- Sweden

- /

- Industrials

- /

- OM:STOR B

Profitability Gains and Leadership Change Might Change The Case For Investing In Storskogen Group (OM:STOR B)

Reviewed by Sasha Jovanovic

- Storskogen Group AB recently reported its third-quarter 2025 earnings, showing improved net income of SEK316 million on nearly flat sales of SEK7.98 billion, and announced that longstanding management team member Peter Ahlgren will transition to a senior advisory role after a successor is found.

- The improved profitability despite stable sales and the planned leadership change are material developments for a company that has undergone significant expansion and restructuring in recent years.

- Next, we'll explore how Storskogen’s higher net income alongside the upcoming leadership transition may influence its investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Storskogen Group Investment Narrative Recap

For shareholders, the core investment case in Storskogen Group relies on its ability to drive sustainable earnings through acquisition-led growth and margin improvements, even as organic revenue has been under pressure. The recent earnings report, showing higher net income on flat sales, signals some resilience, but the most important immediate catalyst, return to consistent organic growth, remains only partially addressed, while the biggest risk continues to be ongoing revenue stagnation in key segments; the management transition is unlikely to materially shift these dynamics in the short term.

The leadership announcement involving Peter Ahlgren moving into a senior advisory role stands out, given his long tenure during Storskogen’s international expansion. This shift, although meaningful internally, does not directly influence the company’s near-term financial performance or address the present challenge of reigniting organic sales growth through new business integration and market demand recovery.

On the other hand, investors should be mindful of one persistent challenge that could still undercut optimism about sustained margin gains...

Read the full narrative on Storskogen Group (it's free!)

Storskogen Group is projected to reach SEK35.1 billion in revenue and SEK2.0 billion in earnings by 2028. This outlook is built on analysts’ expectations of 2.1% annual revenue growth and an earnings increase of SEK1.0 billion from the current SEK973.0 million.

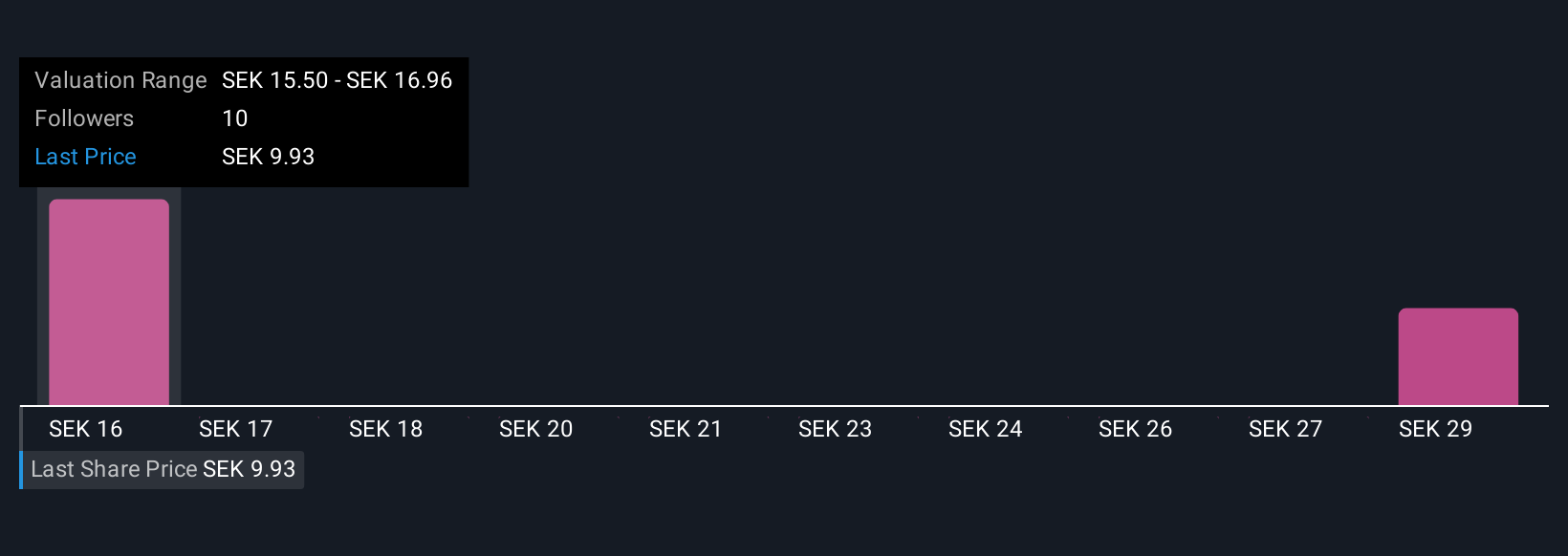

Uncover how Storskogen Group's forecasts yield a SEK15.50 fair value, a 38% upside to its current price.

Exploring Other Perspectives

Fair value estimates from two Simply Wall St Community members range from SEK15.50 to SEK34.69 per share. With organic sales growth remaining a key unresolved catalyst, consider how these divergent opinions reflect uncertainty about Storskogen’s capacity for sustained top-line improvement.

Explore 2 other fair value estimates on Storskogen Group - why the stock might be worth over 3x more than the current price!

Build Your Own Storskogen Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Storskogen Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Storskogen Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Storskogen Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:STOR B

Storskogen Group

Owns and develops small and medium-sized businesses operating in trade, industry, and services business areas.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives