- Sweden

- /

- Commercial Services

- /

- OM:BRAV

Bravida Holding (OM:BRAV): Margin Expansion Challenges Investor Skepticism Despite Revenue Growth Above Market

Reviewed by Simply Wall St

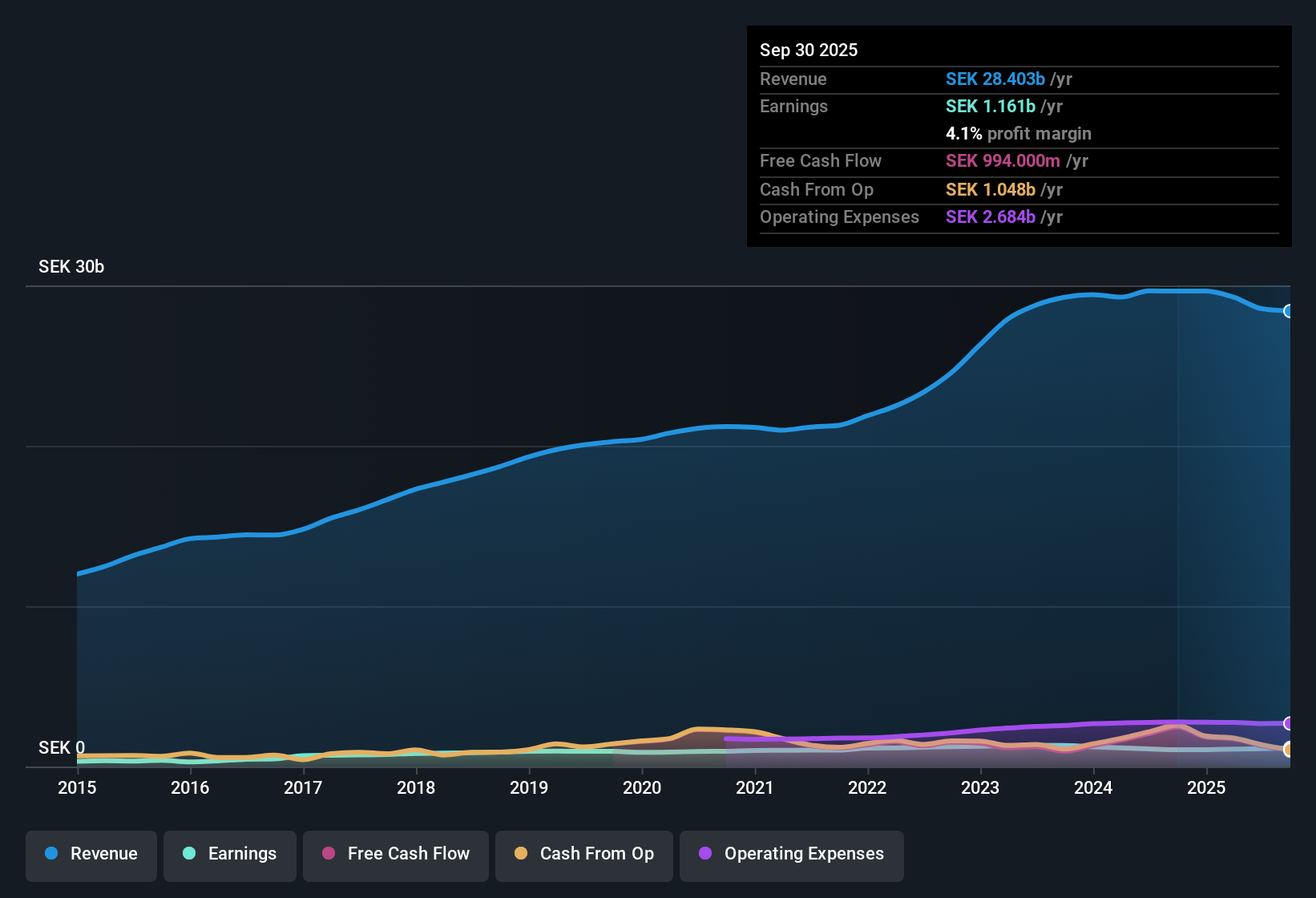

Bravida Holding (OM:BRAV) posted annual revenue growth of 4.6%, topping the Swedish market’s expected pace of 3.9% per year. Annual earnings are forecast to rise around 12% per year, just below the Swedish market’s projected 12.6%. Profit margins edged higher to 3.9% from 3.7% last year. The data highlights recent revenue expansion, improving margins, and a mixed valuation sentiment with shares trading at SEK84.5, significantly below analyst fair value estimates.

See our full analysis for Bravida Holding.Now, let’s see how Bravida’s latest performance measures up against the key market narratives. Some views might get reinforced, while others face new challenges in light of these results.

See what the community is saying about Bravida Holding

Order Intake Drops 26% While Backlog Remains Under Pressure

- Bravida reported a sharp 26% drop in order intake, which poses a direct threat to sustaining future revenue streams if project pipelines do not recover.

- Bears have highlighted that this drop, along with a lower-than-desired order backlog and high restructuring costs, spotlights operational headwinds that challenge Bravida's ability to maintain growth.

- Critics point to significant restructuring costs in Sweden and Denmark, including layoffs, as a concrete risk to net earnings if ongoing restructuring is needed.

- The combination of negative organic growth and growing reliance on acquisitions creates further tension for investors worried about long-term, internally generated expansion.

Margin Expansion Outpaces Industry Norms

- Profit margins increased to 3.9% from 3.7% last year, outstripping the average for five-year margin growth and aligning with analysts’ forecasts for continued margin gains through 2028.

- Analysts' consensus view credits this margin improvement to Bravida's focus on selective project acquisition and service business resilience, with benefits likely to compound if Danish operations complete their expected turnaround in 2025.

- Consensus narrative notes that the strategic shift to higher-margin projects should continue driving net margins up, evidenced by margin expansion during a period of flat earnings growth.

- What is surprising is that, despite lackluster recent earnings growth (just 1.3% this year versus a five-year 2% average), improved margins signal management has successfully increased operating efficiency even as topline momentum cooled.

Momentum in margin recovery driven by selective projects is strengthening the case for long-term profitability gains. See how analysts think Bravida stacks up versus market forecasts in the balanced consensus view. 📊 Read the full Bravida Holding Consensus Narrative.

Valuation: Premium P/E, Deep Discount to DCF Fair Value

- Bravida’s P/E ratio is 15.5x, above the European Commercial Services average of 14.6x but notably below the peer group’s 22.4x. This creates valuation tension that intensifies with the current SEK84.5 share price trading far beneath both analyst price targets (SEK108.2) and DCF fair value (SEK264.28).

- According to the analysts' consensus view, investors will need to believe in multiple expansion and steady earnings growth to justify a rerating. Until then, the market appears cautious about assigning greater value to Bravida despite the potential margin and revenue advantages.

- Consensus narrative ties the current discount to skepticism that Bravida can deliver on the projected 5.6% profit margin and SEK31.6 billion revenue target by 2028.

- Another point of friction is that even with a sector-topping margin trajectory and lower P/E than peers, the market is not pricing in near-term upside, suggesting investors want to see further progress on backlog recovery and organic growth first.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Bravida Holding on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the data from a fresh angle? Use your insight to shape a unique view and share it in just a few minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Bravida Holding.

See What Else Is Out There

Bravida's sluggish organic growth and shaky order intake highlight the risk that inconsistent performance could undermine future earnings momentum and valuation recovery.

If you want more consistent results, use stable growth stocks screener (2098 results) to identify companies that have proven they can deliver steady revenue and earnings no matter the market cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bravida Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BRAV

Bravida Holding

Provides technical services and installations for buildings and industrial facilities in Sweden, Norway, Denmark, and Finland.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives