- Sweden

- /

- Construction

- /

- OM:SWEC B

Sweco (OM:SWEC B): Assessing Valuation as Investor Sentiment Begins to Shift

Reviewed by Kshitija Bhandaru

See our latest analysis for Sweco.

Sweco’s share price has pulled back over the past year, with a 1-year total shareholder return of -5.7%. However, the current lift hints that sentiment may be turning. After a challenging stretch, momentum appears to be picking up as investors weigh the company's prospects relative to its recent performance.

If today's sideways action has you ready to explore something new, now’s the ideal time to broaden your search and discover fast growing stocks with high insider ownership

This recent uptick raises a key question for investors: Is Sweco’s current share price overlooking the firm’s recent growth, or is all future upside already reflected, leaving little room for a buying opportunity?

Most Popular Narrative: 13.5% Undervalued

At SEK160.5 last close, the narrative sets a fair value for Sweco nearly 14% higher. This sharp gap between current price and forecasted fair value centers on the company’s ability to sustain margin gains and growth momentum in the coming years.

Sweco's focus on operational efficiency, including higher pricing, improved billing ratios, and cost control measures, is expected to enhance margins and profitability, supporting higher future earnings.

Curious what forecasted profit margins, revenue leaps, and ambitious future price multiples are fueling this bullish target? The narrative’s bold assumptions might surprise you. Think expansion moves and profit jumps usually reserved for market stars. Want a peek at the numbers behind the optimism?

Result: Fair Value of $185.6 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in key markets and ongoing restructuring costs could threaten Sweco’s expected growth, which may make analyst targets tougher to reach.

Find out about the key risks to this Sweco narrative.

Another View: Valuing by Market Multiples

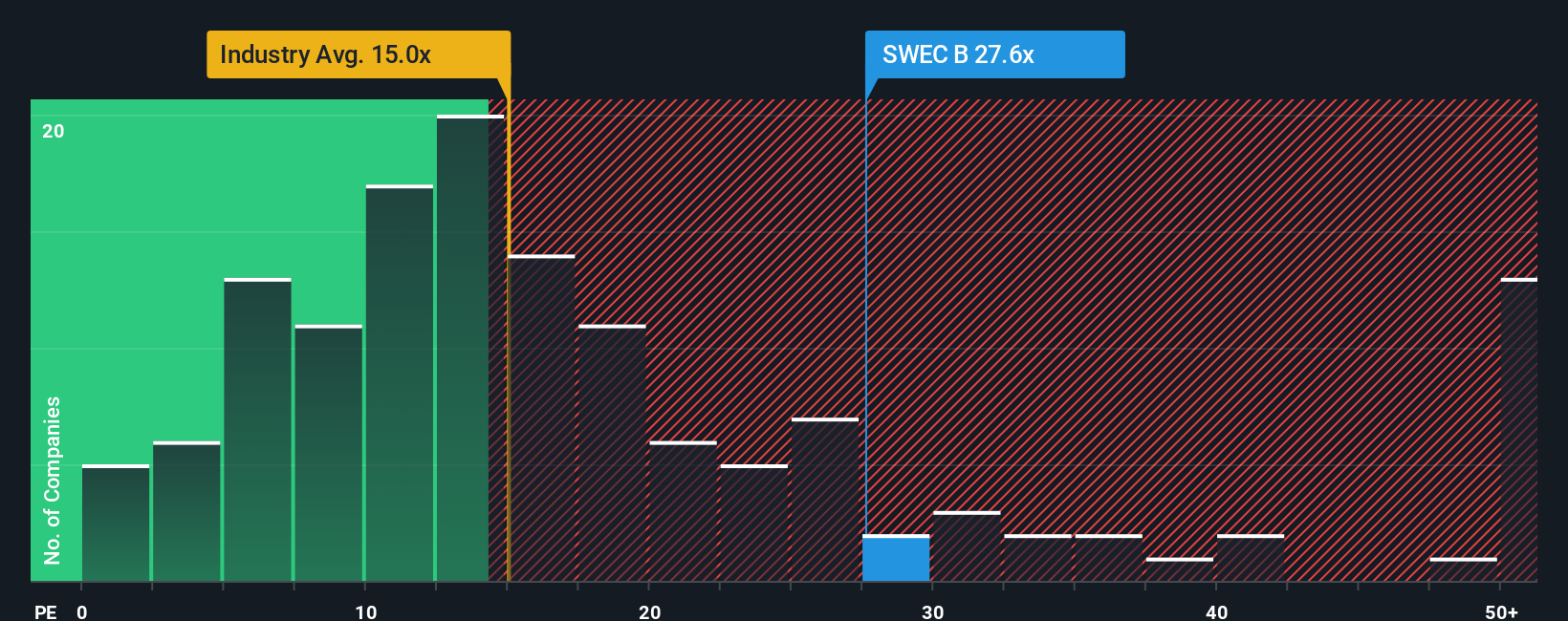

While some analysts see strong future growth, the current price-to-earnings ratio for Sweco is 27.4x, which is significantly higher than both the European Construction industry average of 14.9x and a calculated fair ratio of 23.4x. This gap suggests the shares may be priced for perfection, leaving little room for error. Does the premium reflect true opportunity, or added risk for would-be investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sweco Narrative

Think the story could play out differently, or want to dive into the numbers yourself? It only takes a few minutes to shape your view: Do it your way.

A great starting point for your Sweco research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the market and uncover fresh opportunities. These powerful stock ideas could reshape your portfolio. Don’t let yourself miss out on potential gains!

- Capture high yields and stable income by checking out these 19 dividend stocks with yields > 3% with strong track records of paying dividends above 3%.

- Capitalize on breakthroughs in medicine and technology by tapping into these 32 healthcare AI stocks which are revolutionizing healthcare with artificial intelligence at their core.

- Spot deep value plays early in your search by researching these 885 undervalued stocks based on cash flows for stocks signaling strong upside based on real cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SWEC B

Sweco

Provides architecture and engineering consultancy services worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives