- Sweden

- /

- Construction

- /

- OM:SKA B

Skanska (OM:SKA B): Assessing Valuation as Shares Gain 7% in Recent Weeks

Reviewed by Kshitija Bhandaru

Skanska (OM:SKA B) has been capturing investor attention lately as shares saw upward momentum over the past month, climbing 7%. Many are now re-examining the company’s fundamentals for further clues about what might fuel future gains.

See our latest analysis for Skanska.

Skanska’s share price has found upward momentum recently, which comes after a year marked by steadier gains. The company’s 1-year total shareholder return is a solid 15%. Investors’ optimism seems to be building as the outlook for the business and broader construction sector improves, hinting at renewed confidence in both the company’s fundamentals and its long-term potential.

If you’re interested in spotting where momentum and insider conviction overlap, now’s a great opportunity to broaden your perspective and discover fast growing stocks with high insider ownership

With shares trading close to analyst targets and steady growth in profits and revenue, the crucial question remains: is Skanska currently undervalued, or is the market already factoring in the company’s future gains?

Most Popular Narrative: 3% Undervalued

Skanska's last close was SEK245.7, just a shade below the consensus analyst fair value of SEK254.25. This narrow margin spotlights a modest undervaluation and puts the focus on the narrative’s financial projections and real-world project momentum.

Skanska's record-high order backlog (19 months of production, SEK 268 billion) and strong book-to-bill ratios (>100% across all geographies) position the company to benefit from sustained government infrastructure spending, especially in the US and Europe, supporting future revenue growth. The company is seeing robust demand and improved outlooks in key markets (Swedish civil, Central European residential), which are driven by continued urbanization, population growth, and increased public investments in defense, energy, and water infrastructure, laying the groundwork for mid, and long-term earnings expansion.

Want to know why Skanska's fair value is so close to its current price? There is a key set of market-beating growth forecasts and future profit projections driving this narrative. The full story reveals the real reasons analysts think Skanska's upside remains intact. Don’t miss what sets these projections apart from rivals!

Result: Fair Value of SEK254.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in Nordic property markets and continued delays in US asset sales could quickly dampen Skanska’s current growth narrative.

Find out about the key risks to this Skanska narrative.

Another View: DCF Model Challenges the Analyst Narrative

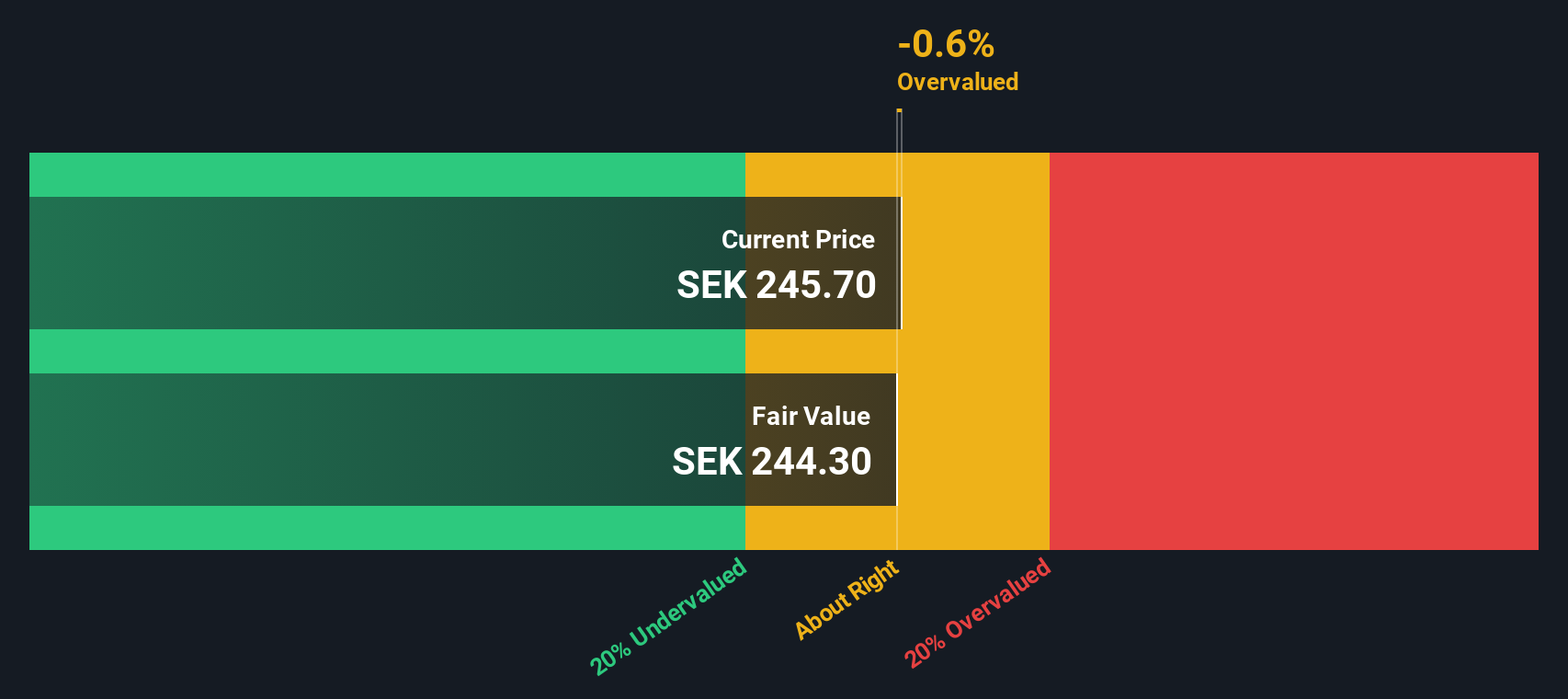

While the analyst consensus pins Skanska as modestly undervalued based on future earnings, the Simply Wall St DCF model tells a different story. According to our DCF calculation, Skanska is trading slightly above its fair value today, which hints at potential overvaluation. Which approach offers the more reliable picture for investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Skanska for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Skanska Narrative

If you want to follow your instincts or reach your own conclusions, you can craft a personalized Skanska story using the latest data in just minutes. Do it your way

A great starting point for your Skanska research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Opportunities?

Seize your chance to get ahead in the market by tapping into our top stock ideas. Don’t miss out while others act on tomorrow’s winners today.

- Tap into strong income growth by uncovering reliable yield opportunities with these 19 dividend stocks with yields > 3%, which consistently outperform even in rocky markets.

- Unleash your potential for high returns with these 3569 penny stocks with strong financials, boasting solid financial foundations and the agility to deliver rapid gains.

- Ride innovation waves and spot early movers by evaluating these 24 AI penny stocks pushing the boundaries of artificial intelligence across industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SKA B

Skanska

Operates as a construction and project development company in the Nordics, Europe, and the United States.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives