- Sweden

- /

- Commercial Services

- /

- OM:COOR

Coor (OM:COOR) One-Off SEK75M Loss Tests Bullish Earnings Recovery Narratives

Reviewed by Simply Wall St

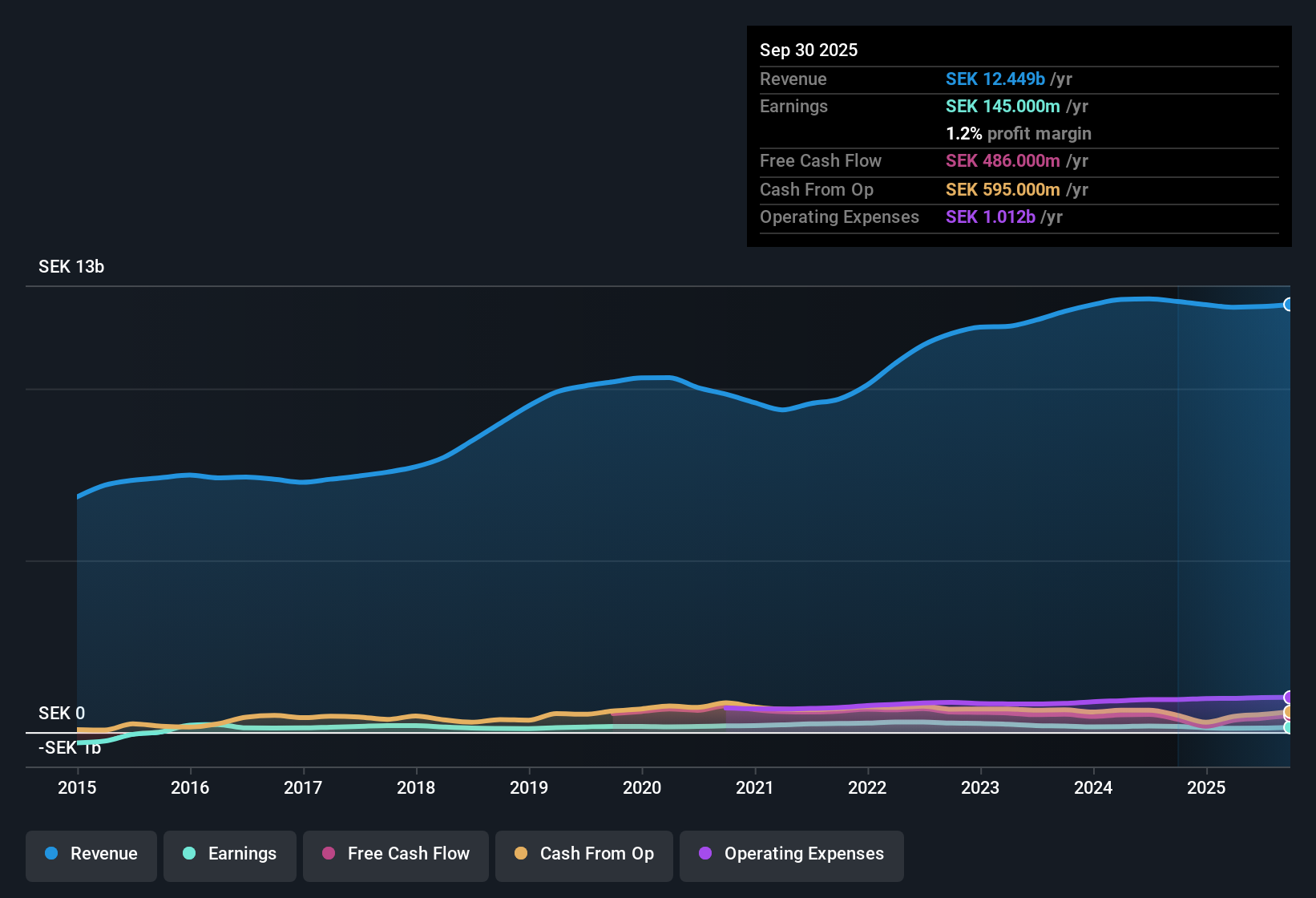

Coor Service Management Holding (OM:COOR) reported a one-off loss of SEK75.0 million that weighed on its latest twelve-month results through September 30, 2025. This loss brought the net profit margin down to 1% from 1.4% a year ago. Over the past five years, the company’s earnings have declined by an average of 12.3% per year. Revenue is forecast to grow 2.9% per year, which is slower than the Swedish market’s 3.6% pace. Despite recent setbacks, analysts anticipate Coor’s earnings will bounce back strongly. They forecast annual earnings growth of 23.8%, almost double the broader market’s 12.3%.

See our full analysis for Coor Service Management Holding.Next, we will see how these figures compare to the most widely discussed narratives around Coor, and where expectations may shift in light of the latest results.

See what the community is saying about Coor Service Management Holding

New Structure Targets SEK 120 Million in Cost Savings

- Coor expects its new organizational structure to yield SEK 120 million in annual cost savings. Management sees this as a key lever to improve net margins beyond the current 1%.

- Analysts' consensus view highlights that successful execution could drive margins higher and counteract high personnel costs.

- However, the plan’s success depends on delivering full-year savings without eroding service quality, especially as negative organic growth in Denmark (down 5%) and Finland (down 9%) continues to pressure top-line stability.

- Consensus narrative notes that the CEO’s focus on operational efficiencies is expected to support long-term earnings growth, yet real-profit turnaround may require further margin expansion to hit stated goals.

- See how analysts weigh these operational bets in the full consensus view. 📊 Read the full Coor Service Management Holding Consensus Narrative.

PE Ratio Nearly Double Sector Average

- Coor’s Price-To-Earnings ratio sits at 37.5x, far above both the peer average (19.9x) and the European Commercial Services sector (14.5x).

- According to analysts' consensus view, this premium valuation creates tension with the company’s history of declining profits.

- This raises the bar for future performance. Analysts project net margins to increase from 1.0% today to 4.3% in three years, so the current high PE may be justified only if strong profit growth materializes as forecast.

- The consensus narrative points out that for the share price to reach analysts' 2028 target (which assumes margin improvement), Coor would need to deliver steady gains in net income well above recent trends.

DCF Fair Value Sits More Than Double Market Price

- The latest DCF fair value stands at SEK 100.08, more than double the current share price of SEK 47.02 and exceeding the consensus analyst target of SEK 57.63.

- Analysts' consensus view finds this discount striking.

- Coor is trading below several fair value estimates even after a period of profit declines and non-recurring losses. This suggests some investors may be skeptical that future earnings growth and margin expansion will meet expectations and close the valuation gap.

- The narrative points out that investors should carefully "sense check" analyst assumptions on revenue reaching SEK 13.4 billion and earnings hitting SEK 584.4 million by 2028 before concluding the stock is deeply undervalued today.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Coor Service Management Holding on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the numbers? Use your insights to craft a fresh narrative in just a few minutes. Do it your way

A great starting point for your Coor Service Management Holding research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

Coor’s track record of declining earnings, slim margins, and questions around sustainable profit growth make its recovery story uncertain.

If you want steadier performers, check out stable growth stocks screener (2088 results) to focus on companies consistently delivering revenue and earnings growth, regardless of the economic cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:COOR

Coor Service Management Holding

Provides facility management services in Sweden, Norway, Denmark, and Finland.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives