- Sweden

- /

- Aerospace & Defense

- /

- OM:W5

After Leaping 26% W5 Solutions AB (publ) (STO:W5) Shares Are Not Flying Under The Radar

W5 Solutions AB (publ) (STO:W5) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 52% in the last year.

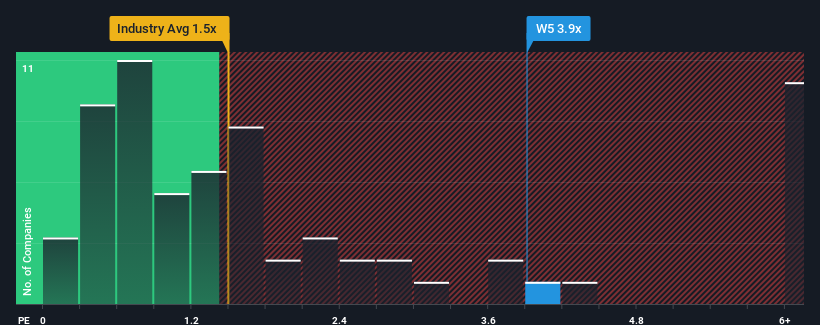

Following the firm bounce in price, given close to half the companies operating in Sweden's Aerospace & Defense industry have price-to-sales ratios (or "P/S") below 2.5x, you may consider W5 Solutions as a stock to potentially avoid with its 3.9x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for W5 Solutions

What Does W5 Solutions' P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, W5 Solutions has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on W5 Solutions will help you uncover what's on the horizon.How Is W5 Solutions' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as W5 Solutions' is when the company's growth is on track to outshine the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 128%. Pleasingly, revenue has also lifted 193% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 56% during the coming year according to the dual analysts following the company. That's shaping up to be materially higher than the 14% growth forecast for the broader industry.

In light of this, it's understandable that W5 Solutions' P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does W5 Solutions' P/S Mean For Investors?

The large bounce in W5 Solutions' shares has lifted the company's P/S handsomely. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of W5 Solutions' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You should always think about risks. Case in point, we've spotted 3 warning signs for W5 Solutions you should be aware of, and 1 of them is concerning.

If you're unsure about the strength of W5 Solutions' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if W5 Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:W5

W5 Solutions

Manufactures and supplies systems and solutions for the defense and civil security sectors in Sweden.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives