- Sweden

- /

- Industrials

- /

- OM:VOLO

Volati (OM:VOLO) Earnings Surge 27.9%—Profit Growth Challenges Bearish Narratives

Reviewed by Simply Wall St

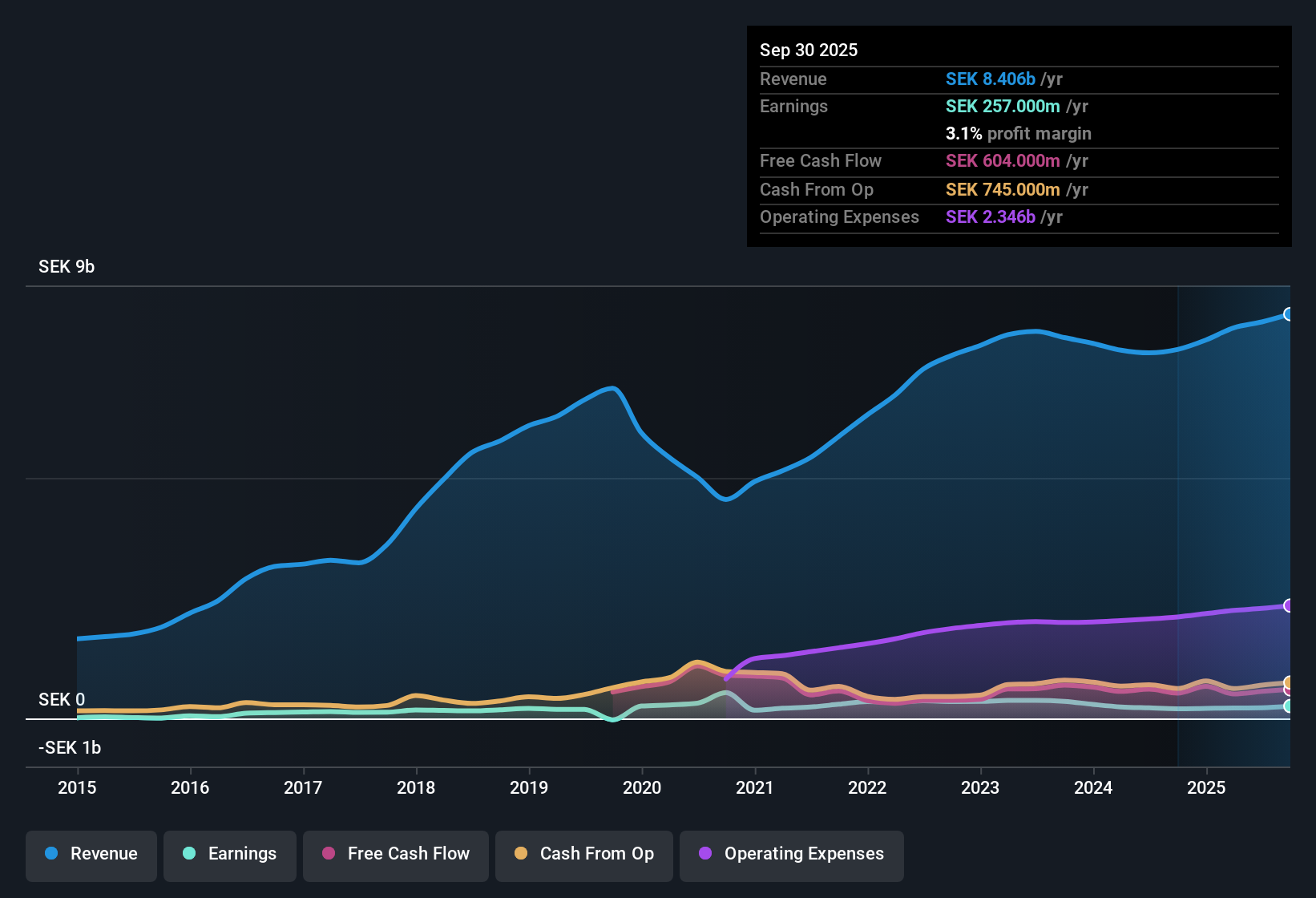

Volati (OM:VOLO) is forecast to deliver substantial earnings growth of 32.08% per year, with earnings expected to outpace the Swedish market's 12.6% annual rate over the next three years. Revenue is projected to grow at 5.5% annually, ahead of the Swedish market's 3.8%. The net profit margin has climbed to 3.1% compared to last year’s 2.6%. The stock is currently trading at SEK108, below its estimated fair value of SEK285.42. With recent earnings growth of 27.9% over the past year reversing a five-year trend of declining earnings, Volati is drawing attention for its high earnings quality, improved margins, and minimal risk signals.

See our full analysis for Volati.Next, we'll see how Volati's strong results compare to the prevailing narratives. Some assumptions might hold up, while others could be challenged by the latest data.

See what the community is saying about Volati

Profit Margins Expand as Costs Drop

- Net profit margin rose to 3.1%, up from 2.6% last year, outpacing overall Swedish market profit growth during a period when Volati reversed years of declining earnings.

- Analysts’ consensus view highlights that improved EBITDA margins have come from cost controls, synergy benefits from acquisitions, and operational tweaks. Together these factors suggest Volati is positioned to benefit further as market conditions recover.

- Consensus notes that operational improvements allowed the company to lift margins even in tough segments. This strengthens the case for sustainable profitability gains as the environment improves.

- Consensus also flags that Volati’s platforms have shown resilience and that structural changes set up further margin upside if the market backdrop brightens.

Acquisitions Fuel Revenue Prospects

- With 27 acquisitions completed since 2020, Volati’s revenue is projected by analysts to grow at 6.6% annually for the next three years, well ahead of the Swedish market’s 3.8% estimated pace.

- According to the consensus view, the acquisition strategy is credited not just for bolstering current revenue, but also for expanding market reach and unlocking operational efficiencies that underpin Volati’s longer-term growth narrative.

- Consensus points out that credit facility expansion supports further M&A, giving Volati liquidity to continue its bolt-on growth approach.

- Consensus suggests that recovery in the construction segment, one of Volati’s key end markets, could amplify the revenue impact from recent deals.

Discount to DCF Fair Value Draws Attention

- Trading at SEK108.00 per share, Volati sits at a roughly 62% discount to its DCF fair value estimate of SEK285.42. Even the analyst consensus price target of SEK146.00 offers a sizable potential upside from today’s price.

- Analysts’ consensus view links this wide valuation gap to Volati’s strong projected earnings and margin expansion, while highlighting that investors must believe revenues will reach SEK10.0 billion and earnings SEK661.9 million by 2028, at a future PE ratio (21.2x) below today’s level.

- Consensus emphasizes that fair value depends on Volati delivering higher profit margins and steady growth in share count, with merger synergies and construction market recovery acting as key swing factors.

- Consensus additionally highlights that continued discipline around debt and efficient integration of new acquisitions remains crucial if Volati is to unlock the upside suggested by today’s valuation discount.

Curious how numbers become stories that shape markets? 📊 Read the full Volati Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Volati on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you interpret the figures another way? Share your unique perspective and build your own narrative in under three minutes. Do it your way.

A great starting point for your Volati research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Volati’s ambitious growth story relies on sustaining margin gains and steady revenue momentum, but the business has yet to prove long-term, consistent profitability across cycles.

If you’d prefer companies with a rock-solid track record of dependable results, check out our curated list of stable growth stocks screener (2101 results) that keep delivering through both favorable and unfavorable periods.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VOLO

Volati

A private equity firm specializing in growth capital, buyouts, add on acquisitions in mature and middle market companies.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives