- Sweden

- /

- Professional Services

- /

- OM:PENG B

Projektengagemang Sweden AB (publ)'s (STO:PENG B) Shares Climb 33% But Its Business Is Yet to Catch Up

The Projektengagemang Sweden AB (publ) (STO:PENG B) share price has done very well over the last month, posting an excellent gain of 33%. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 7.7% over the last year.

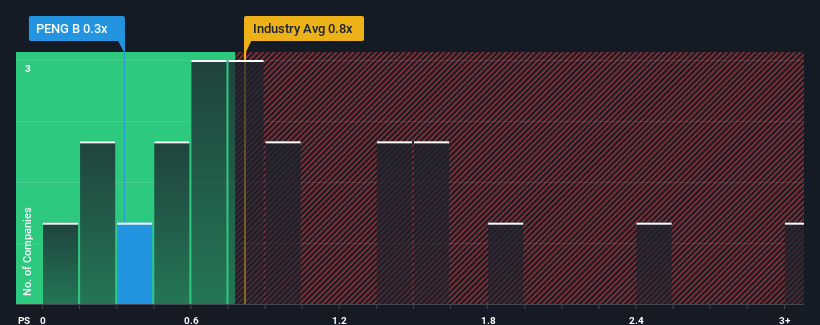

Although its price has surged higher, it's still not a stretch to say that Projektengagemang Sweden's price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Professional Services industry in Sweden, where the median P/S ratio is around 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Projektengagemang Sweden

How Projektengagemang Sweden Has Been Performing

Projektengagemang Sweden could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Projektengagemang Sweden's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Projektengagemang Sweden's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 5.0%. This means it has also seen a slide in revenue over the longer-term as revenue is down 24% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 2.3% per year during the coming three years according to the only analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 6.7% each year, which is noticeably more attractive.

With this information, we find it interesting that Projektengagemang Sweden is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What Does Projektengagemang Sweden's P/S Mean For Investors?

Projektengagemang Sweden's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

When you consider that Projektengagemang Sweden's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It is also worth noting that we have found 1 warning sign for Projektengagemang Sweden that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:PENG B

Projektengagemang Sweden

Operates as an engineering and architectural consulting firm in Sweden.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives