- Sweden

- /

- Professional Services

- /

- OM:EWRK

Benign Growth For Ework Group AB (publ) (STO:EWRK) Underpins Stock's 30% Plummet

Ework Group AB (publ) (STO:EWRK) shareholders that were waiting for something to happen have been dealt a blow with a 30% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 29% share price drop.

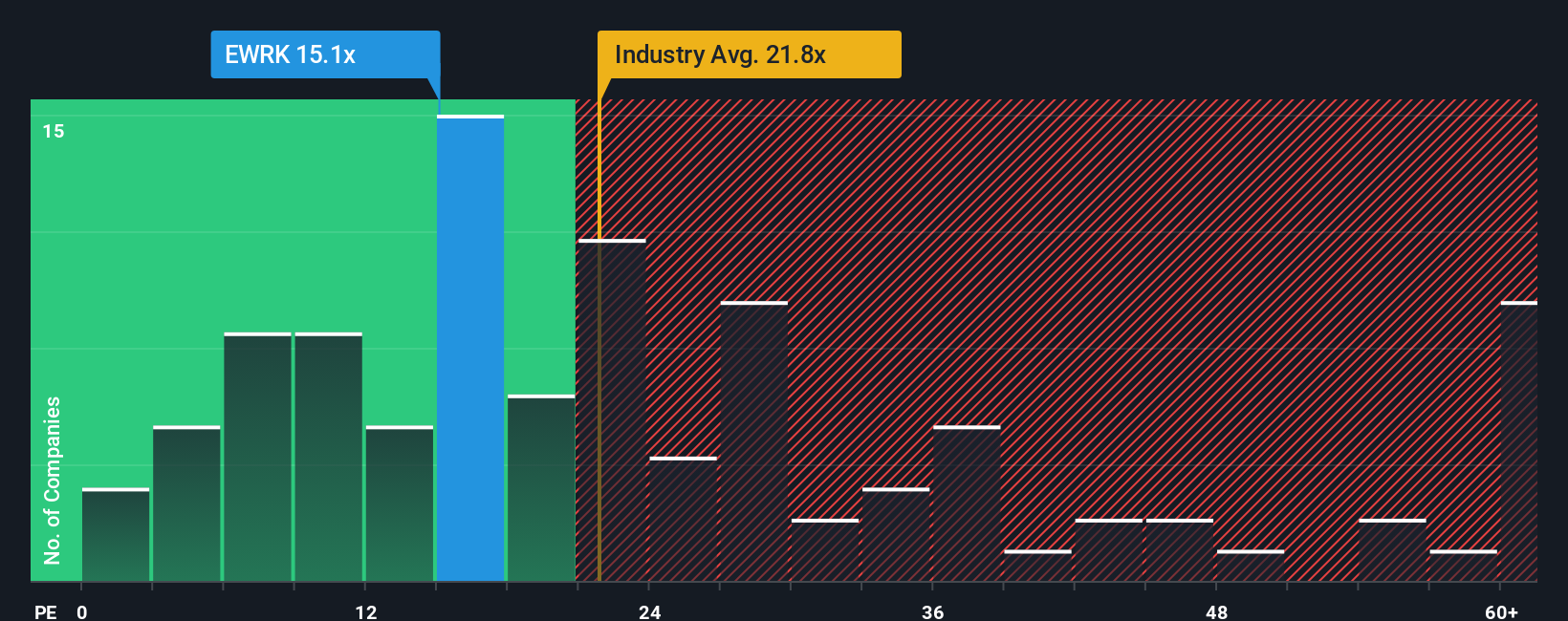

Since its price has dipped substantially, Ework Group's price-to-earnings (or "P/E") ratio of 15.1x might make it look like a buy right now compared to the market in Sweden, where around half of the companies have P/E ratios above 23x and even P/E's above 37x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Ework Group hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Ework Group

Is There Any Growth For Ework Group?

There's an inherent assumption that a company should underperform the market for P/E ratios like Ework Group's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 4.8%. Regardless, EPS has managed to lift by a handy 6.7% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the one analyst covering the company suggest earnings should grow by 14% each year over the next three years. Meanwhile, the rest of the market is forecast to expand by 19% each year, which is noticeably more attractive.

In light of this, it's understandable that Ework Group's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

The softening of Ework Group's shares means its P/E is now sitting at a pretty low level. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Ework Group maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 2 warning signs for Ework Group (1 is concerning!) that we have uncovered.

If these risks are making you reconsider your opinion on Ework Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Ework Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:EWRK

Ework Group

Engages in the provision of total talent solutions for IT/OT, research and development, engineering, and business development in Sweden, Norway, Finland, Germany, Denmark, Poland, and Slovakia.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026