Exploring 3 Undervalued Small Caps With Recent Insider Activity

Reviewed by Simply Wall St

In the final week of December, global markets experienced moderate gains despite a decline in U.S. consumer confidence and mixed economic indicators, such as falling durable goods orders and new home sales. While large-cap growth stocks initially led the rally, small-cap stocks, represented by indices like the Russell 2000, faced a more challenging environment due to these broader economic pressures. In this context, identifying potentially undervalued small-cap stocks requires careful consideration of recent insider activity and market conditions that could signal resilience or future growth potential amidst fluctuating consumer sentiment and economic data.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Paradeep Phosphates | 24.5x | 0.8x | 28.58% | ★★★★★☆ |

| Maharashtra Seamless | 10.7x | 1.8x | 32.80% | ★★★★★☆ |

| Avia Avian | 14.7x | 3.4x | 20.65% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 36.28% | ★★★★★☆ |

| East West Banking | 3.2x | 0.7x | 34.03% | ★★★★★☆ |

| PSC | 7.8x | 0.4x | 42.96% | ★★★★☆☆ |

| Logistri Fastighets | 12.7x | 9.0x | 42.05% | ★★★★☆☆ |

| Kambi Group | 16.5x | 1.5x | 40.24% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| THG | NA | 0.3x | -981.71% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

VBG Group (OM:VBG B)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: VBG Group is a company involved in the production and distribution of mobile thermal solutions, truck and trailer equipment, and power transmission products, with a market capitalization of SEK 8.75 billion.

Operations: The company's revenue streams are diversified across Mobile Thermal Solutions, Truck & Trailer Equipment, and RINGFEDER Power Transmission. Over the provided periods, the gross profit margin has shown a declining trend from 40.94% to a low of 29.17%, before recovering to around 32.74%. Operating expenses have increased alongside revenue growth, impacting overall profitability metrics such as net income margin.

PE: 12.9x

VBG Group, a smaller company in its sector, recently reported Q3 sales of SEK 1,272.9 million and net income of SEK 112.3 million, showing a decline from last year. Despite the dip in quarterly performance, nine-month figures reveal steady growth with sales at SEK 4.3 billion and net income rising to SEK 475.9 million. Insider confidence is evident with recent share purchases this year, indicating potential value recognition amidst external borrowing risks and projected annual earnings growth of 2.29%.

- Dive into the specifics of VBG Group here with our thorough valuation report.

Explore historical data to track VBG Group's performance over time in our Past section.

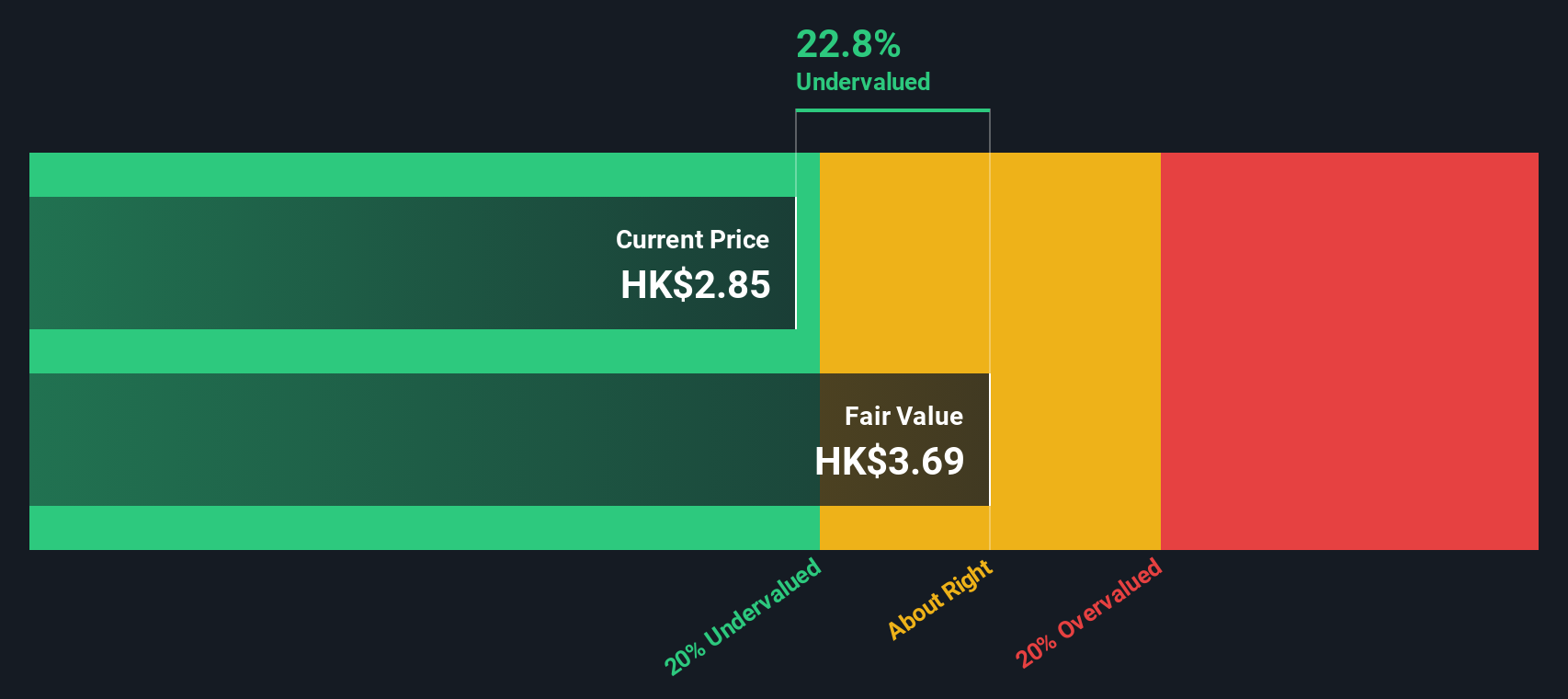

SSY Group (SEHK:2005)

Simply Wall St Value Rating: ★★★★☆☆

Overview: SSY Group is a company engaged in the production and sale of medical materials and intravenous infusion solutions, with a market cap of HK$8.45 billion.

Operations: The primary revenue stream is from Intravenous Infusion Solution and Others, contributing significantly to the total revenue. The gross profit margin has shown an upward trend, reaching 62.91% in recent periods before a slight decline to 54.39%. Operating expenses are primarily driven by sales and marketing costs, with general and administrative expenses also being notable components.

PE: 7.7x

SSY Group, a smaller player in the pharmaceutical industry, shows potential with recent approvals from China's National Medical Products Administration for several drugs, including Nikethamide and Paracetamol Tablets. These developments could enhance their market presence. Insider confidence is evident as Jiguang Qu acquired 1.5 million shares for approximately HK$7.51 million between November and December 2024, reflecting belief in the company's future prospects. However, reliance on external borrowing poses some risk despite anticipated annual earnings growth of 6.89%.

- Delve into the full analysis valuation report here for a deeper understanding of SSY Group.

Review our historical performance report to gain insights into SSY Group's's past performance.

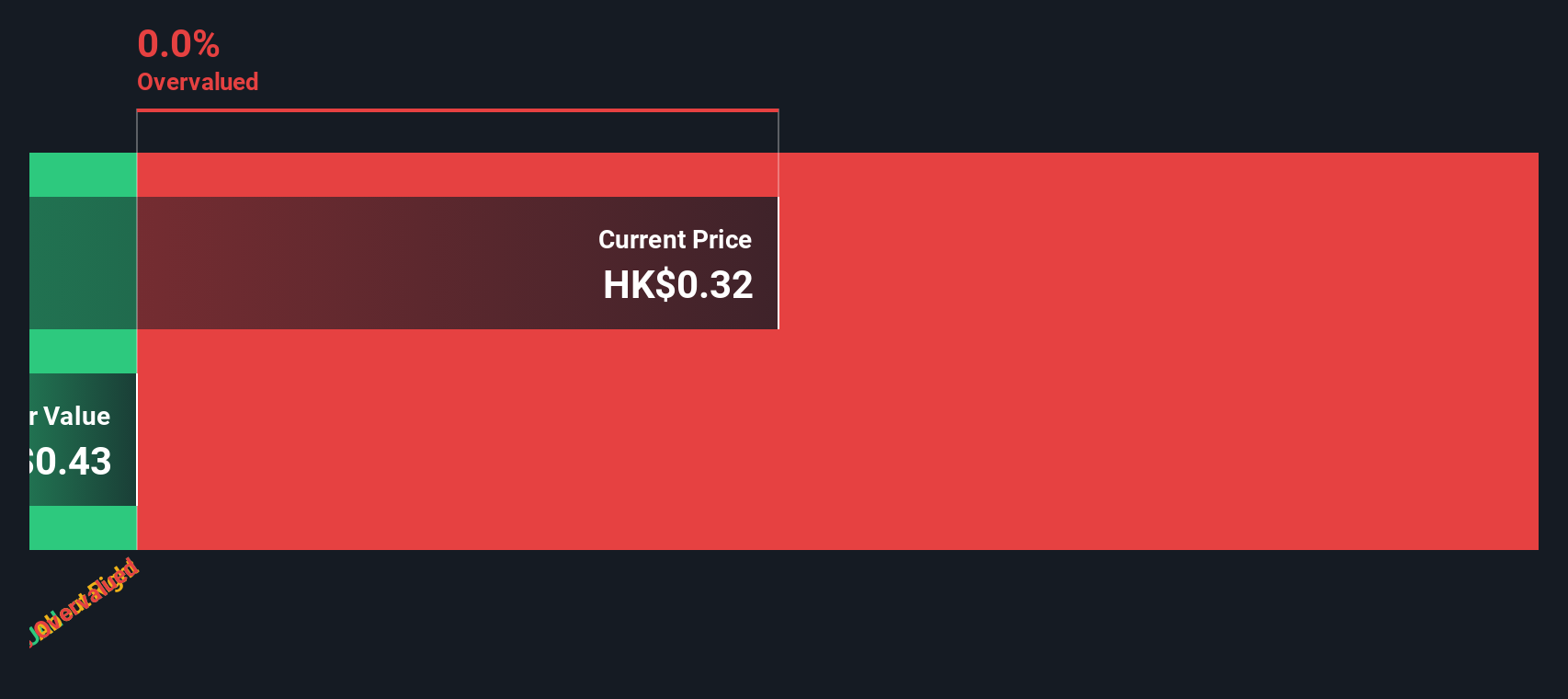

Gemdale Properties and Investment (SEHK:535)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Gemdale Properties and Investment is engaged in property development, investment, and management operations with a focus on the real estate sector.

Operations: The company generates revenue primarily from Property Development (CN¥17.26 billion) and Property Investment and Management (CN¥1.23 billion). The gross profit margin has shown variability, with recent figures around 8.82%.

PE: -1.8x

Gemdale Properties and Investment, a smaller company in the real estate sector, recently reported significant sales figures for 2024, with contracted sales reaching RMB 17.5 billion over 1.27 million square meters by November. Despite challenges like declining earnings at an annual rate of 29.5% over five years and reliance on external borrowing, insider confidence is evident as a non-executive director acquired over 8.7 million shares valued at approximately US$1.41 million, indicating potential optimism about future prospects amidst current financial hurdles.

- Unlock comprehensive insights into our analysis of Gemdale Properties and Investment stock in this valuation report.

Learn about Gemdale Properties and Investment's historical performance.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 188 Undervalued Small Caps With Insider Buying now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VBG B

VBG Group

Develops, manufactures, markets, and sells various industrial products in Sweden, Germany, rest of the Nordic countries and Europe, North America, Brazil, Australia/New Zealand, China, and internationally.

Flawless balance sheet with proven track record and pays a dividend.