XANO Industri (STO:XANO B) Seems To Use Debt Rather Sparingly

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that XANO Industri AB (publ) (STO:XANO B) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for XANO Industri

What Is XANO Industri's Debt?

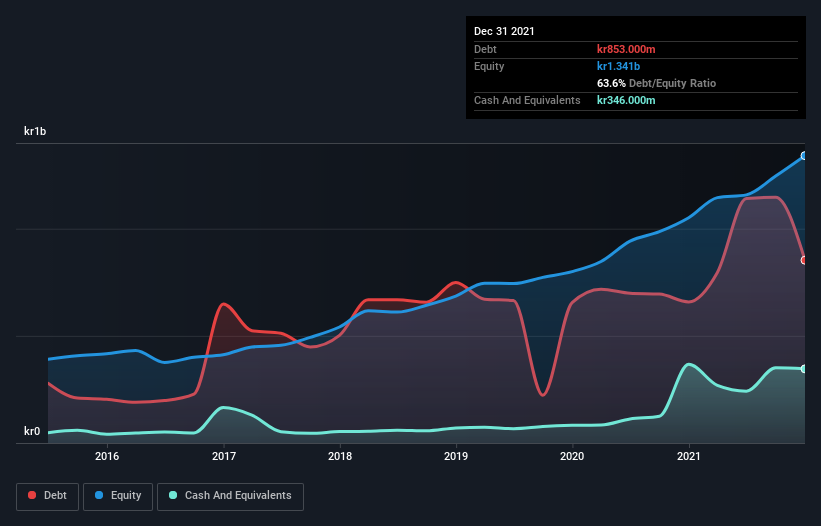

The image below, which you can click on for greater detail, shows that at December 2021 XANO Industri had debt of kr853.0m, up from kr658.3m in one year. However, it does have kr346.0m in cash offsetting this, leading to net debt of about kr507.0m.

How Healthy Is XANO Industri's Balance Sheet?

We can see from the most recent balance sheet that XANO Industri had liabilities of kr1.31b falling due within a year, and liabilities of kr847.0m due beyond that. Offsetting this, it had kr346.0m in cash and kr840.0m in receivables that were due within 12 months. So it has liabilities totalling kr968.0m more than its cash and near-term receivables, combined.

Given XANO Industri has a market capitalization of kr8.29b, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

XANO Industri's net debt is only 0.92 times its EBITDA. And its EBIT easily covers its interest expense, being 22.3 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. In addition to that, we're happy to report that XANO Industri has boosted its EBIT by 58%, thus reducing the spectre of future debt repayments. The balance sheet is clearly the area to focus on when you are analysing debt. But it is XANO Industri's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, XANO Industri recorded free cash flow worth a fulsome 93% of its EBIT, which is stronger than we'd usually expect. That puts it in a very strong position to pay down debt.

Our View

The good news is that XANO Industri's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. And that's just the beginning of the good news since its conversion of EBIT to free cash flow is also very heartening. Considering this range of factors, it seems to us that XANO Industri is quite prudent with its debt, and the risks seem well managed. So we're not worried about the use of a little leverage on the balance sheet. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of XANO Industri's earnings per share history for free.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:XANO B

XANO Industri

Develops, manufactures, and sells industrial products and automation equipment in Sweden, rest of Nordic countries, Europe, and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives