Sandvik (OM:SAND): Assessing Valuation After Improved Profitability in Latest Earnings

Reviewed by Kshitija Bhandaru

Sandvik (OM:SAND) just released its third quarter earnings, revealing an interesting dynamic for investors. While sales saw a slight year-over-year dip, net income climbed, which points to stronger profitability this period.

See our latest analysis for Sandvik.

After posting stronger-than-expected profits, Sandvik’s share price continued its upward momentum. The stock now sits at SEK 270.3 and has returned 14.2% over the last 90 days. For longer-term investors, the 1-year total shareholder return of 30.6% and nearly 68% over three years indicate that sentiment around Sandvik remains positive as earnings quality improves and investors respond to the company’s consistent execution.

If this recent run has you rethinking where to look next, now could be the perfect time to discover fast growing stocks with high insider ownership

With Sandvik’s strong returns and profit gains, investors now face a familiar dilemma: is the current price a reflection of all this progress, or is there still room for upside if growth continues?

Most Popular Narrative: Fairly Valued

With Sandvik’s current share price sitting just above the most popular narrative’s fair value estimate, investor expectations appear closely aligned with analyst forecasts. This positions the stock at a crossroads, where future moves may hinge on how well expected growth is delivered.

The company's launch of electrification and automation-ready products in mining and new product introductions in software are likely to enhance market position and boost future revenue. Sandvik's ongoing restructuring programs have improved cost efficiency, reducing expenses and increasing net margins through savings and operational improvements.

Want to uncover the secret behind Sandvik’s current price? The story isn’t just about old industry strengths. Major changes in margins, a shift in market position, and one bold number power this valuation. See the details that could change investor perspective.

Result: Fair Value of $269.17 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing weakness in general engineering and continued macroeconomic uncertainty could limit Sandvik’s ability to sustain its current growth and improvements in margins.

Find out about the key risks to this Sandvik narrative.

Another View: What Do Earnings Ratios Say?

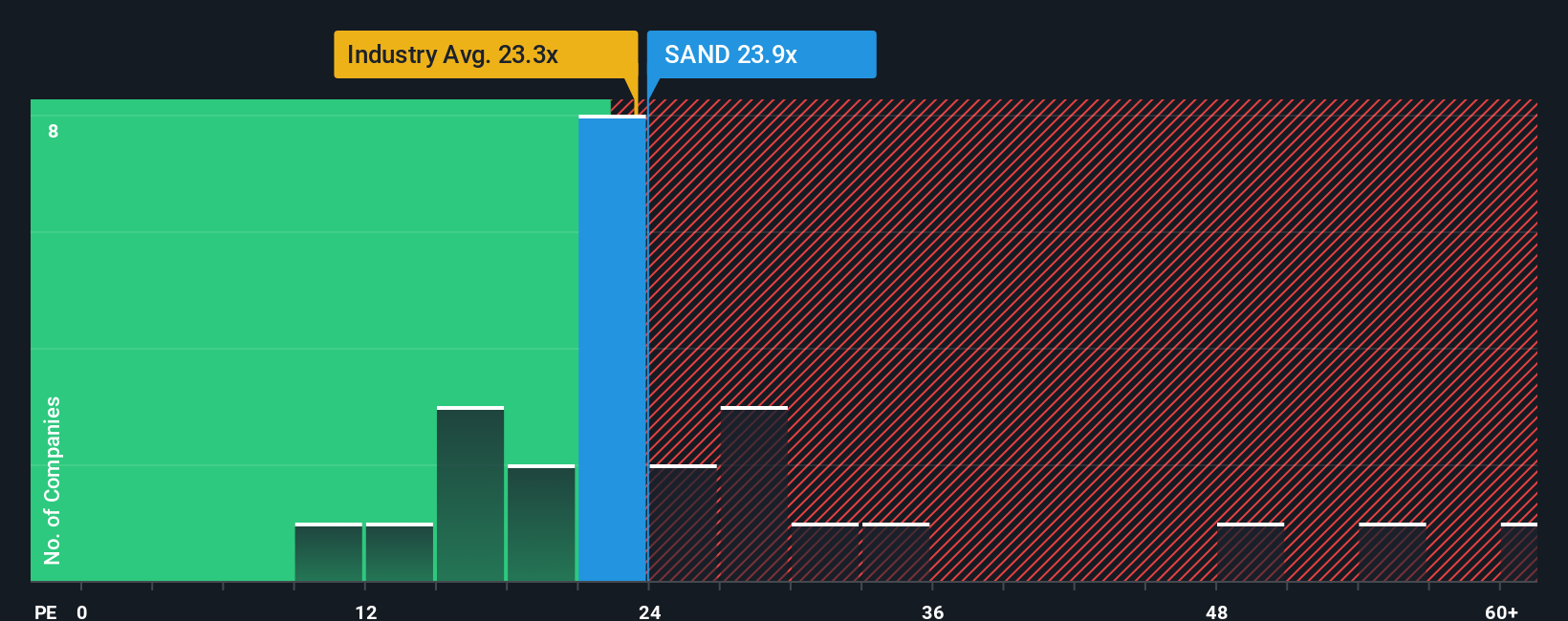

Switching from fair value estimates to actual multiples, Sandvik's price-to-earnings ratio stands at 23.4x, just below the peer group average of 23.5x and slightly higher than the broader Machinery industry at 23.1x. Interestingly, this is still below the fair ratio of 26.4x, suggesting the market is not stretching expectations. Does this leave room for an upward re-rating or present hidden risks if conditions change?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sandvik Narrative

If the consensus doesn’t match your outlook, or you believe a fresh perspective could shed new light, you can craft your own in just a few minutes. Do it your way

A great starting point for your Sandvik research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Market Opportunities?

Step up your investment research and stay ahead of the curve. Don’t let standout opportunities in the market pass you by when new themes are gathering speed.

- Boost your income potential by checking out these 18 dividend stocks with yields > 3%, which offers attractive yields above 3% for steady returns.

- Ride the AI momentum and secure your spot in the next investment wave by reviewing these 24 AI penny stocks, which are shaping tomorrow’s technology landscape.

- Tap into overlooked value by spotting these 871 undervalued stocks based on cash flows, as these could deliver strong upside based on robust cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SAND

Sandvik

An engineering company, provides products and solutions for mining and rock excavation, metal cutting, and materials technology worldwide.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives