- Sweden

- /

- Aerospace & Defense

- /

- OM:W5

Not Many Are Piling Into W5 Solutions AB (publ) (STO:W5) Stock Yet As It Plummets 25%

W5 Solutions AB (publ) (STO:W5) shareholders won't be pleased to see that the share price has had a very rough month, dropping 25% and undoing the prior period's positive performance. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

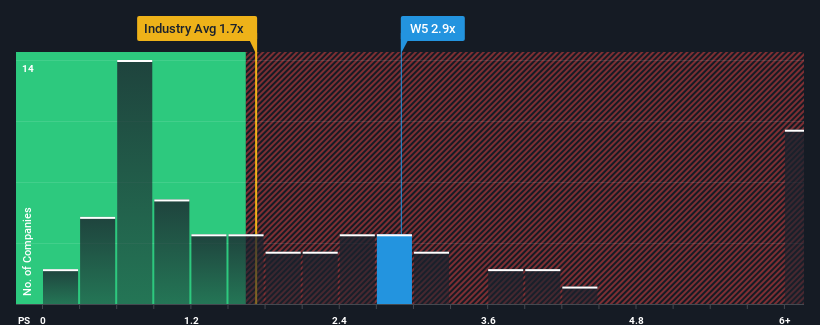

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about W5 Solutions' P/S ratio of 2.9x, since the median price-to-sales (or "P/S") ratio for the Aerospace & Defense industry in Sweden is also close to 2.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for W5 Solutions

How Has W5 Solutions Performed Recently?

Recent times have been advantageous for W5 Solutions as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on W5 Solutions.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like W5 Solutions' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 134%. The latest three year period has also seen an excellent 250% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 23% per year over the next three years. With the industry only predicted to deliver 14% per annum, the company is positioned for a stronger revenue result.

With this information, we find it interesting that W5 Solutions is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On W5 Solutions' P/S

With its share price dropping off a cliff, the P/S for W5 Solutions looks to be in line with the rest of the Aerospace & Defense industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Looking at W5 Solutions' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 1 warning sign for W5 Solutions that you need to be mindful of.

If these risks are making you reconsider your opinion on W5 Solutions, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if W5 Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:W5

W5 Solutions

Manufactures and supplies systems and solutions for the defense and civil security sectors in Sweden.

Very undervalued with reasonable growth potential.

Market Insights

Community Narratives