

- The gap between the share price and intrinsic valuation heavily supports the perspective that the market may be undervaluing Rejlers’ future potential, especially when factoring in analysts' expectations for annual revenue growth of 4.8% and annual earnings growth of 14.2%, outpacing most local peers.

- The stock’s discount to DCF fair value is particularly notable given its growth forecasts exceed those of the Swedish market and peer companies. This suggests that the current price offers investors a margin of safety despite a premium to the Swedish peer P/E.

- This disconnect also highlights the opportunity for re-rating if the company delivers on consensus growth targets or closes the profitability gap with industry leaders.

Dividend Sustainability Poses Minor Risk Flag

- The balance of risks and rewards points to ongoing profit growth and high-quality recent earnings, but the sustainability of the dividend stands out as a specific area investors may want to monitor going forward.

- While revenue and profit trends remain positive, the prevailing view is that any hitch in sustained free cash flow or future margin compression could put pressure on dividend continuity. Investors focused on stable payouts should factor this consideration into their case.

- With current earnings remaining above peers and industry averages, most signs do not point to a near-term cut. However, monitoring future results for unexpected shifts in payout strategy remains prudent for income-focused shareholders.

- Skeptics highlight that, historically, even minor pressure on profit margins in sector peers has forced dividend adjustments, so keeping an eye on margin trends will be key.

See our latest analysis for Rejlers.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Rejlers's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Rejlers shows robust core operations, the outlook is clouded by questions about long-term dividend sustainability if free cash flow or margins come under pressure.

If you value more reliable payouts, check out these 1980 dividend stocks with yields > 3% that consistently deliver strong, stable dividends even as markets change.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:REJL B

Rejlers

Engages in the provision of engineering consultancy services in Sweden, Finland, Norway, and Abu Dhabi.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives