- Sweden

- /

- Industrials

- /

- OM:STOR B

Even With A 26% Surge, Cautious Investors Are Not Rewarding Storskogen Group AB (publ)'s (STO:STOR B) Performance Completely

Storskogen Group AB (publ) (STO:STOR B) shares have continued their recent momentum with a 26% gain in the last month alone. The last month tops off a massive increase of 145% in the last year.

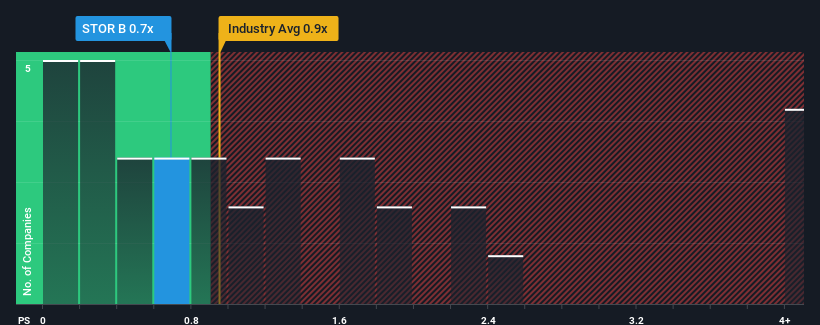

Although its price has surged higher, when close to half the companies operating in Sweden's Industrials industry have price-to-sales ratios (or "P/S") above 1.7x, you may still consider Storskogen Group as an enticing stock to check out with its 0.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Storskogen Group

What Does Storskogen Group's P/S Mean For Shareholders?

For instance, Storskogen Group's receding revenue in recent times would have to be some food for thought. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Storskogen Group's earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

Storskogen Group's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 6.1% decrease to the company's top line. Even so, admirably revenue has lifted 98% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

When compared to the industry's one-year growth forecast of 12%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we find it odd that Storskogen Group is trading at a P/S lower than the industry. It looks like most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Storskogen Group's P/S?

Despite Storskogen Group's share price climbing recently, its P/S still lags most other companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Storskogen Group revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You always need to take note of risks, for example - Storskogen Group has 1 warning sign we think you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:STOR B

Storskogen Group

Owns and develops small and medium-sized businesses operating in trade, industry, and services business areas.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives