- Sweden

- /

- Commercial Services

- /

- OM:BRAV

Did Bravida's (OM:BRAV) Northern Norway Expansion Just Redefine Its Competitive Edge?

Reviewed by Sasha Jovanovic

- Bravida Holding recently announced the formation of its Nomination Committee for the 2026 AGM and completed the acquisition of NITEK AS, a leading HVAC systems supplier in northern Norway, with the deal effective from November 2025.

- This acquisition positions Bravida as the largest HVAC contractor in the region, significantly enhancing its service capabilities and reinforcing its commitment to transparent governance and shareholder involvement.

- We’ll explore how becoming northern Norway’s largest HVAC contractor strengthens Bravida’s investment case and future growth potential.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Bravida Holding Investment Narrative Recap

For me, the core belief behind holding Bravida shares is the company’s ability to drive margin-focused growth through both selective project wins and disciplined acquisitions, especially in its core Nordic markets. The recently announced NITEK AS acquisition in northern Norway adds capacity and expands market leadership, but it does not significantly alter the immediate catalyst of improved order intake, nor does it fully address the ongoing risk of lagging organic growth and persistent order backlog concerns.

Of recent announcements, the Q2 2025 earnings report stands out: although revenue dipped year-on-year, net income improved, and earnings per share rose, reflecting underlying operational improvements despite wider market pressures. This result is particularly relevant given the company’s focus on higher-margin business and cost control amid regional challenges, reinforcing the immediate importance of sustaining internal growth and recovering order intake.

Yet in contrast to these positives, there remains the ongoing risk that order backlog levels are not where they need to be, a factor investors should be aware of, especially given...

Read the full narrative on Bravida Holding (it's free!)

Bravida Holding's narrative projects SEK31.6 billion in revenue and SEK1.8 billion in earnings by 2028. This requires 3.4% yearly revenue growth and a SEK0.7 billion earnings increase from the current earnings of SEK1.1 billion.

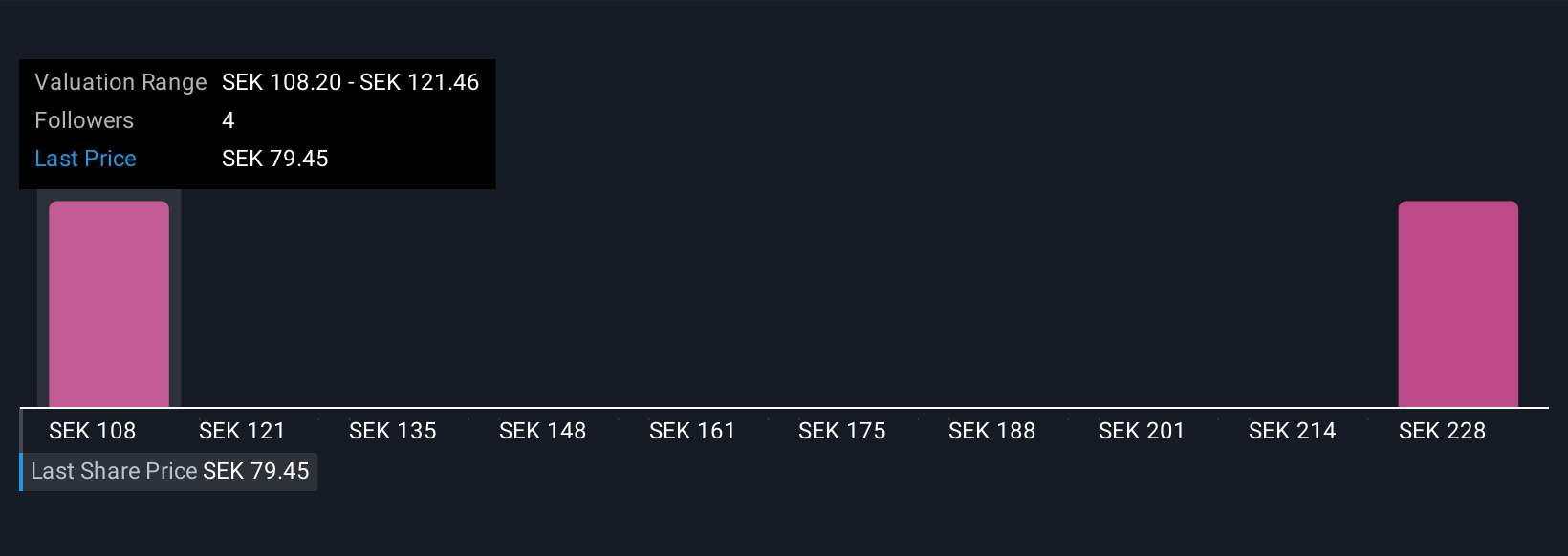

Uncover how Bravida Holding's forecasts yield a SEK108.20 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members produced 2 fair value estimates for Bravida, ranging from SEK108.20 to SEK265.38. Many see acquisition-driven growth as a positive, but opinions differ on whether this fully offsets risks tied to order backlog and organic growth.

Explore 2 other fair value estimates on Bravida Holding - why the stock might be worth over 2x more than the current price!

Build Your Own Bravida Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bravida Holding research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Bravida Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bravida Holding's overall financial health at a glance.

No Opportunity In Bravida Holding?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bravida Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BRAV

Bravida Holding

Provides technical services and installations for buildings and industrial facilities in Sweden, Norway, Denmark, and Finland.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives