- Sweden

- /

- Construction

- /

- OM:SKA B

Evaluating Skanska Shares After Steady 16% Climb and Infrastructure Sector Momentum in 2025

Reviewed by Bailey Pemberton

Thinking about what to do with Skanska stock right now? You are definitely not alone. It is one of those names that tends to spark debate, especially after the price action we have seen recently. Over the past week, Skanska shares managed a steady 2.2% rise, adding to gains of 6.3% this past month. Looking longer term, the returns are even more eye-catching with a 16.0% jump over the last year and a remarkable 102.2% over three years. Even the five-year return stands at 56.5%. With those numbers, it is no surprise that both growth-minded and value-conscious investors are giving this stock a closer look.

Some of these moves can be traced to broader market developments that have boosted sentiment in the construction and infrastructure sectors, as investors look for stability and long-term growth potential amidst shifting macroeconomic trends. But does Skanska actually represent good value at these prices, or are buyers simply chasing recent performance?

To make that call, it helps to look at cold, hard valuation metrics. Skanska currently earns a value score of 2 out of 6, meaning it is undervalued in 2 out of 6 checks analysts commonly track. That is a score suggesting some areas of strength, but also room for skepticism. This is exactly the kind of scenario where digging into the details matters most.

Next, let’s break down the main valuation approaches used by professionals, with an eye on where Skanska stands out and where it may fall short. And stick around, because at the end, we will look beyond just the numbers to a smarter way to think about valuation altogether.

Skanska scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Skanska Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model is a classic way of estimating a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value. This approach provides an idea of what the shares are truly worth based on fundamentals, not just market mood.

For Skanska, the DCF analysis uses a two-stage free cash flow to equity approach, with inputs grounded in analyst forecasts and extended ten-year projections. The company’s latest reported Free Cash Flow stands at SEK 13.14 billion, reflecting strong operational health. Looking ahead, analysts expect annual free cash flows to remain robust, with projected FCF for 2027 at SEK 7.12 billion. Further out, extrapolated estimates suggest cash flows will range between SEK 5.41 and 7.12 billion per year over the next decade.

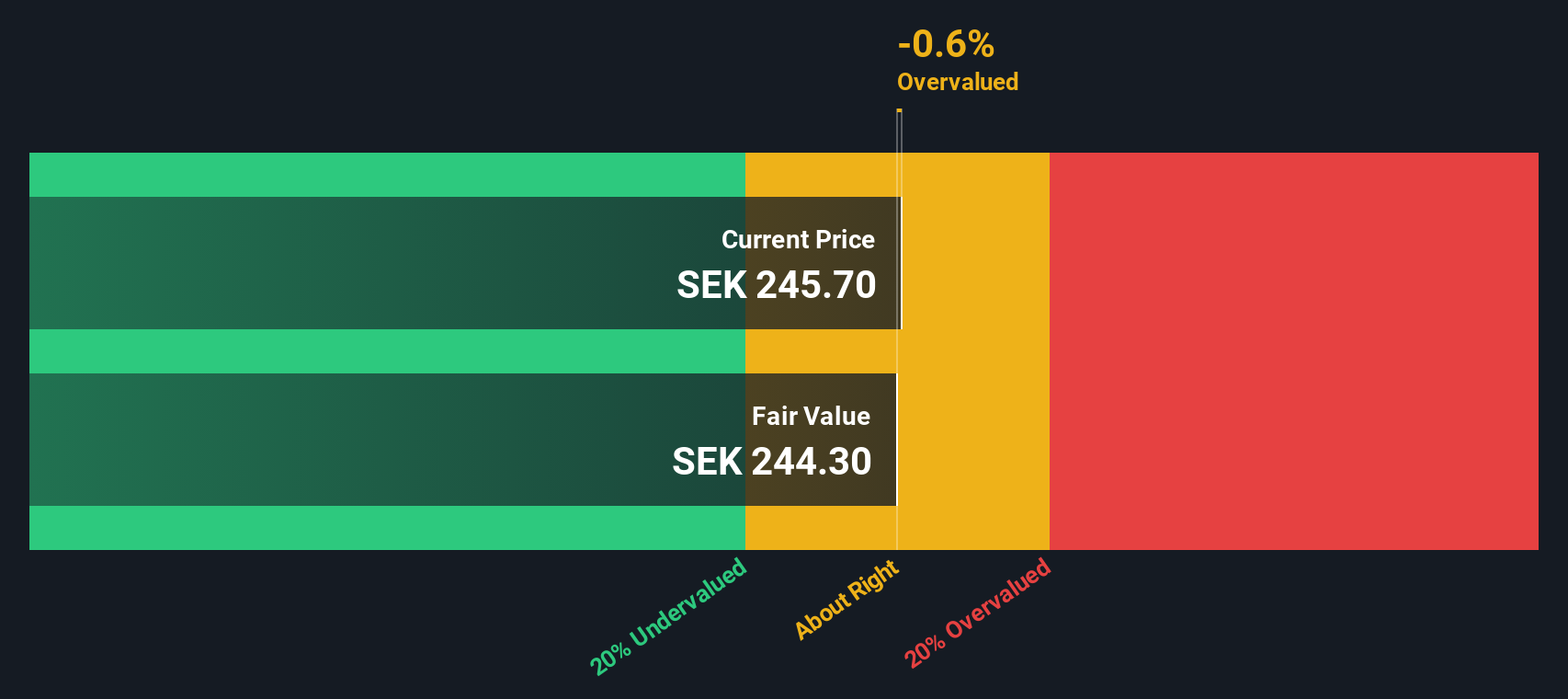

According to this model, Skanska’s intrinsic value comes out to SEK 244.14 per share. When compared to the current market price, this signals the stock is trading at a 0.4% premium to its DCF-based fair value. In other words, the market price and the company’s fundamental value are almost perfectly aligned.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Skanska's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Skanska Price vs Earnings (PE)

For established and profitable companies like Skanska, the price-to-earnings (PE) ratio is one of the most useful and popular valuation tools. It helps investors quickly gauge how much they are paying for each krona of the company’s current earnings. This provides a straightforward way to compare valuation against other companies and the broader industry.

Growth expectations and risk play a big role in determining what is considered a “normal” or fair PE ratio. In general, companies with faster earnings growth, more stable profits, and lower risk profiles can justify a higher PE. Slower-growing or riskier firms tend to trade at lower multiples.

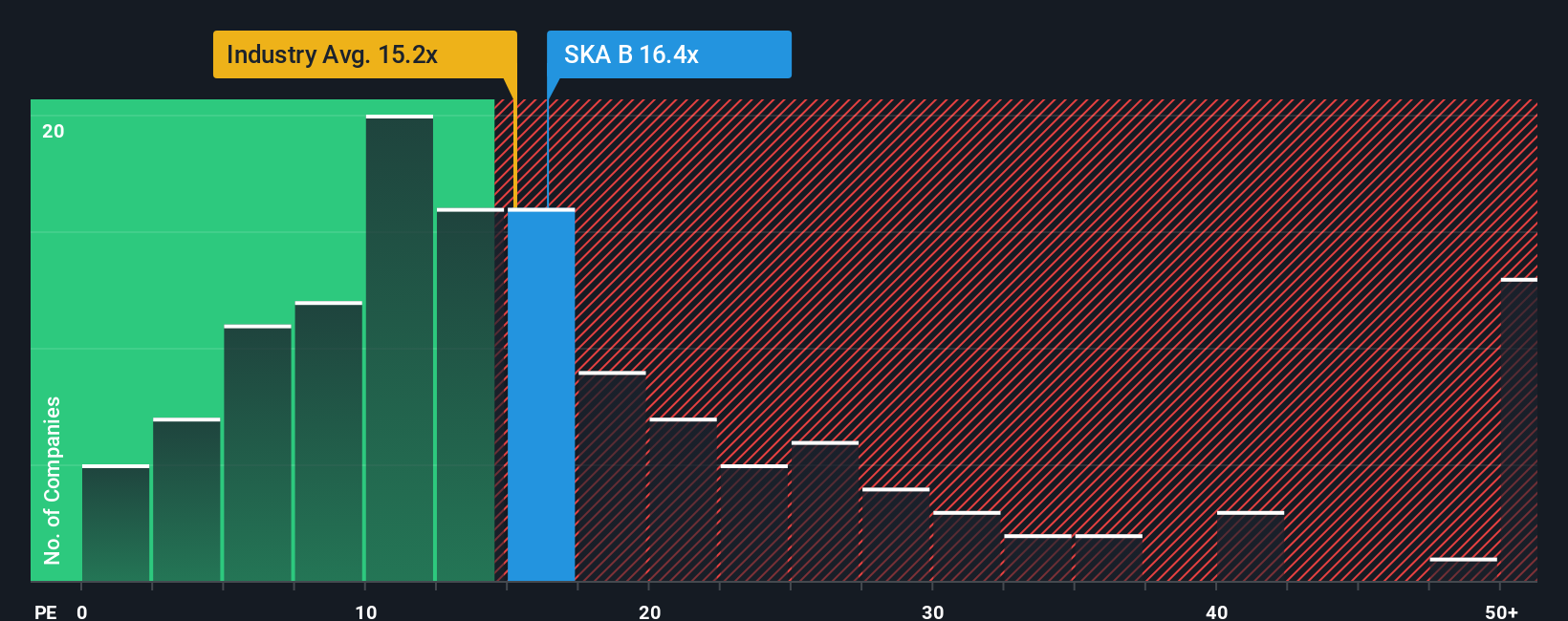

Currently, Skanska trades at a PE ratio of 16.4x. This figure is close to the Construction industry average of 16.1x and somewhat below the peer group average of 20.0x. Simply Wall St’s proprietary "Fair Ratio" model goes a step further by calculating what PE ratio is justified for Skanska after weighing company-specific factors like earnings growth, profit margins, industry, market cap, and risk. For Skanska, the Fair Ratio comes out at 23.7x, which is noticeably higher than both its current PE and the industry norm.

By factoring in the company’s strengths and business context, the Fair Ratio offers a more accurate benchmark than peer or industry averages alone. In Skanska’s case, the current PE is significantly below the Fair Ratio, suggesting the stock is undervalued according to this method.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Skanska Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply the investable story behind a company. It is your perspective on how Skanska’s future will unfold, expressed through your assumptions for things like revenue growth, profit margins, and fair value estimates, all tied together with the logic that supports them.

Unlike traditional metrics, a Narrative connects the company’s qualitative story to a financial forecast and, ultimately, to its estimated fair value. Narratives are an easy, accessible tool available to millions of investors on Simply Wall St’s Community page, where anyone can see, build, and share their own views in just a few clicks.

This approach helps you make informed decisions by comparing your (or the community’s) estimated Fair Value to the current Share Price, so you can see not only what’s priced in, but also why it’s justified. In addition, Narratives are kept up-to-date automatically as new information such as earnings results or major news arrives, so your investment story and valuation stay relevant.

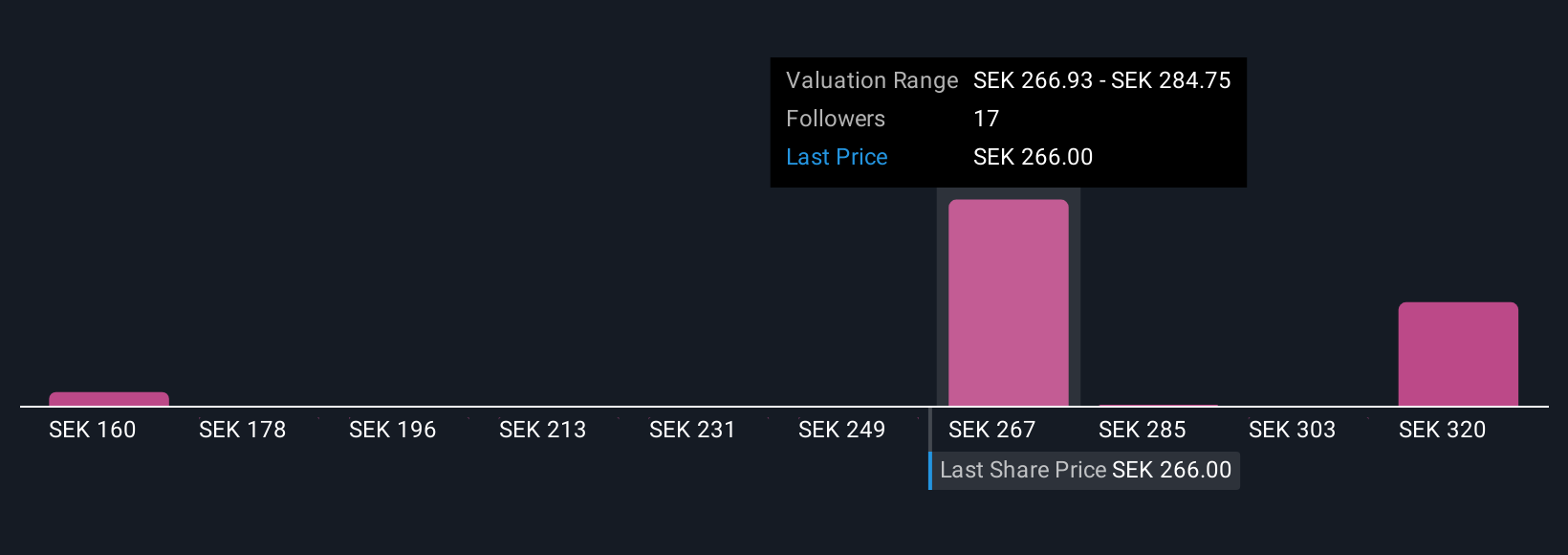

For example, some Skanska investors see sustained revenue growth from a record order backlog and strong public investment, supporting a fair value of SEK285.0 per share. More cautious investors point to risks in property markets and restructuring costs, giving a lower fair value of SEK240.0. Both perspectives are turned into actionable insights via Narratives.

Do you think there's more to the story for Skanska? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SKA B

Skanska

Operates as a construction and project development company in the Nordics, Europe, and the United States.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.