- Sweden

- /

- Aerospace & Defense

- /

- OM:SAAB B

Do New Swedish Defense Contracts Shift the Long-Term Outlook for Saab (OM:SAAB B)?

Reviewed by Sasha Jovanovic

- In recent days, the Swedish Defence Materiel Administration (FMV) announced several major orders for Saab, including a SEK 9.6 billion contract for the final production phase of two Blekinge-class submarines, and additional agreements covering advanced fighter system studies and Gripen support services.

- These sizeable contracts and program extensions highlight Saab's established role as a core supplier to Sweden’s defense sector and its ongoing involvement in developing future technologies and military systems.

- We'll consider how this string of major Swedish government contracts impacts Saab's position within the analysts' investment narrative focused on sustained defense demand.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Saab Investment Narrative Recap

To be a shareholder in Saab, I think you’d need confidence in the long-term trajectory of European defense spending, Saab’s position as a critical domestic supplier, and its emerging strengths in advanced technologies. While the string of new Swedish government contracts underscores the company’s embedded role in national defense, the immediate impact on the short-term narrative, a focus on defense demand resilience and strong order backlog, appears supportive but not transformative. The most significant risk remains Saab’s high exposure to changes in government priorities and budget cycles.

Of the latest announcements, the SEK 9.6 billion order for the next phase of Blekinge-class submarines stands out, reinforcing Saab’s position in core high-value programs with lengthy delivery schedules. Large, multi-year program wins like these are essential for underpinning the order book, but they also reinforce Saab’s dependence on a small set of government buyers, which is both a catalyst for stability and a key risk.

Conversely, investors should be equally mindful of the challenges tied to Saab’s reliance on a concentrated base of government contracts, where sudden policy changes could...

Read the full narrative on Saab (it's free!)

Saab's outlook anticipates SEK112.3 billion in revenue and SEK9.8 billion in earnings by 2028. This scenario assumes a 17.1% annual revenue growth and a SEK4.6 billion increase in earnings from the current SEK5.2 billion.

Uncover how Saab's forecasts yield a SEK473.00 fair value, in line with its current price.

Exploring Other Perspectives

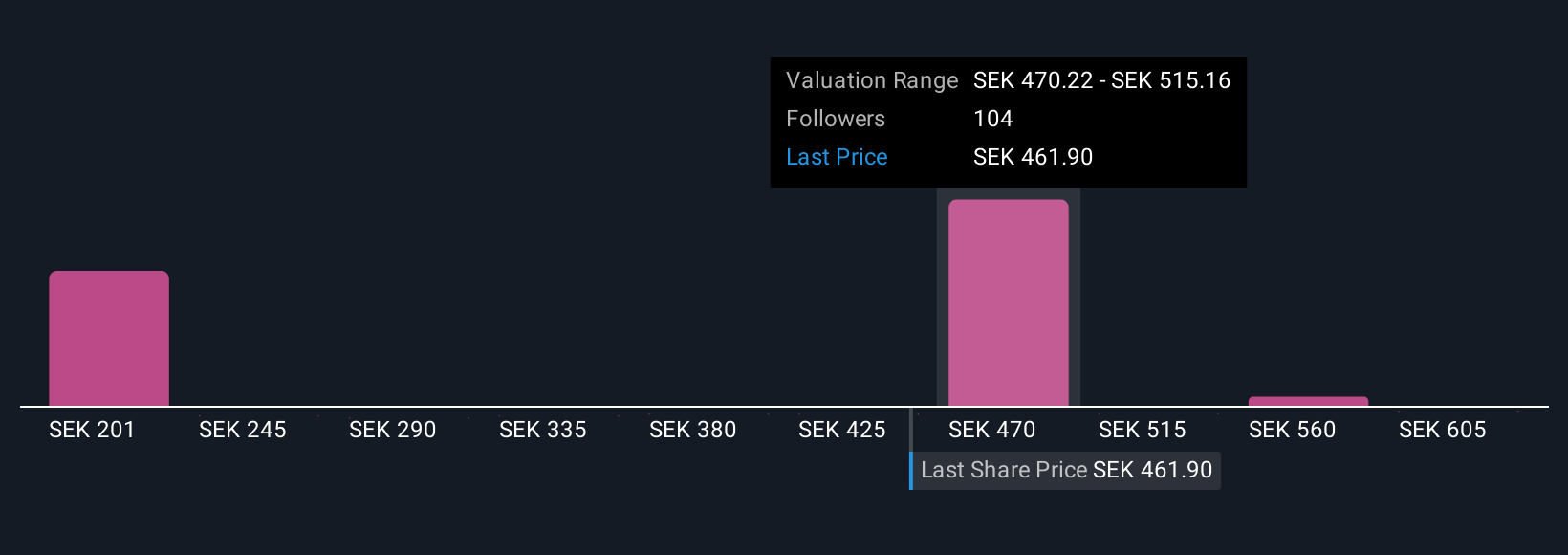

Sixteen Simply Wall St Community members have estimated Saab’s fair value from SEK 200 to SEK 650, highlighting wide-ranging outlooks. Against that backdrop, reliance on a handful of buyers means shifts in policy or budgets could significantly sway future returns, explore how your view compares.

Explore 16 other fair value estimates on Saab - why the stock might be worth less than half the current price!

Build Your Own Saab Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Saab research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Saab research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Saab's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SAAB B

Saab

Provides products, services, and solutions for military defense, aviation, and civil security markets Internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives