- Switzerland

- /

- Chemicals

- /

- SWX:CLN

3 European Dividend Stocks Offering Yields Up To 7.0%

Reviewed by Simply Wall St

As European markets grapple with concerns over Middle Eastern tensions and economic uncertainties, the STOXX Europe 600 Index recently saw a decline of 1.54%, reflecting broader market apprehensions. Amidst this backdrop, investors often seek dividend stocks for their potential to provide steady income and resilience during volatile periods, making them an attractive option in uncertain times.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.50% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 3.97% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.52% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.50% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.98% | ★★★★★★ |

| Holcim (SWX:HOLN) | 5.35% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.78% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.20% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.83% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.52% | ★★★★★★ |

Click here to see the full list of 236 stocks from our Top European Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

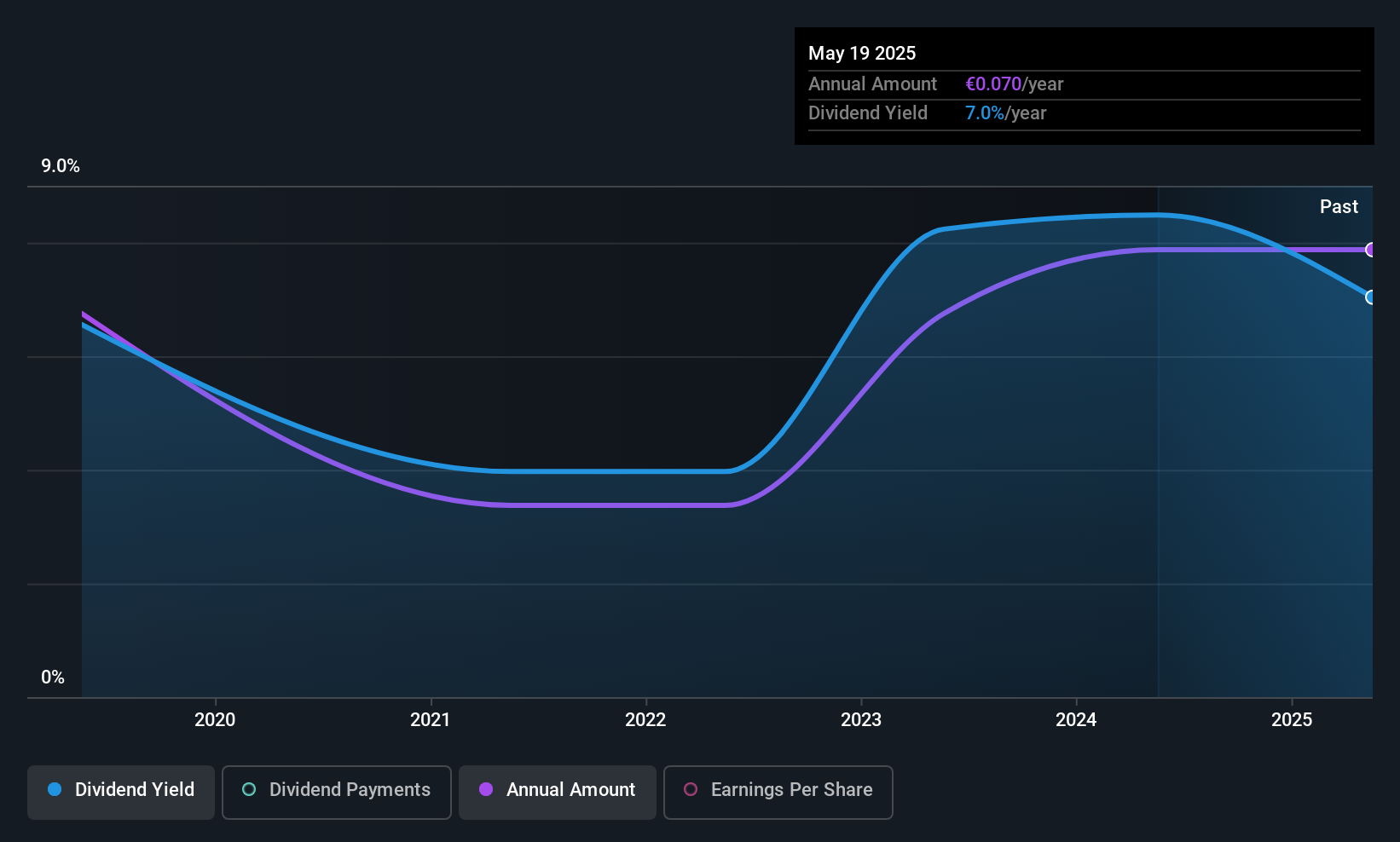

RCS MediaGroup (BIT:RCS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: RCS MediaGroup S.p.A. offers multimedia publishing services in Italy, Spain, and internationally with a market cap of €513.76 million.

Operations: RCS MediaGroup S.p.A.'s revenue segments include Magazines Italy (€64.30 million), Italy Newspapers (€370.10 million), Unidad Editorial (€218.80 million), and Advertising and Sport (€284.70 million).

Dividend Yield: 7.0%

RCS MediaGroup's dividend yield of 7.05% ranks in the top 25% of Italian dividend payers, supported by a cash payout ratio of 38.3%, indicating dividends are well-covered by cash flows. Despite a reasonable earnings payout ratio of 58.4%, dividends have been volatile over its six-year history, lacking stability and consistent growth. Recent Q1 results show revenue growth to €169.6 million, with net loss narrowing to €0.6 million, reflecting some financial resilience amidst fluctuating sales figures.

- Unlock comprehensive insights into our analysis of RCS MediaGroup stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of RCS MediaGroup shares in the market.

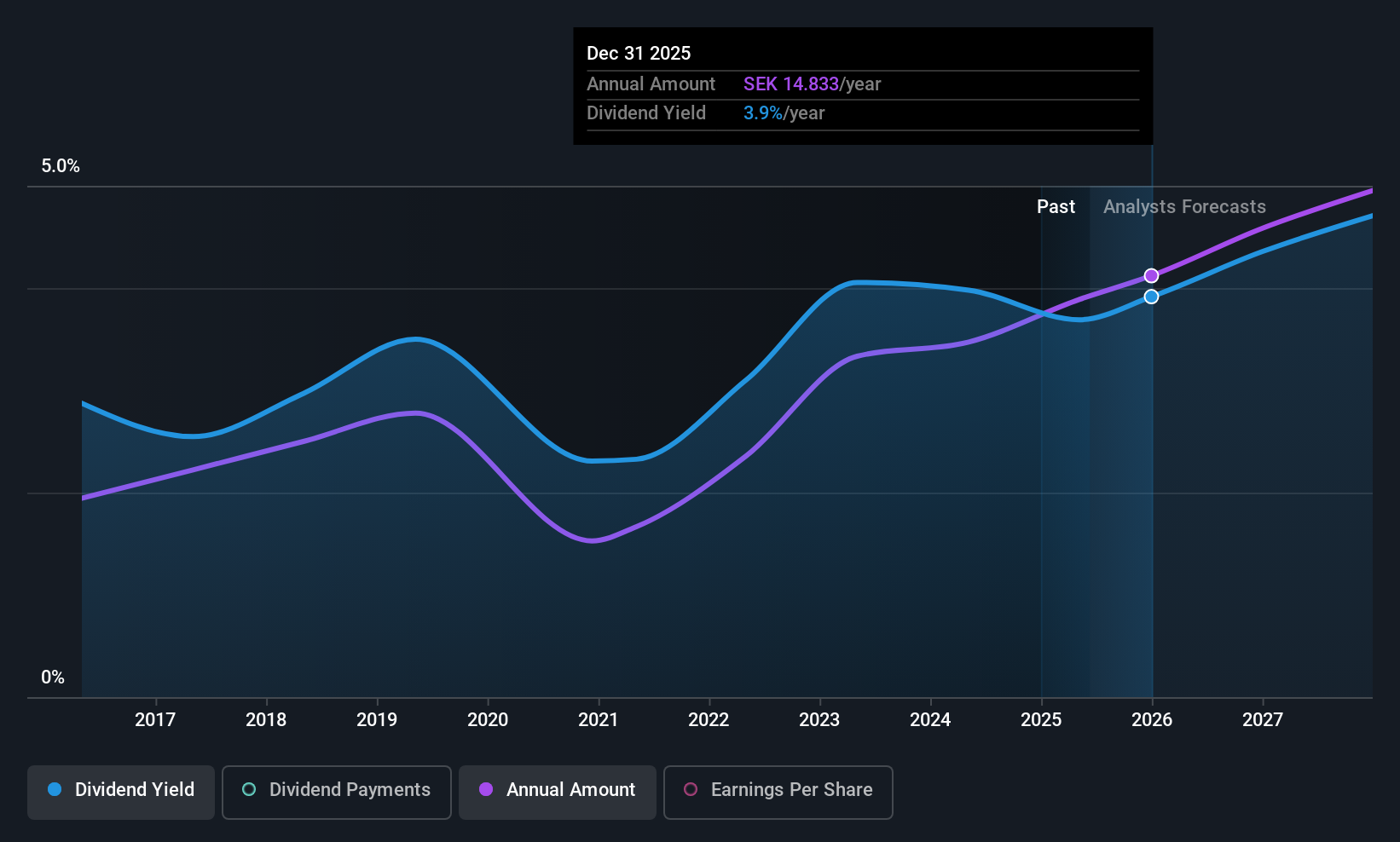

Loomis (OM:LOOMIS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Loomis AB (publ) offers secure payment solutions across several countries including the United States, France, and the United Kingdom, with a market cap of SEK26.88 billion.

Operations: Loomis AB (publ) generates revenue from its operations primarily in the United States with SEK16 billion and Europe and Latin America with SEK14.91 billion, alongside contributions from SME/Pay amounting to SEK120 million.

Dividend Yield: 3.6%

Loomis's dividend yield of 3.55% is below the top 25% of Swedish payers, yet dividends are well-covered by earnings and cash flows, with payout ratios at 58.2% and 22.1%, respectively. Despite a history of volatility, recent increases to SEK 14 per share highlight potential growth in payouts. Q1 results show sales rising to SEK 7.67 billion and net income increasing to SEK 382 million, indicating solid financial performance supporting dividend sustainability amidst market challenges.

- Dive into the specifics of Loomis here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Loomis is trading behind its estimated value.

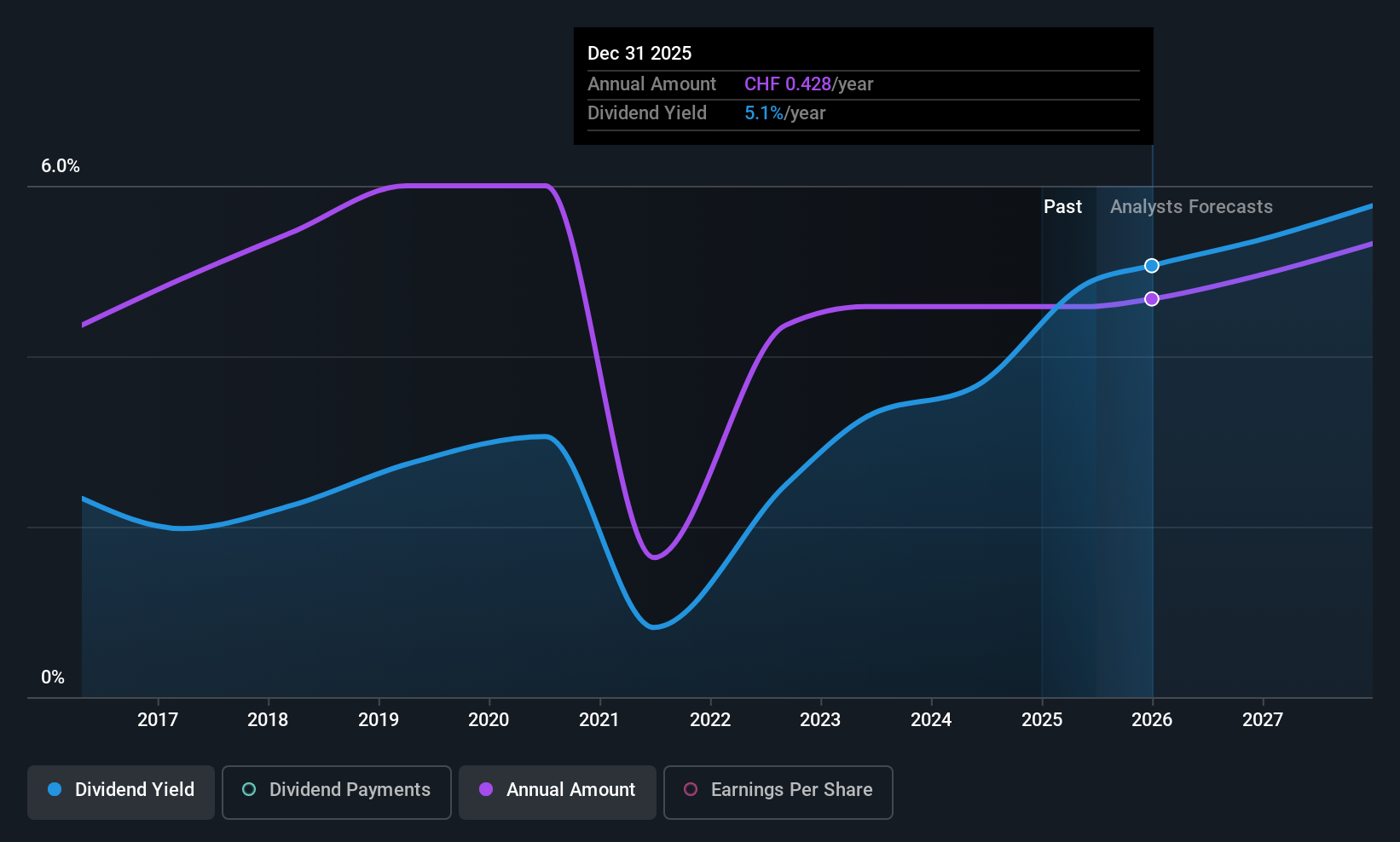

Clariant (SWX:CLN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Clariant AG is a company that develops, manufactures, distributes, and sells specialty chemicals across various regions including Switzerland, Europe, the Middle East, Africa, the United States, and the Asia Pacific with a market cap of CHF2.82 billion.

Operations: Clariant's revenue segments consist of Catalysis at CHF883 million, Care Chemicals at CHF2.24 billion, and Adsorbents & Additives at CHF1.03 billion.

Dividend Yield: 4.9%

Clariant's dividend yield of 4.89% ranks in the top 25% of Swiss payers, with dividends covered by earnings and cash flows, evidenced by payout ratios of 56.6% and 65.7%, respectively. Despite a history of volatility, recent affirmations maintain stability at CHF 0.42 per share for the past year through capital reduction. The company faces challenges with high debt levels and volatile share prices but remains competitively valued against peers, trading below estimated fair value.

- Get an in-depth perspective on Clariant's performance by reading our dividend report here.

- According our valuation report, there's an indication that Clariant's share price might be on the cheaper side.

Where To Now?

- Dive into all 236 of the Top European Dividend Stocks we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:CLN

Clariant

Develops, manufactures, distributes, and sells specialty chemicals in Switzerland, Europe, the Middle East, Africa, the United States, and the Asia Pacific.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives