Systemair (OM:SYSR) Net Margin Gains Reinforce Bullish Operating-Leverage Narrative in Q2 2026

Reviewed by Simply Wall St

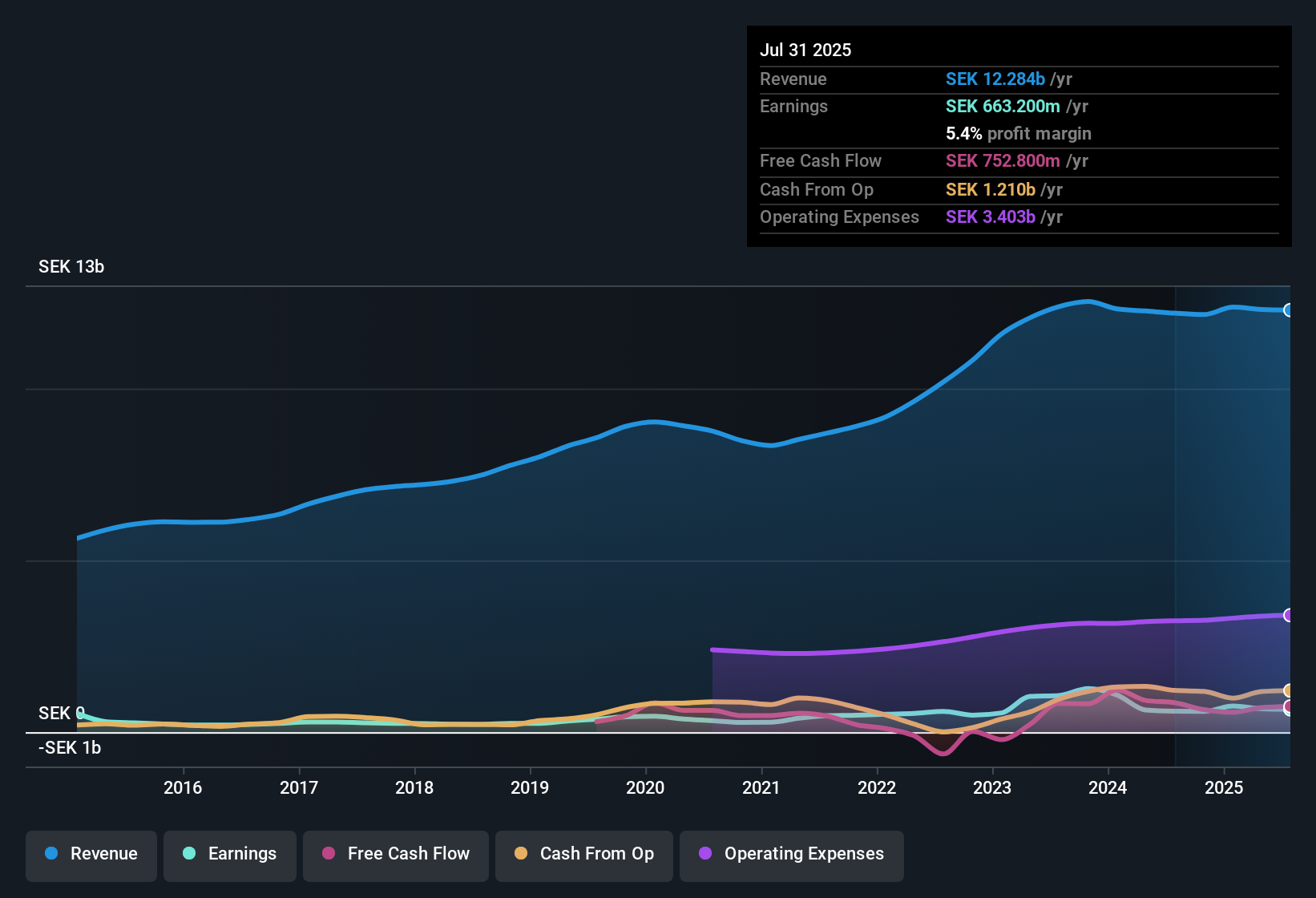

Systemair (OM:SYSR) just posted its Q2 2026 numbers with revenue of SEK3.3 billion, basic EPS of 1.28 SEK and net income of SEK265 million, setting the tone for the quarter. The company has seen revenue move from SEK3.1 billion and basic EPS of 1.14 SEK in Q2 2025 to SEK3.3 billion and 1.28 SEK in Q2 2026, while trailing 12 month revenue reached SEK12.4 billion and EPS came in at 3.32 SEK, framing a picture of scaling sales and earnings. With net margins also tracking higher over the last year, this set of results points to a business steadily converting more of its top line into bottom line profit.

See our full analysis for Systemair.With the latest figures on the table, the next step is to weigh these results against the prevailing narratives around Systemair, seeing where the numbers back up the story and where they start to push back.

See what the community is saying about Systemair

Net Margin Edge Supports Growth Story

- Systemair’s trailing 12 month net profit margin sits at 5.6 percent compared with 5.0 percent a year earlier, while earnings over the same period rose 14.2 percent to 690.4 million SEK.

- Consensus narrative highlights a tilt toward higher margin, specialized ventilation projects and stricter energy efficiency rules, and the current margin profile helps test that view:

- Trailing 12 month revenue of about 12.4 billion SEK and net income of 690.4 million SEK are consistent with the idea that more complex, infrastructure style work is supporting profitability rather than dragging it down.

- At the same time, the margin step up from 5.0 percent to 5.6 percent leaves room to judge whether expansion into emerging markets is already flowing through to better earnings quality or is still mainly a future expectation.

Investors weighing whether these margin gains truly reflect a shift into higher quality projects can dig deeper into how much of recent profit comes from energy efficient and infrastructure focused solutions versus traditional construction work. 📊 Read the full Systemair Consensus Narrative.

Earnings Growth Outpaces Revenue

- Over the last year, earnings grew 14.2 percent on a trailing 12 month basis while revenue increased from 12.2 billion SEK to about 12.4 billion SEK, so profit is rising faster than sales.

- Supporters of the bullish view point to this gap between profit and revenue growth as evidence of operating leverage, but the numbers also frame the stakes:

- Forecasts call for earnings to grow 18.2 percent per year, well ahead of the projected 4.7 percent annual revenue growth, which assumes further efficiency or mix benefits beyond what the recent 14.2 percent earnings growth already delivered.

- If the planned push into emerging markets like India and Saudi Arabia does not sustain that kind of profit growth on only mid single digit revenue gains, the bullish expectation for structurally higher margins could be harder to justify.

Backers of the growth story may want to watch whether future quarters keep showing earnings rising materially faster than revenue so the forecast 18.2 percent growth path remains credible in practice. 🐂 Systemair Bull Case

Premium P E With Implied Upside

- At a 26.2 times trailing P E versus the European Building industry at 21.8 times, Systemair trades on a premium multiple even though the 87.0 SEK share price sits about 17.8 percent below the 105.90 SEK DCF fair value and below the 93.33 SEK analyst target.

- Critics focused on the bearish angle argue that paying above industry multiples heightens valuation risk, and the data give them and the bulls something specific to weigh:

- The premium P E is partly offset by forecasts for 18.2 percent yearly earnings growth compared with the broader Swedish market at 13.5 percent, meaning investors are paying up but also expecting faster profit expansion.

- However, with revenue only projected to grow 4.7 percent per year, any disappointment on margin expansion could leave the stock looking expensive relative to sector peers despite the apparent discount to DCF fair value.

Investors trying to reconcile the premium P E with the discount to DCF fair value might focus on whether margins and earnings growth can consistently beat both industry and market averages. 🐻 Systemair Bear Case

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Systemair on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? In just a few minutes, you can turn that viewpoint into a structured narrative that reflects your own expectations: Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Systemair.

See What Else Is Out There

Systemair’s growth story leans heavily on margin expansion and optimistic forecasts, while revenue momentum remains modest and leaves little room for disappointment.

If you want exposure to companies where earnings and sales trends already look steadier and less assumption driven, use our stable growth stocks screener (2087 results) today to shift your attention toward businesses with more predictable trajectories and fewer moving parts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SYSR

Systemair

Manufactures and sells of ventilation, heating and cooling products, and systems in Europe, North America, the Middle East, Asia, Australia, and Africa.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026