- Sweden

- /

- Commercial Services

- /

- OM:LOOMIS

Top Swedish Dividend Stocks To Consider In August 2024

Reviewed by Simply Wall St

As global markets experience mixed performances, with European indices showing resilience amid fluctuating earnings reports and economic data, the Swedish market remains a focal point for dividend investors seeking stability and income. Despite broader uncertainties, Sweden's robust economy and well-established companies offer promising opportunities for those looking to invest in reliable dividend stocks. In the current market environment, a good dividend stock is typically characterized by consistent earnings, strong cash flow, and a history of stable or growing dividends. These attributes can provide investors with steady income even when broader market conditions are volatile.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Betsson (OM:BETS B) | 5.87% | ★★★★★☆ |

| Nordea Bank Abp (OM:NDA SE) | 8.71% | ★★★★★☆ |

| Zinzino (OM:ZZ B) | 4.00% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.44% | ★★★★★☆ |

| Axfood (OM:AXFO) | 3.21% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.92% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.31% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 4.87% | ★★★★★☆ |

| Loomis (OM:LOOMIS) | 3.67% | ★★★★☆☆ |

| SSAB (OM:SSAB A) | 9.39% | ★★★★☆☆ |

Click here to see the full list of 21 stocks from our Top Swedish Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

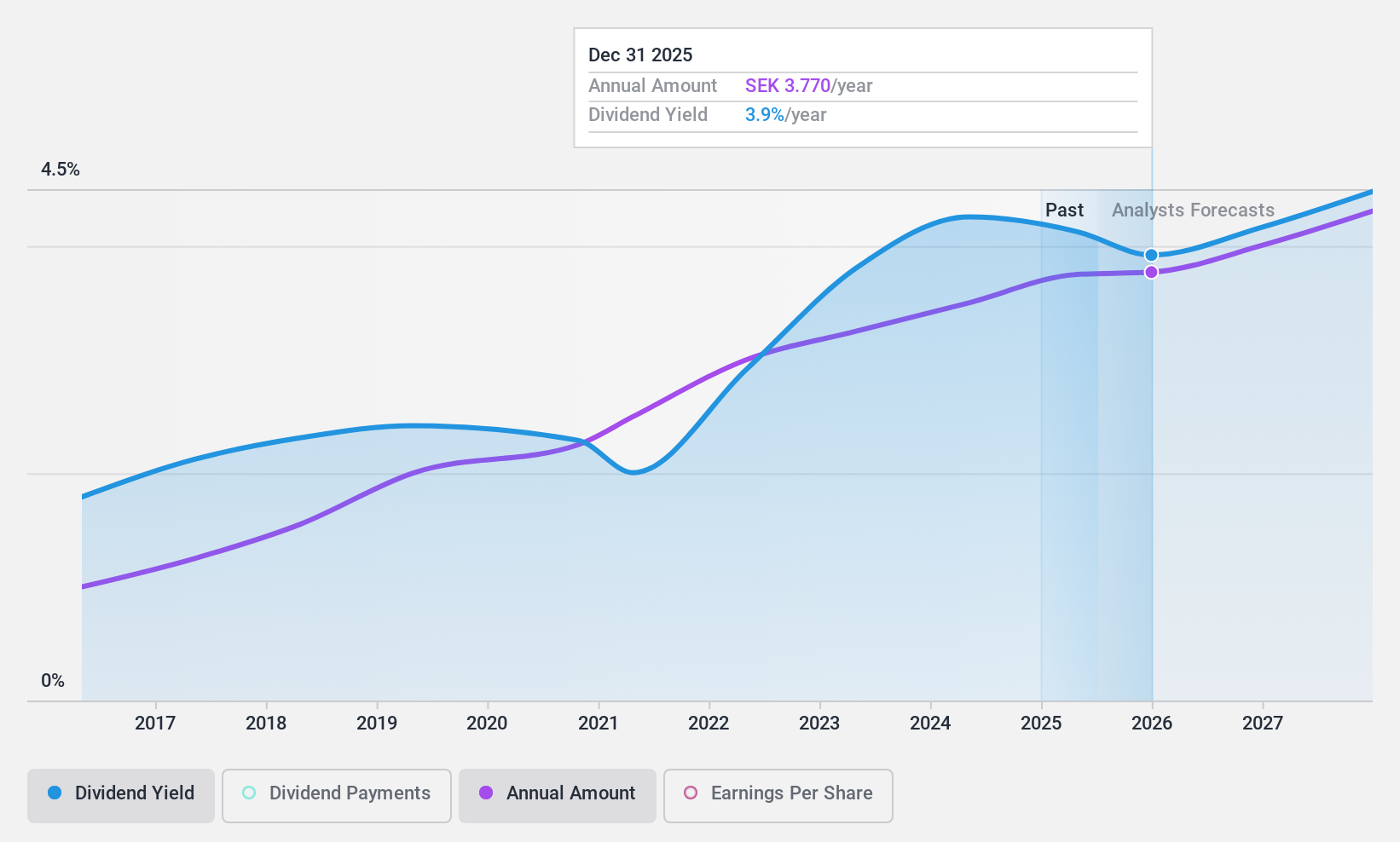

Bravida Holding (OM:BRAV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bravida Holding AB (publ) offers technical services and installations for buildings and industrial facilities across Sweden, Norway, Denmark, and Finland, with a market cap of SEK17.27 billion.

Operations: Bravida Holding AB (publ) generates revenue from providing technical services and installations for buildings and industrial facilities in Sweden, Norway, Denmark, and Finland.

Dividend Yield: 4.1%

Bravida Holding's recent earnings report showed a decline in net income and EPS despite an increase in sales. The company announced a dividend of SEK 3.50 per share for 2023, covered by both earnings (65% payout ratio) and cash flows (34.8% cash payout ratio). Despite the stable dividend payments over eight years, the company's track record is relatively short. Recent contracts with Swedish Transport Administration and Vaxholm Municipality may bolster future revenues.

- Click here and access our complete dividend analysis report to understand the dynamics of Bravida Holding.

- Our comprehensive valuation report raises the possibility that Bravida Holding is priced lower than what may be justified by its financials.

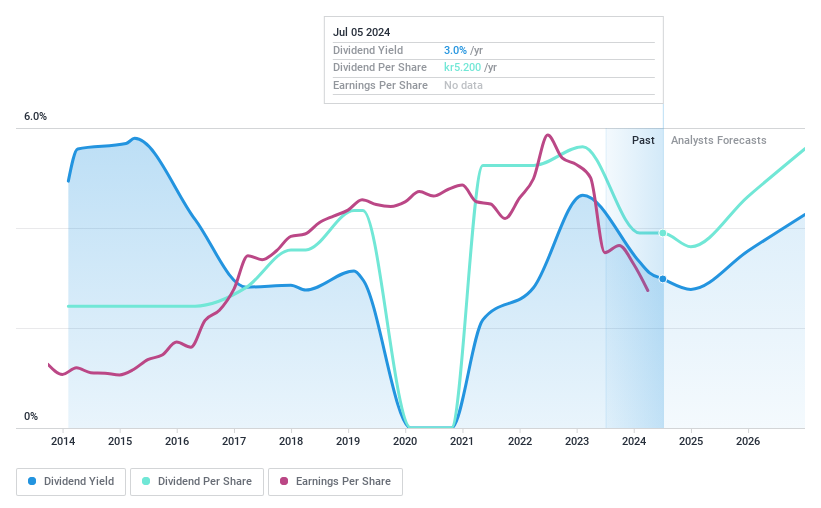

Knowit (OM:KNOW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Knowit AB (publ) is a consultancy company specializing in the development of digital solutions, with a market cap of SEK4.39 billion.

Operations: Knowit AB (publ) generates revenue from four primary segments: Insight (SEK898.95 million), Solutions (SEK3.90 billion), Experience (SEK1.44 billion), and Connectivity (SEK1.02 billion).

Dividend Yield: 3.2%

Knowit AB's dividend payments have been volatile over the past decade, with recent decreases. Despite a low cash payout ratio of 41.6%, earnings coverage is higher at 77.3%. The company's latest earnings report shows a decline in net income and EPS compared to last year, which may impact future dividends. Trading significantly below its estimated fair value suggests potential for capital appreciation, but the current dividend yield of 3.24% lags behind top-tier Swedish dividend payers.

- Delve into the full analysis dividend report here for a deeper understanding of Knowit.

- The valuation report we've compiled suggests that Knowit's current price could be quite moderate.

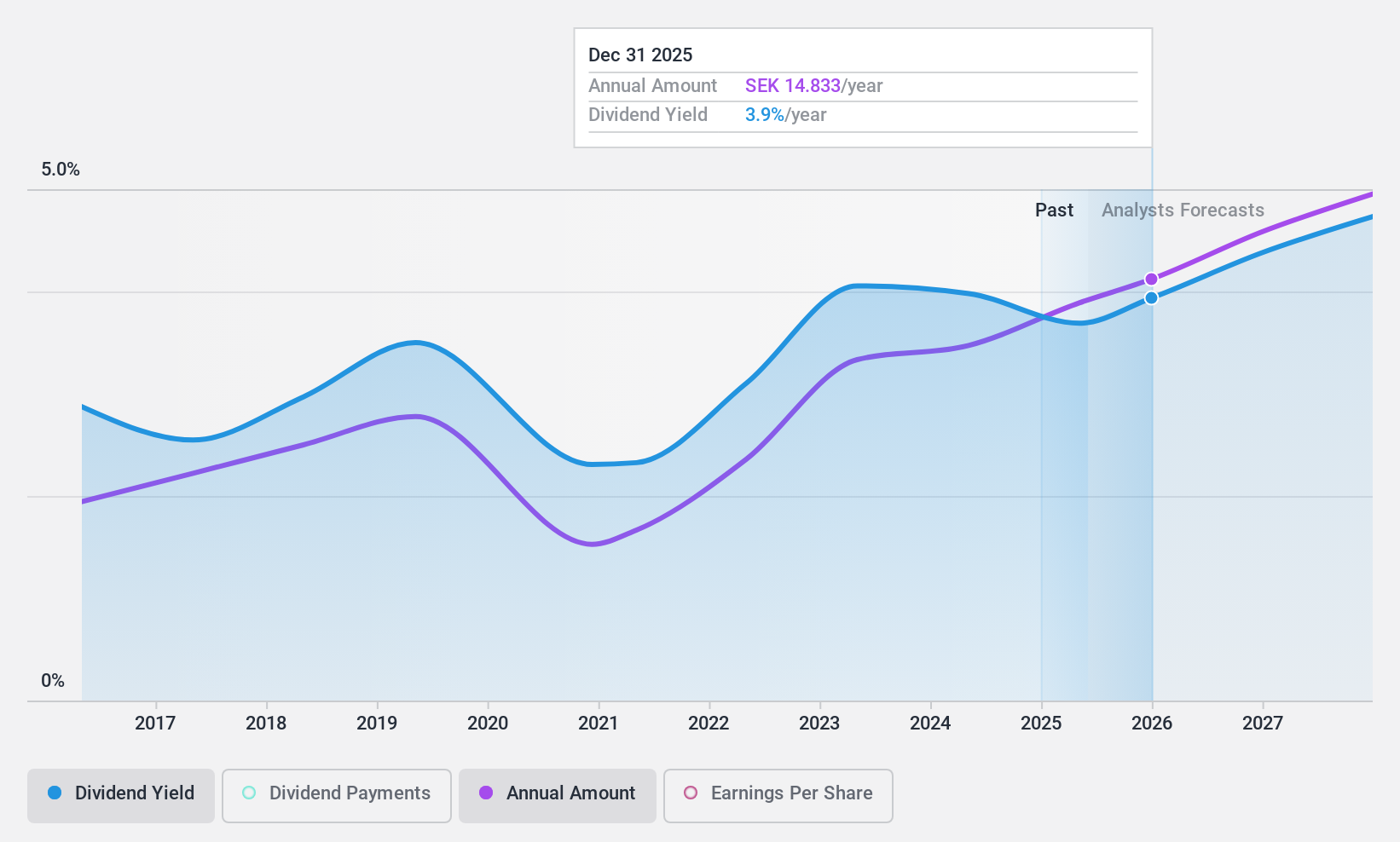

Loomis (OM:LOOMIS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Loomis AB (publ) offers services for the distribution, payments, handling, storage, and recycling of cash and other valuables with a market cap of SEK23.72 billion.

Operations: Loomis AB (publ) generates revenue from Loomis Pay (SEK77 million), Europe and Latin America (SEK14.32 billion), and the United States of America (SEK15.45 billion).

Dividend Yield: 3.7%

Loomis's dividend payments are well-covered by earnings (59.4% payout ratio) and cash flows (26.3% cash payout ratio), though they have been volatile over the past decade. The company recently increased its dividend to SEK 12.50 per share, despite a history of instability in payouts. Recent buybacks totaling nearly SEK 400 million indicate strong capital management, while Q2 2024 earnings showed growth in sales and net income, supporting future dividend sustainability.

- Unlock comprehensive insights into our analysis of Loomis stock in this dividend report.

- In light of our recent valuation report, it seems possible that Loomis is trading behind its estimated value.

Make It Happen

- Discover the full array of 21 Top Swedish Dividend Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:LOOMIS

Loomis

Provides solutions for the distribution, payments, handling, storage, and recycling of cash and other valuables.

Flawless balance sheet, good value and pays a dividend.