- Sweden

- /

- Construction

- /

- OM:VESTUM

Vestum (OM:VESTUM): Five Years of Compounded Losses Challenge Bullish Profitability Narrative

Reviewed by Simply Wall St

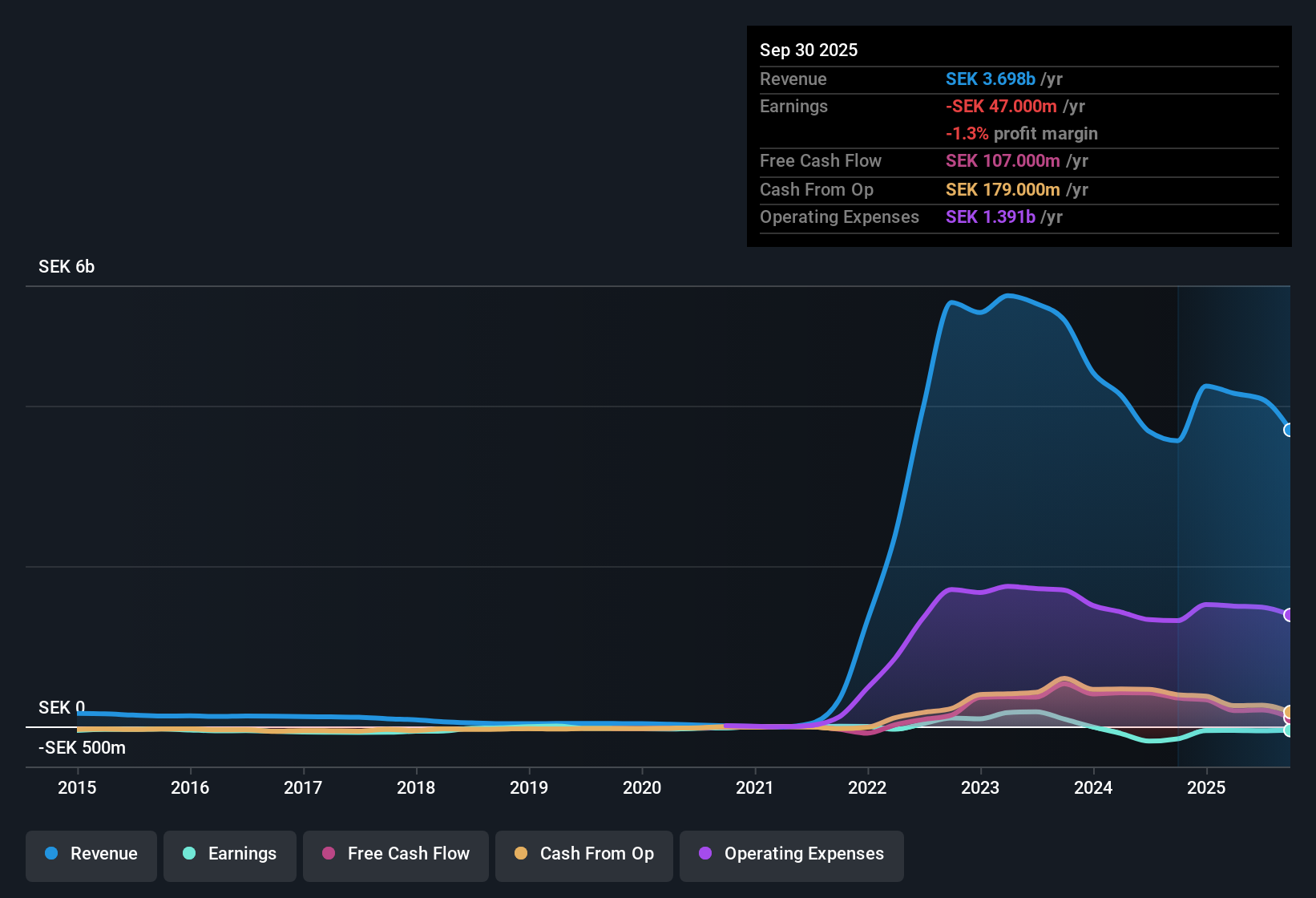

Vestum (OM:VESTUM) reported another year of rising losses, with the company’s net profit margin remaining stubbornly negative and annual losses compounding at 28.4% over the last five years. Despite the lack of improvement in profitability, earnings are forecast to surge 103.4% annually. Expectations are for Vestum to become profitable in the next three years and revenue is projected to grow at a brisk 6.8% per year. Investors are weighing these growth forecasts against the company’s track record, its premium price-to-sales valuation, and discounted cash flow estimates signaling room for a possible upside.

See our full analysis for Vestum.Next, we’ll see how these headline numbers align or conflict with the dominant narratives that have shaped sentiment around Vestum, highlighting which market stories get confirmed and which may start to look shaky.

Curious how numbers become stories that shape markets? Explore Community Narratives

DCF Fair Value Nearly Triple the Share Price

- Vestum is trading at SEK8.95 per share, notably below its discounted cash flow (DCF) fair value of SEK30.45. This indicates a gap of over 240% and suggests upside potential far greater than the share price currently implies.

- The prevailing market view highlights a tension between market skepticism and model-based optimism.

- Bulls may point to the deep value gap as a rare opportunity, but skeptics wonder if missed profitability targets have suppressed sentiment and kept the price at a steep discount.

- Projected 103.4% annual earnings growth underscores what bullish investors are watching. On the other hand, bears continue to focus on the five-year run of compounded net losses as a reason for caution.

Unprofitable Track Record Offsets Growth Forecast

- The company’s net profit margin has stayed negative over the last five years, as losses compounded by 28.4% per year. This leaves no comparable period of profitability to build investor confidence despite upbeat forecasts.

- What stands out in the prevailing market view is how a positive outlook for future growth contrasts with sustained historical losses.

- Although profitability is expected within three years, the company’s inability to generate positive margins in recent years makes bullish excitement about the recovery look speculative for now.

- With no flagged risk factors, the reward narrative relies exclusively on successfully executing turnaround scenarios, not on evidence of improving returns so far.

Premium Price-to-Sales, Discount to Peers

- Vestum’s price-to-sales ratio stands at 0.8x, higher than sector peers and the broader European construction benchmark, both at 0.5x. However, its discounted cash flow model values the shares far above both current price and analyst targets.

- The prevailing market view highlights this disconnect.

- Some bullish investors may see the higher price-to-sales ratio as a sign of strong growth expectations, while others may be wary of paying a premium for a company that has not delivered profits.

- Trading below both analyst target price and DCF fair value suggests that the market has adopted a more conservative stance and may be waiting for actual profitability to arrive before closing the gap.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Vestum's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Vestum’s persistent net losses and inconsistent profitability, despite strong growth projections, highlight the risks of betting on an uncertain turnaround story.

If you want consistency instead of speculation, discover companies delivering reliable performance with steady expansion and proven earnings using stable growth stocks screener (2090 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VESTUM

Vestum

Engages in the infrastructure, water, and service businesses in Sweden and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives