3 Undervalued European Small Caps With Insider Action To Consider

Reviewed by Simply Wall St

As European markets rally, with the STOXX Europe 600 Index reaching record levels and major indices like Germany’s DAX and France’s CAC 40 seeing notable gains, investor sentiment is buoyed by expectations for lower U.S. borrowing costs. Amid this backdrop of optimism, identifying small-cap stocks that are potentially undervalued and exhibit insider activity can present intriguing opportunities for investors looking to navigate the current market landscape effectively.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Cairn Homes | 12.3x | 1.6x | 29.61% | ★★★★★★ |

| Boozt | 17.1x | 0.8x | 40.29% | ★★★★★☆ |

| Bytes Technology Group | 17.4x | 4.4x | 11.42% | ★★★★☆☆ |

| Renold | 10.7x | 0.7x | 0.53% | ★★★★☆☆ |

| Pexip Holding | 35.8x | 5.3x | 40.99% | ★★★☆☆☆ |

| Nyab | 21.5x | 0.9x | 37.09% | ★★★☆☆☆ |

| Fevara | NA | 0.9x | 39.26% | ★★★☆☆☆ |

| FastPartner | 16.7x | 4.3x | -29.71% | ★★★☆☆☆ |

| CVS Group | 46.6x | 1.4x | 36.04% | ★★★☆☆☆ |

| Fastighets AB Trianon | 13.7x | 4.5x | -210.61% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

BEWI (OB:BEWI)

Simply Wall St Value Rating: ★★★★★☆

Overview: BEWI is a company engaged in the production and sale of packaging, components, and insulation products, with a market cap of approximately €1.02 billion.

Operations: The company generates revenue primarily from its Packaging and Components (€318.60 million) and Insulation & Construction (€427.60 million) segments. Over recent periods, the gross profit margin has shown an upward trend, reaching 56.76% by mid-2025, indicating effective cost management relative to sales growth.

PE: -9.0x

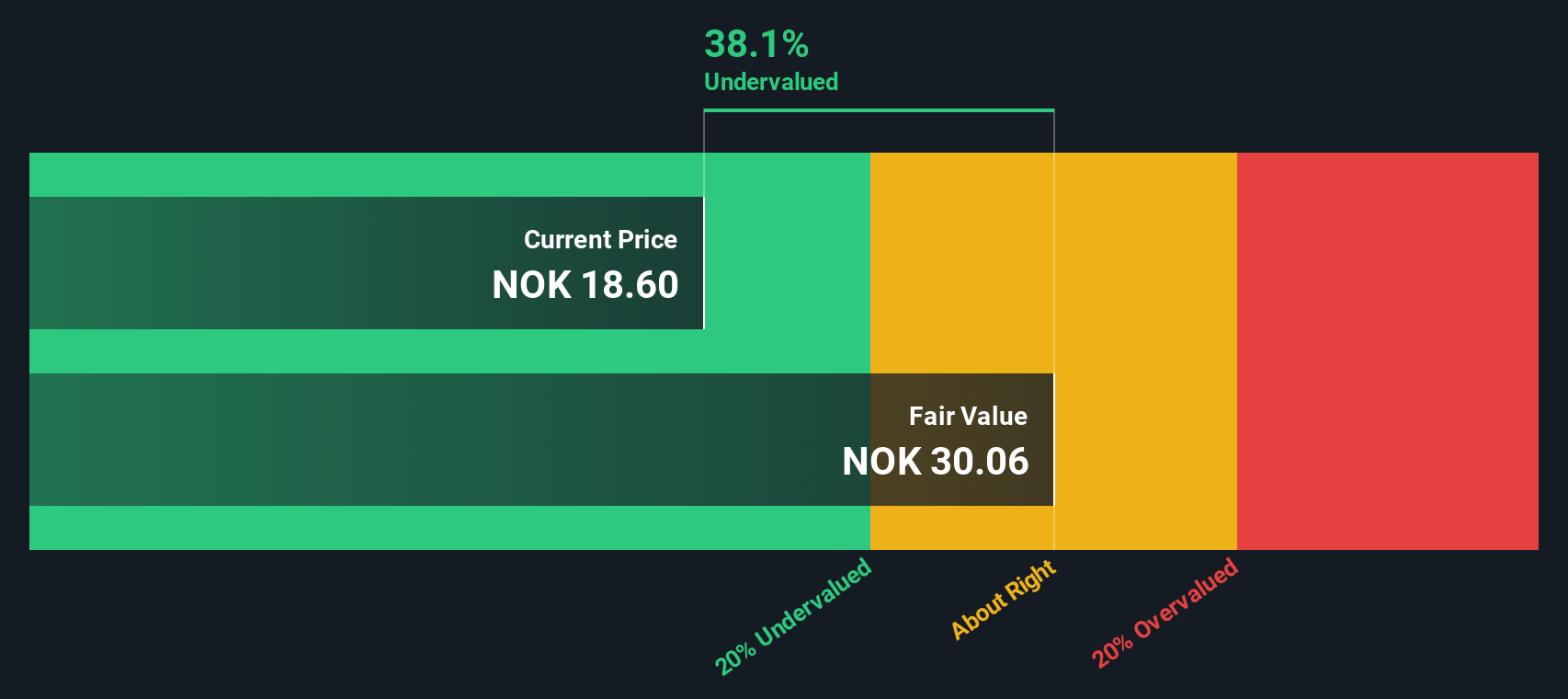

BEWI, a European company with a market cap under €1 billion, has recently faced financial challenges, reporting a net loss of €14.6 million in Q2 2025 despite slightly increased sales. The company is actively managing its debt through a tender offer for existing bonds and plans for early redemption, signaling strategic financial restructuring. Insider confidence is illustrated by recent share purchases during the follow-on equity offering completed at NOK 896 million. Despite current losses, earnings are forecast to grow significantly in the coming years.

Boozt (OM:BOOZT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Boozt is an online fashion and lifestyle retailer operating through its platforms Boozt.com and Booztlet.com, with a market cap of SEK 5.17 billion.

Operations: Boozt generates revenue primarily from Boozt.Com and Booztlet.Com, with the former contributing significantly more to its total revenue. The company's gross profit margin has shown variability, reaching 28.97% in the latest period. Key expenses include sales and marketing, general and administrative costs, which have consistently impacted its profitability over time.

PE: 17.1x

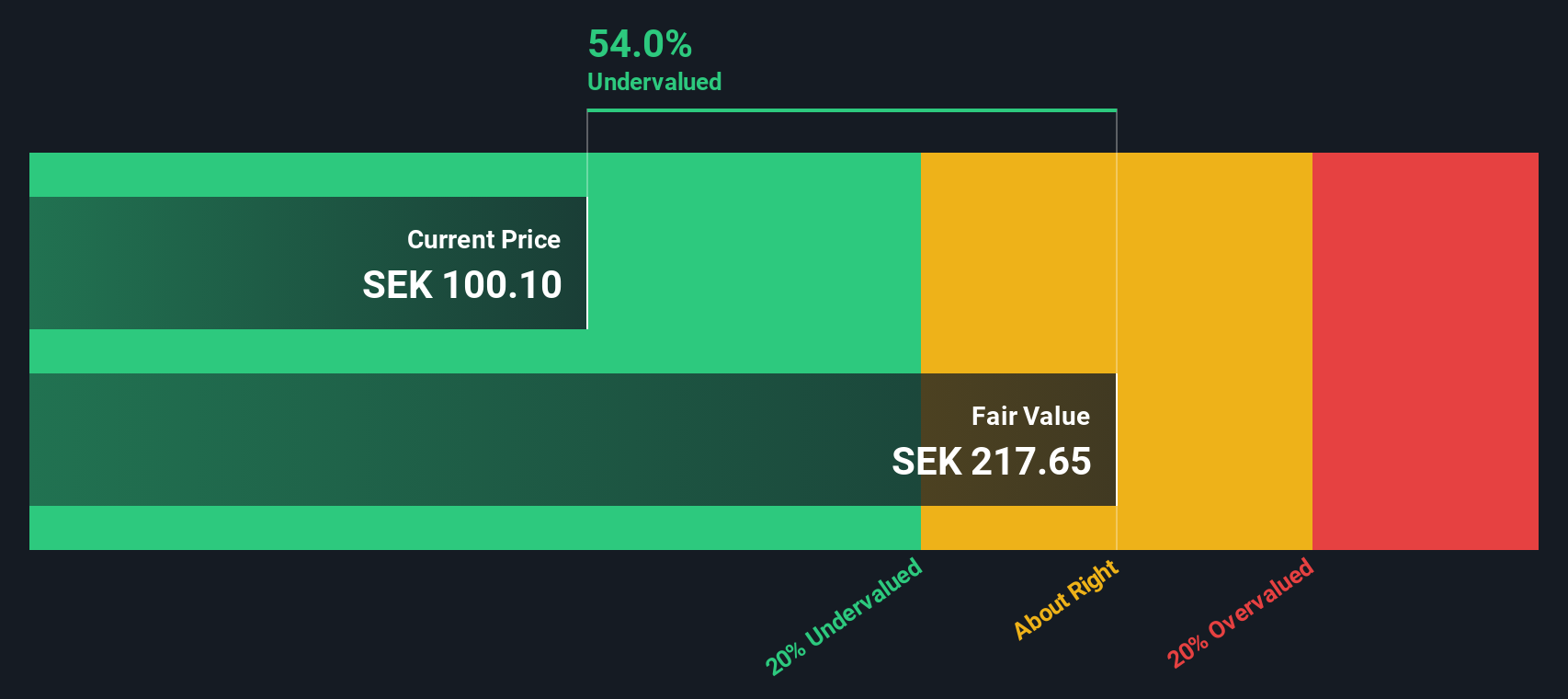

Boozt, a European online fashion retailer, has shown signs of being undervalued despite facing challenges. Recent insider confidence is evident as Mads Famme purchased 7,015 shares for SEK 596,255 in early October 2025. The company reported Q2 sales of SEK 1,823 million and net income rose to SEK 76 million from SEK 59 million the previous year. With a completed buyback of over one million shares worth SEK 94 million by June-end and earnings forecasted to grow annually by about 6.61%, Boozt's strategic moves suggest potential growth opportunities ahead.

- Click to explore a detailed breakdown of our findings in Boozt's valuation report.

Evaluate Boozt's historical performance by accessing our past performance report.

Systemair (OM:SYSR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Systemair is a company engaged in the manufacture and sale of ventilation products, with a market capitalization of SEK 10.37 billion.

Operations: The company generates its revenue primarily from the manufacture and sale of ventilation products, with recent recorded revenues reaching SEK 12.28 billion. The cost of goods sold (COGS) stands at SEK 7.81 billion, contributing to a gross profit margin of 36.39%. Operating expenses are reported at SEK 3.40 billion, largely driven by sales and marketing expenses amounting to SEK 2.74 billion and general & administrative expenses at SEK 658.8 million.

PE: 25.0x

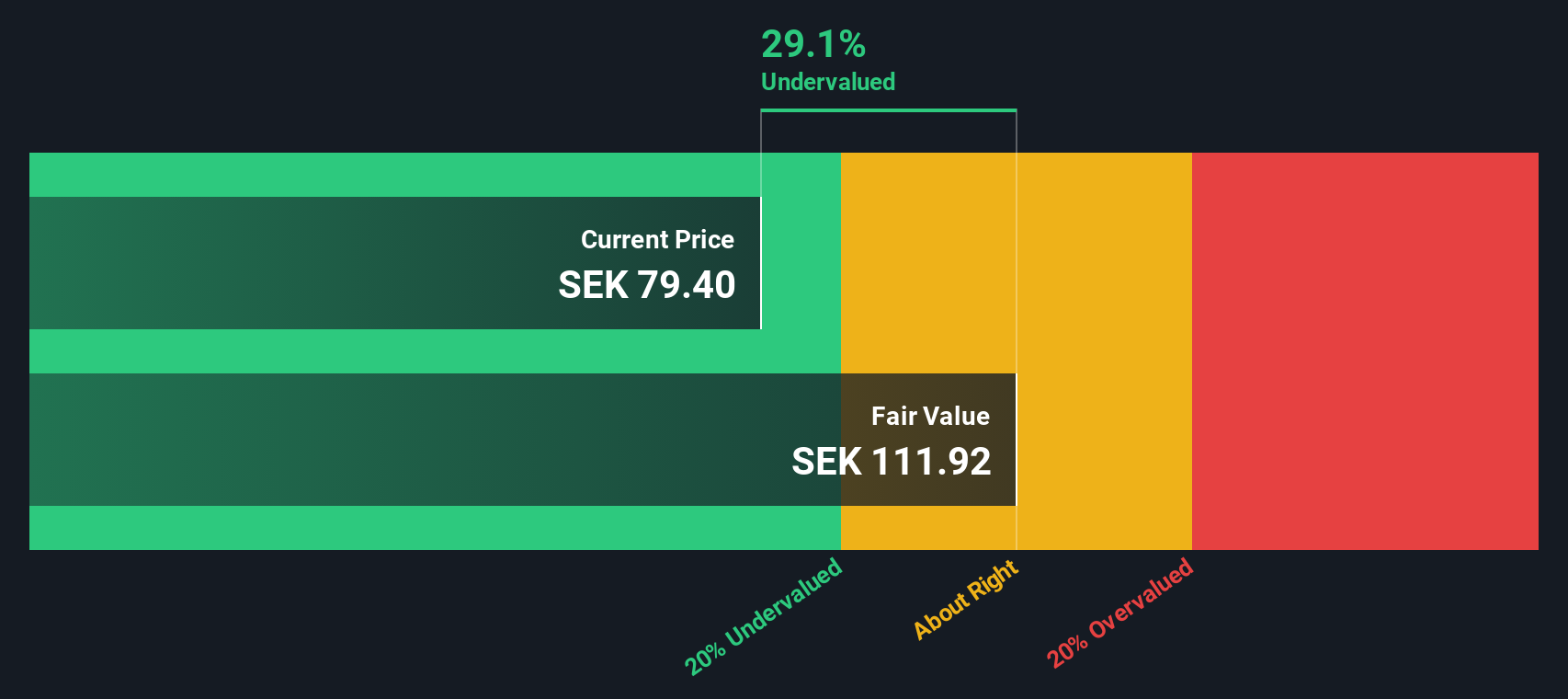

Systemair, a European company with a focus on ventilation products, has shown insider confidence through recent share purchases. Despite facing a slight dip in sales and net income for the quarter ending July 31, 2025, with sales at SEK 3.09 billion and net income at SEK 192 million, the company remains promising due to an earnings growth forecast of 18% annually. Their decision to increase dividends to SEK 1.35 per share underscores potential resilience amidst reliance on external borrowing for funding.

- Get an in-depth perspective on Systemair's performance by reading our valuation report here.

Understand Systemair's track record by examining our Past report.

Make It Happen

- Access the full spectrum of 50 Undervalued European Small Caps With Insider Buying by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boozt might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BOOZT

Boozt

Sells fashion, apparel, shoes, accessories, kids, home, sports, and beauty products online.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives