The Swedish stock market has been experiencing mixed performances, mirroring global trends where small-cap and value shares have outpaced large-cap growth stocks. Despite some volatility, there are opportunities for discerning investors to find undervalued stocks that may offer significant upside potential. In this article, we will explore three Swedish stocks estimated to be up to 25.6% undervalued. Identifying such opportunities requires a keen understanding of market conditions and the ability to discern intrinsic value amidst broader economic fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sleep Cycle (OM:SLEEP) | SEK41.90 | SEK80.39 | 47.9% |

| Scandi Standard (OM:SCST) | SEK83.20 | SEK161.97 | 48.6% |

| Nilörngruppen (OM:NIL B) | SEK71.80 | SEK137.12 | 47.6% |

| Stille (OM:STIL) | SEK236.00 | SEK444.91 | 47% |

| Litium (OM:LITI) | SEK8.76 | SEK16.52 | 47% |

| Flexion Mobile (OM:FLEXM) | SEK9.36 | SEK18.30 | 48.8% |

| Cavotec (OM:CCC) | SEK21.30 | SEK42.33 | 49.7% |

| Humble Group (OM:HUMBLE) | SEK9.435 | SEK18.45 | 48.9% |

| Ferronordic (OM:FNM) | SEK78.60 | SEK153.10 | 48.7% |

| Wästbygg Gruppen (OM:WBGR B) | SEK52.00 | SEK98.10 | 47% |

Let's dive into some prime choices out of the screener.

Probi (OM:PROB)

Overview: Probi AB (publ) researches, manufactures, and sells probiotics for dietary supplements and food companies globally, with a market cap of SEK3.07 billion.

Operations: Probi generates revenue from the sale of probiotics for dietary supplements and food companies across North America, South America, Europe, Sweden, the Middle East, Africa, Asia Pacific, and internationally.

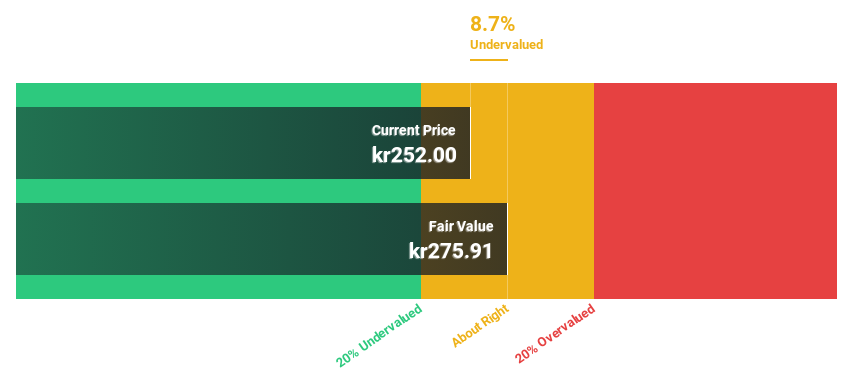

Estimated Discount To Fair Value: 10%

Probi AB's recent earnings report shows a significant turnaround with net income of SEK 8.04 million for Q2 2024, compared to a loss last year. Sales grew to SEK 178.88 million from SEK 143.72 million, highlighting strong revenue performance. Despite lower profit margins (2.1%) compared to last year (3.2%), Probi's revenue is forecasted to grow at 6.1% annually, outpacing the Swedish market average of 1%. Trading at SEK269, it remains undervalued based on DCF estimates of SEK298.94 per share.

- Our earnings growth report unveils the potential for significant increases in Probi's future results.

- Get an in-depth perspective on Probi's balance sheet by reading our health report here.

Sweco (OM:SWEC B)

Overview: Sweco AB (publ) offers architecture and engineering consultancy services globally, with a market cap of SEK61.32 billion.

Operations: Sweco's revenue segments include SEK1.47 billion from the UK, SEK3.50 billion from Norway, SEK8.74 billion from Sweden, SEK3.97 billion from Belgium, SEK3.24 billion from Denmark, SEK3.67 billion from Finland, SEK3.00 billion from the Netherlands, and SEK2.71 billion from Germany & Central Europe.

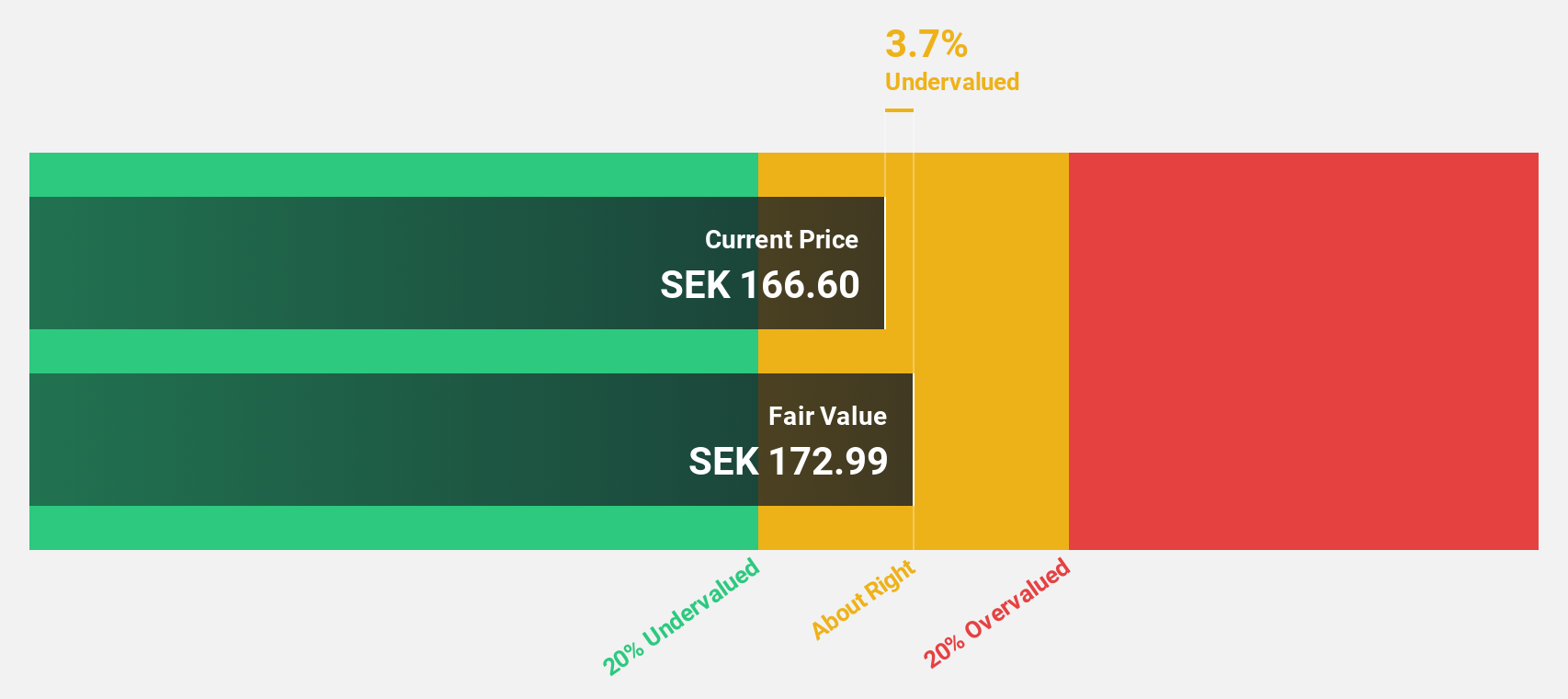

Estimated Discount To Fair Value: 25.6%

Sweco AB is trading at SEK170.4, significantly below its estimated fair value of SEK228.96, indicating it may be undervalued based on cash flows. Recent earnings reports show strong financial performance with Q2 2024 sales of SEK8.08 billion and net income of SEK540 million, up from last year. Additionally, Sweco has secured several high-value contracts including a SEK400 million project with the Swedish Transport Administration and a strategic partnership for green hydrogen production in Finland.

- The growth report we've compiled suggests that Sweco's future prospects could be on the up.

- Navigate through the intricacies of Sweco with our comprehensive financial health report here.

Yubico (OM:YUBICO)

Overview: Yubico AB offers authentication solutions for computers, networks, and online services, with a market cap of SEK23.04 billion.

Operations: The company generates SEK1.93 billion from its Security Software & Services segment.

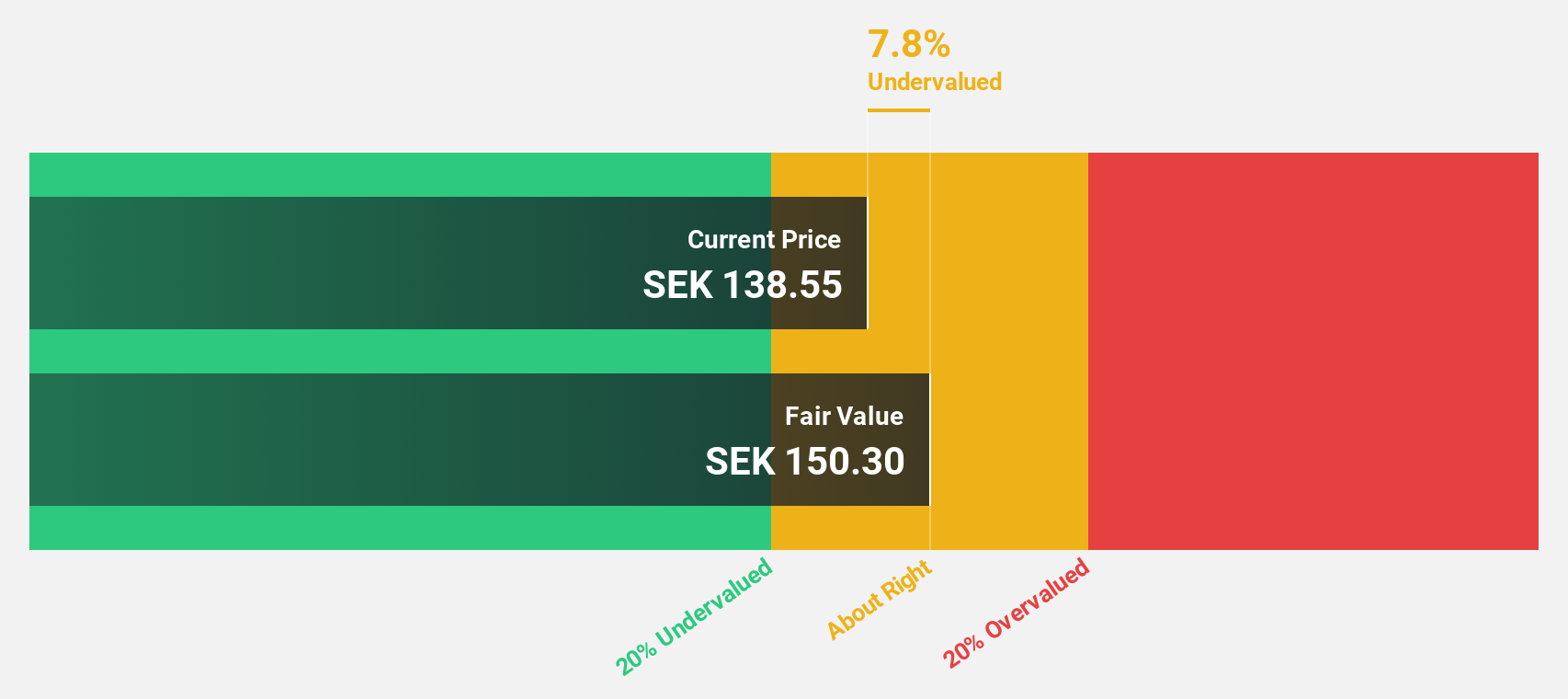

Estimated Discount To Fair Value: 18.9%

Yubico is trading at SEK267.5, below its estimated fair value of SEK329.74. Despite a drop in profit margins from 16.9% to 8.6%, revenue grew by 19.9% last year and is forecast to grow 22.9% annually, outpacing the Swedish market's growth rate of 1%. Recent product advancements, including the YubiKey Secure Web feature for U.S. Air Force applications and new firmware updates, bolster its position in secure authentication solutions despite significant insider selling recently observed.

- The analysis detailed in our Yubico growth report hints at robust future financial performance.

- Take a closer look at Yubico's balance sheet health here in our report.

Turning Ideas Into Actions

- Reveal the 44 hidden gems among our Undervalued Swedish Stocks Based On Cash Flows screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:YUBICO

Yubico

Provides authentication solutions for use in computers, networks, and online services.

Exceptional growth potential moderate.