- Sweden

- /

- Construction

- /

- OM:SKA B

Major US Contract Win and Leadership Appointment Could Be a Game Changer for Skanska (OM:SKA B)

Reviewed by Sasha Jovanovic

- In recent days, Skanska AB announced several major contract wins, including agreements to construct a US$256 million data center in the USA, a NOK950 million pumped-storage hydropower plant in Norway, and a €60 million highway upgrade in Finland, alongside the appointment of Pontus Winqvist as Chief Financial Officer and Executive Vice President, effective November 27, 2025.

- These developments highlight Skanska’s growing momentum in large-scale international infrastructure projects and reinforce the company’s leadership stability through internal succession.

- We’ll now examine how Skanska’s freshly secured US contract could influence the investment narrative and outlook for the company.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Skanska Investment Narrative Recap

To be a shareholder in Skanska, you need to believe that the company’s large order backlog and disciplined approach to high-quality infrastructure and green projects can offset near-term headwinds in residential property and commercial divestments. The latest contract wins, including the US$256 million data center, add to backlog and visibility but do not materially change the biggest short-term catalyst, an improvement in Nordic real estate markets, or reduce exposure to the risk posed by slow recovery in these segments.

Of the latest announcements, the US data center contract highlights Skanska’s ability to secure substantial international projects, which can help sustain group revenues as property development volumes face challenges. However, while these wins reaffirm the company’s reputation and underpin its order book, they do not by themselves remove the vulnerability to margin pressures if Nordic markets remain subdued and transaction activity in the US stays slow.

By contrast, investors should be aware that continued weakness in the Nordic residential market could prolong...

Read the full narrative on Skanska (it's free!)

Skanska's narrative projects SEK206.4 billion in revenue and SEK9.0 billion in earnings by 2028. This requires 3.8% yearly revenue growth and a SEK2.8 billion earnings increase from SEK6.2 billion today.

Uncover how Skanska's forecasts yield a SEK275.00 fair value, a 14% upside to its current price.

Exploring Other Perspectives

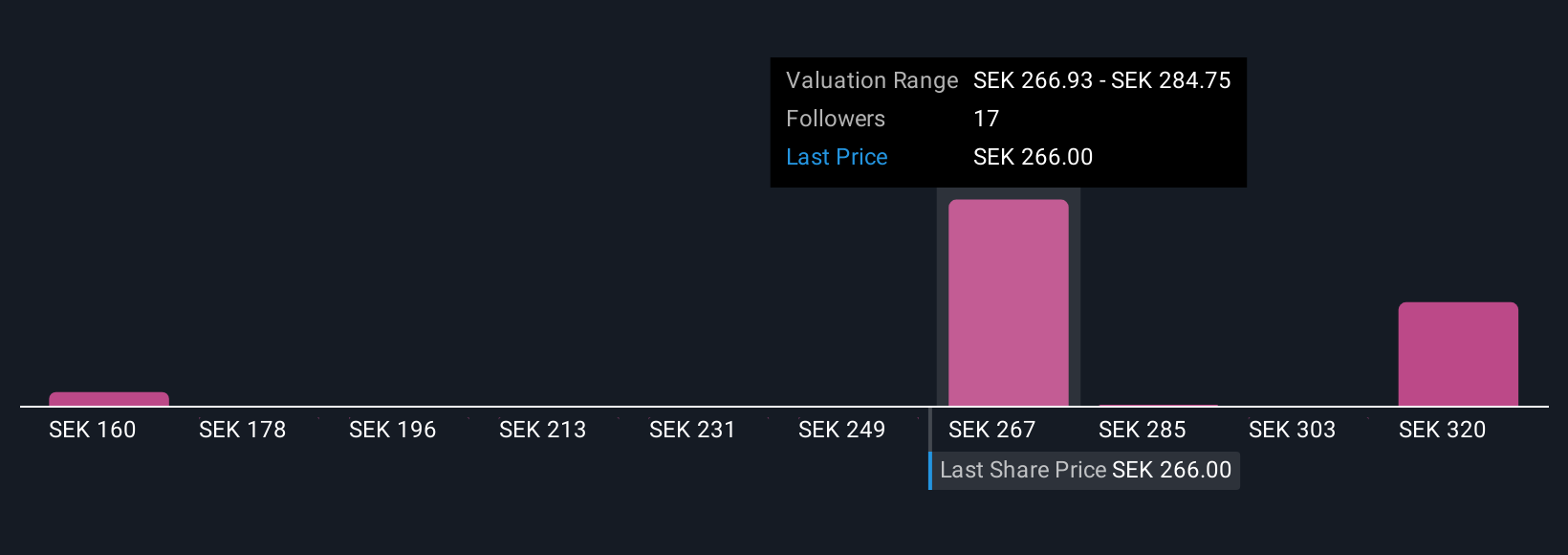

Six Simply Wall St Community estimates put Skanska’s fair value between SEK160 and SEK367.85. With opinions split, remember that persistent softness in core Nordic property could keep earnings below expectations for longer, so explore multiple viewpoints before deciding.

Explore 6 other fair value estimates on Skanska - why the stock might be worth as much as 52% more than the current price!

Build Your Own Skanska Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Skanska research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Skanska research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Skanska's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SKA B

Skanska

Operates as a construction and project development company in the Nordics, Europe, and the United States.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.