- Sweden

- /

- Professional Services

- /

- OM:PION B

If EPS Growth Is Important To You, PION Group (STO:PION B) Presents An Opportunity

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like PION Group (STO:PION B). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for PION Group

PION Group's Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. PION Group's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 45%. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

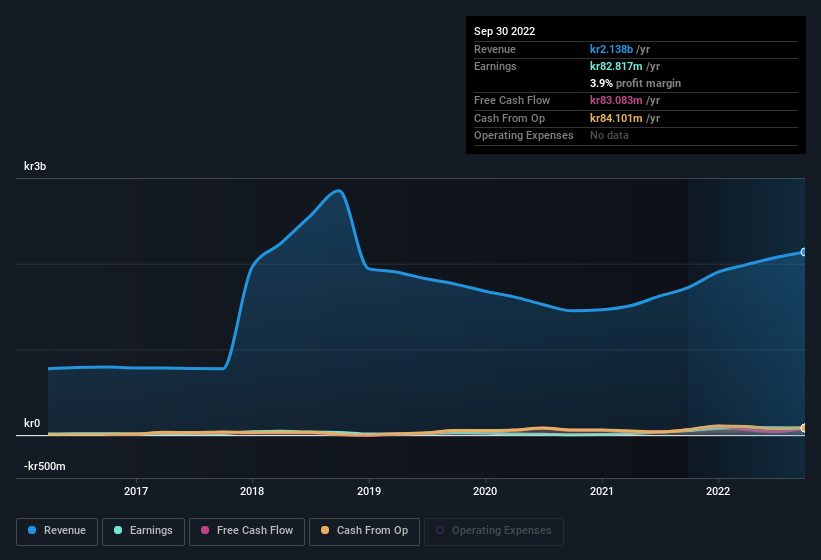

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for PION Group remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 24% to kr2.1b. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

PION Group isn't a huge company, given its market capitalisation of kr623m. That makes it extra important to check on its balance sheet strength.

Are PION Group Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

With strong conviction, PION Group insiders have stood united by refusing to sell shares over the last year. But more importantly, VD & CEO Jan Bengtsson spent kr691k acquiring shares, doing so at an average price of kr12.57. Strong buying like that could be a sign of opportunity.

Does PION Group Deserve A Spot On Your Watchlist?

PION Group's earnings have taken off in quite an impressive fashion. Growth-minded people will be intrigued by the incredible movement in EPS growth. And in fact, it could well signal a fundamental shift in the business economics. If that's the case, you may regret neglecting to put PION Group on your watchlist. It is worth noting though that we have found 3 warning signs for PION Group that you need to take into consideration.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of PION Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:PION B

PION Group

Operates as a staffing and recruitment company in Sweden, Finland, and Norway.

Flawless balance sheet and fair value.

Market Insights

Community Narratives